Answered step by step

Verified Expert Solution

Question

1 Approved Answer

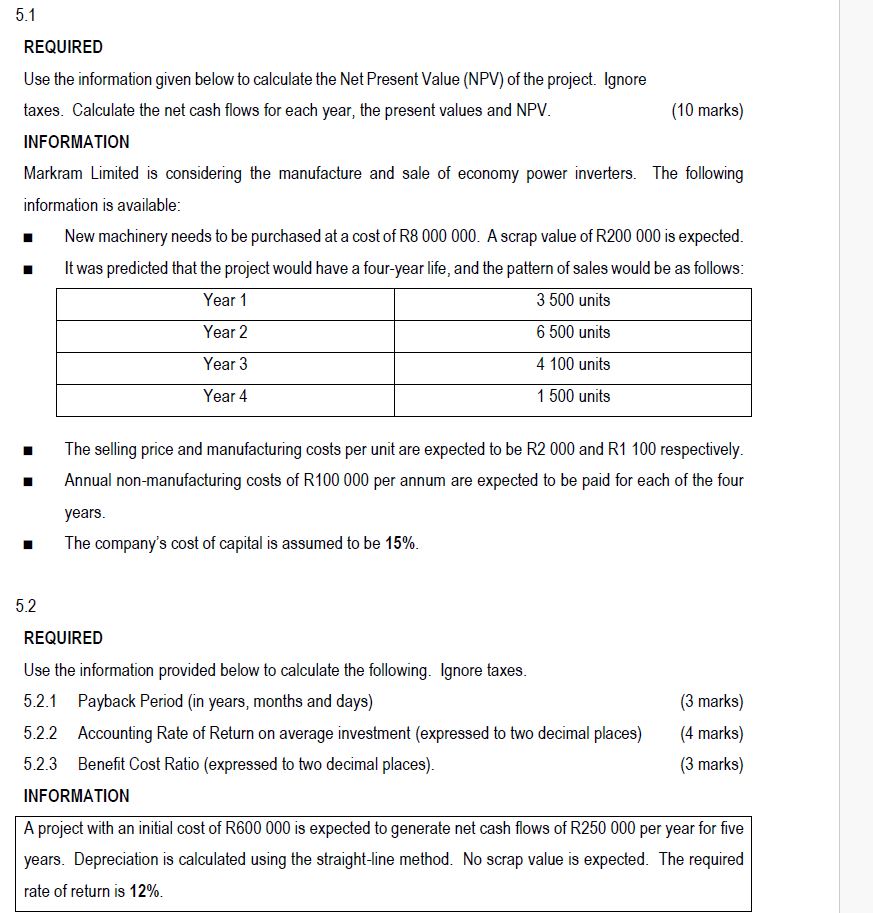

REQUIRED Use the information given below to calculate the Net Present Value ( NPV ) of the project. Ignore taxes. Calculate the net cash flows

REQUIRED

Use the information given below to calculate the Net Present Value NPV of the project. Ignore

taxes. Calculate the net cash flows for each year, the present values and NPV

INFORMATION

Markram Limited is considering the manufacture and sale of economy power inverters. The following

information is available:

New machinery needs to be purchased at a cost of R A scrap value of R is expected.

It was predicted that the project would have a fouryear life, and the pattern of sales would be as follows:

The selling price and manufacturing costs per unit are expected to be R and R respectively.

Annual nonmanufacturing costs of R per annum are expected to be paid for each of the four

years.

The company's cost of capital is assumed to be

REQUIRED

Use the information provided below to calculate the following. Ignore taxes.

Payback Period in years, months and days

marks

Accounting Rate of Return on average investment expressed to two decimal places

marks

Benefit Cost Ratio expressed to two decimal places

marks

INFORMATION

A project with an initial cost of R is expected to generate net cash flows of R per year for five

years. Depreciation is calculated using the straightline method. No scrap value is expected. The required

rate of return is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started