Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REQUIRED Use the information given below to prepare the following for the first three months of operations (i e. July, August and September 2023): 4.1

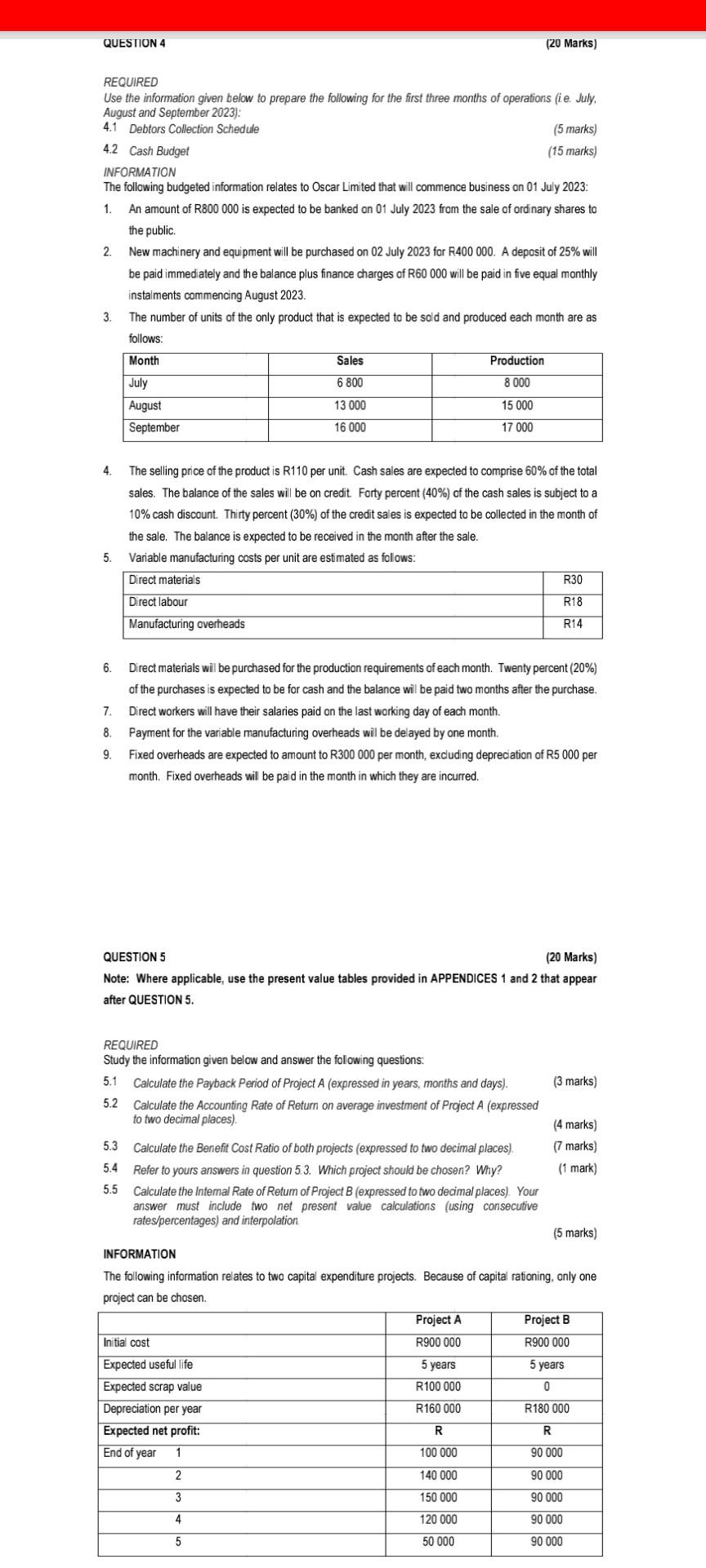

REQUIRED Use the information given below to prepare the following for the first three months of operations (i e. July, August and September 2023): 4.1 Debtors Collection Schedule (5 marks) 4.2 Cash Budget (15 marks) INFORMATION The following budgeted information relates to Oscar Limited that will commence business on 01 July 2023: 1. An amount of R800 000 is expected to be banked on 01 July 2023 from the sale of ordinary shares to the public. 2. New machinery and equipment will be purchased on 02 July 2023 for R400000. A deposit of 25% will be paid immediately and the balance plus finance charges of R60000 will be paid in five equal monthly instalments commencing August 2023. 3. The number of units of the only product that is expected to be sold and produced each month are as frllowic 4. The selling price of the product is R 110 per unit. Cash sales are expected to comprise 60% of the total sales. The balance of the sales will be on credit. Forty percent (40%) of the cash sales is subject to a 10% cash discount. Thirty percent (30%) of the credit sales is expected to be collected in the month of the sale. The balance is expected to be received in the month after the sale. 5. Variable manufacturing costs per unit are estimated as folows: 6. Direct materials will be purchased for the production requirements of each month. Twenty percent (20%) of the purchases is expected to be for cash and the balance will be paid two months after the purchase. 7. Direct workers will have their salaries paid on the last working day of each month. 8. Payment for the variable manufacturing overheads will be delayed by one month. 9. Fixed overheads are expected to amount to R300 000 per month, excluding depreciation of R5 000 per month. Fixed overheads will be paid in the month in which they are incurred. QUESTION 5 (20 Marks) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Study the information given below and answer the following questions: 5.1 Calculate the Payback Period of Project A (expressed in years, months and days). (3 marks) 5.2 Calculate the Accounting Rate of Return on average investment of Project A (expressed to two decimal places). (4 marks) 5.3 Calculate the Benefit Cost Ratio of both projects (expressed to two decimal places). ( 7 marks) 5.4 Refer to yours answers in question 5.3. Which project should be chosen? Why? (1 mark) 5.5 Calculate the Intemal Rate of Return of Project B (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation (5 marks) INFORMATION The following information relates to two capital expenditure projects. Because of capital rationing, only one project can be chosen

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started