Answered step by step

Verified Expert Solution

Question

1 Approved Answer

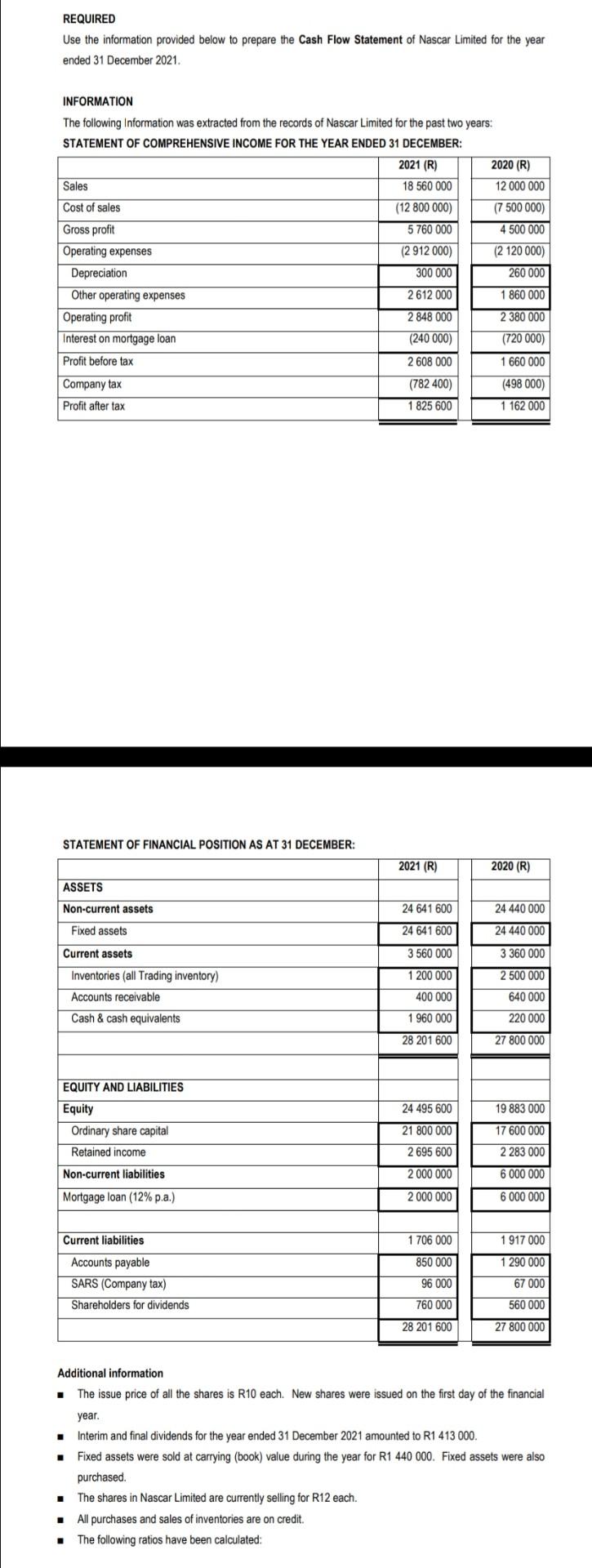

REQUIRED Use the information provided below to prepare the Cash Flow Statement of Nascar Limited for the year ended 31 December 2021. INFORMATION The following

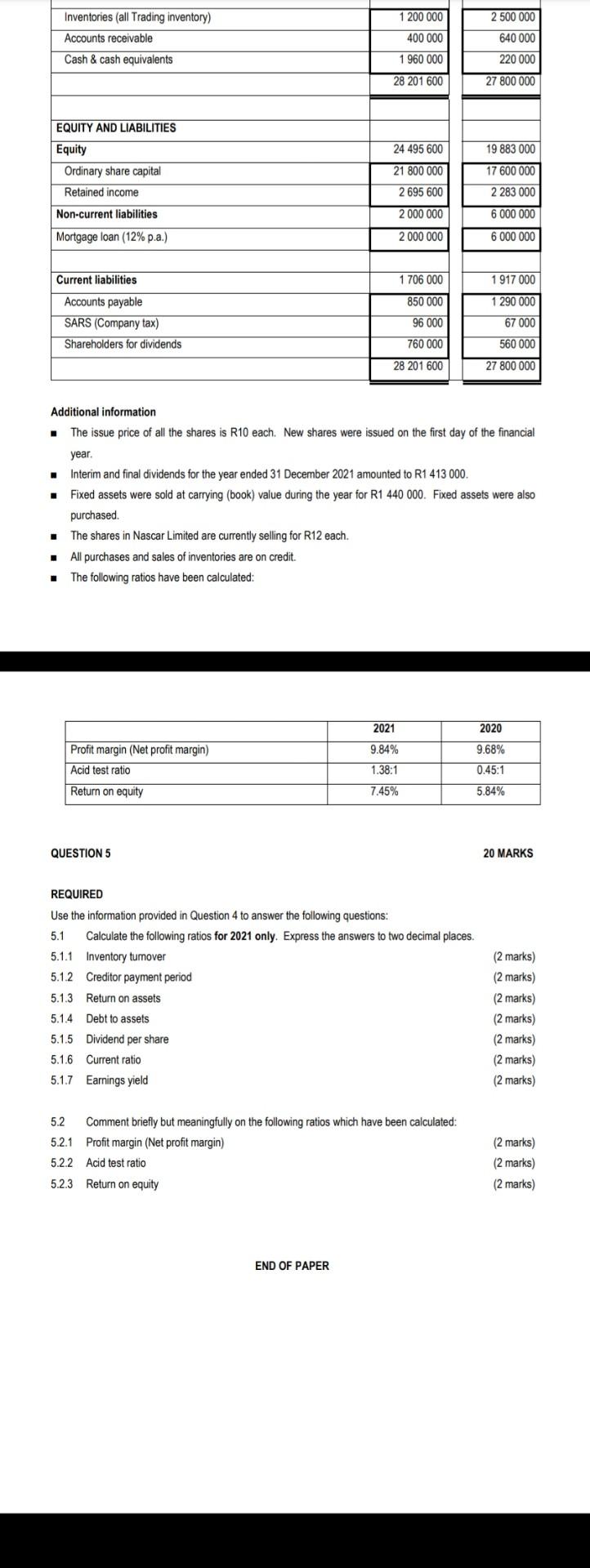

REQUIRED Use the information provided below to prepare the Cash Flow Statement of Nascar Limited for the year ended 31 December 2021. INFORMATION The following Information was extracted from the records of Nascar Limited for the past two years: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER: Additional information - The issue price of all the shares is R10 each. New shares were issued on the first day of the financial year. - Interim and final dividends for the year ended 31 December 2021 amounted to R1 413000 - Fixed assets were sold at carrying (book) value during the year for R1 440000 . Fixed assets were also purchased. - The shares in Nascar Limited are currently selling for R12 each. - All purchases and sales of inventories are on credit. - The following ratios have been calculated: Additional information - The issue price of all the shares is R10 each. New shares were issued on the first day of the financial year. - Interim and final dividends for the year ended 31 December 2021 amounted to R1 413000 . - Fixed assets were sold at carrying (book) value during the year for R1 440000 . Fixed assets were also purchased. - The shares in Nascar Limited are currently selling for R12 each. - All purchases and sales of inventories are on credit. - The following ratios have been calculated: QUESTION 5 20 MARKS REQUIRED Use the information provided in Question 4 to answer the following questions: 5.15.1.15.1.25.1.35.1.45.1.55.1.65.1.7Calculatethefollowingratiosfor2021only.Expresstheanswerstotwodecimalplaces.InventoryturnoverCreditorpaymentperiodReturnonassetsDebttoassetsDividendpershareCurrentratioEarningsyield(2marks)(2marks)(2marks)(2marks)(2marks)(2marks)(2marks) 5.2 Comment briefly but meaningfully on the following ratios which have been calculated: 5.2.1 Profit margin (Net profit margin) (2 marks) 5.2.2 Acid test ratio (2 marks) 5.2.3 Return on equity (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started