Question

REQUIRED Using the decomposed ROE framework, you are required to answer the following: (a) Which firm had a higher operating return on assets (calculate operating

REQUIRED

Using the decomposed ROE framework, you are required to answer the following:

(a) Which firm had a higher operating return on assets (calculate operating ROA)? From the information provided in the above table, identify and discuss three factors that contributed to the difference in operating ROA between these two firms?

(b) Which firm had been able to generate higher return from debt financing than the cost of debt (calculate spread and financial leverage gain)? Do you think that the firm's debt policy played any role here? If so, how?

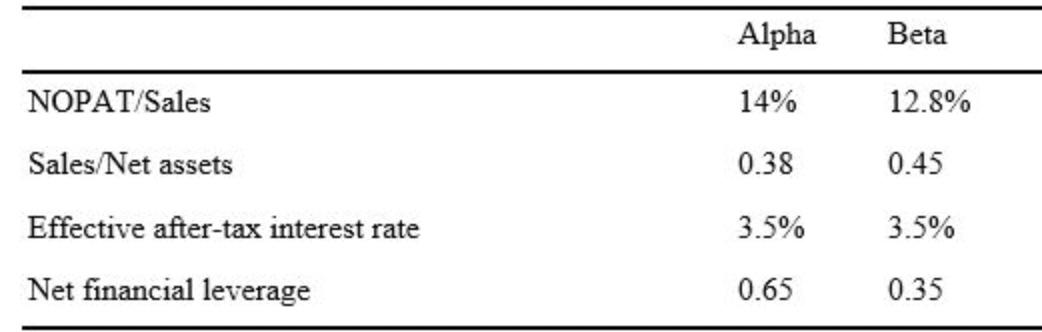

For the year ended 30 June 2020, Alpha Supermarkets had a return on equity (ROE) of 6.50 percent while Beta Supermarket's return was 6.55 percent. The following data are available to the analyst from their financial statements:

NOPAT/Sales Sales/Net assets Effective after-tax interest rate Net financial leverage Alpha 14% 0.38 3.5% 0.65 Beta 12.8% 0.45 3.5% 0.35

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Return on Assets ROA Formula and Go...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started