Answered step by step

Verified Expert Solution

Question

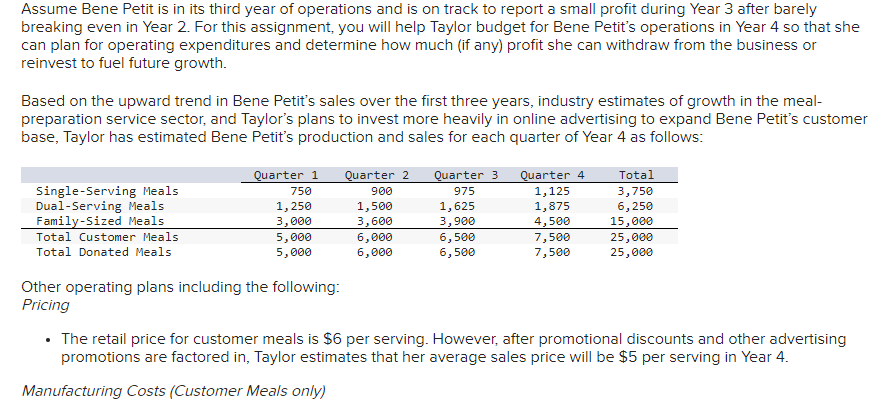

1 Approved Answer

Required: What is Year 4s budgeted operating income? What is the contribution margin per customer meal sold? What is the break-even point (in customer meals)

Required:

What is Year 4s budgeted operating income?

What is the contribution margin per customer meal sold?

What is the break-even point (in customer meals)

What is the margin of safety (in total customer meals)?

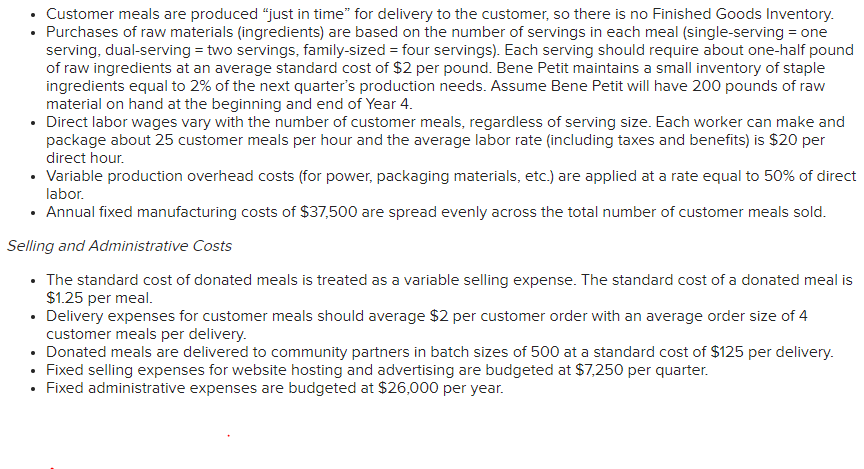

| For this spreadsheet, enter formulas in the yellow cells linking to the assumptions on the right. Check figure : Total Variable Expenses (Cell F39) = $156,250 | ||||||||||||

| Master Budget | 20% | 24% | 26% | 30% | Assumptions | |||||||

| Sales Forecast | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Total | Sales Mix | ||||||

| Single Serve Meals | 750 | 900 | 975 | 1,125 | 3,750 | 15% | ||||||

| Dual Serve Meals | 1,250 | 1,500 | 1,625 | 1,875 | 6,250 | 25% | ||||||

| Family Sized Meals | 3,000 | 3,600 | 3,900 | 4,500 | 15,000 | 60% | ||||||

| Total Customer Meals | 5,000 | 6,000 | 6,500 | 7,500 | 25,000 | 25000 | Total Customer Meals | |||||

| Total Donated Meals | 5,000 | 6,000 | 6,500 | 7,500 | 25,000 | 1 to 1 | Donated Meals | |||||

| Number of Servings | Serving sizes | |||||||||||

| Single Serve Meals | 750 | 900 | 975 | 1,125 | 3,750 | 1 | ||||||

| Dual Serve Meals | 2,500 | 3,000 | 3,250 | 3,750 | 12,500 | 2 | ||||||

| Family Sized Meals | 12,000 | 14,400 | 15,600 | 18,000 | 60,000 | 4 | ||||||

| Total Servings | 15,250 | 18,300 | 19,825 | 22,875 | 76,250 | |||||||

| 1. Sales Budget | ||||||||||||

| Sales Revenue | $ 5.00 | Sales price per serving | ||||||||||

| 2. Ingredients Purchases Budget | ||||||||||||

| Total Pounds of Ingredients Needed | 0.5 | pounds per serving | ||||||||||

| Ending Inventory of IngredientsRaw Materials | 200 | 200 | 2% | of next quarter DM needs | ||||||||

| Beginning Inventory of Ingredients | (200) | (200) | 2% | of current quarter DM needs | ||||||||

| Pounds of Ingredients Purchased | ||||||||||||

| Cost per Pound | $ 2.00 | $ 2.00 | $ 2.00 | $ 2.00 | $ 2.00 | $ 2.00 | per pound of ingredients | |||||

| Total Ingredients Purchased | ||||||||||||

| 3. Variable Manufacturing Cost Budget | Variable Cost Standards | SQ | SP | Unit Cost | ||||||||

| DM (Ingredient) Costs | $ (15,250) | $ (18,300) | $ (19,825) | $ (22,875) | $ (76,250) | DM (Ingredient) Costs | 0.5 | $ 2.00 | $ 1.00 | per serving | ||

| Direct Labor | $ (4,000) | $ (4,800) | $ (5,200) | $ (6,000) | $ (20,000) | Direct Labor | 0.04 | 20 | $ 0.80 | per meal | ||

| Variable Overhead (50% of DL) | $ (2,000) | $ (2,400) | $ (2,600) | $ (3,000) | $ (10,000) | Variable Overhead (50% of DL) | 0.04 | 10 | $ 0.40 | per meal | ||

| Total Variable Manufacturing Costs | $ (21,250) | $ (25,500) | $ (27,625) | $ (31,875) | $ (106,250) | |||||||

| 4. Variable Selling and Administrative Expenses | ||||||||||||

| Donated Meals (Production Cost) | $ (6,250) | $ (7,500) | $ (8,125) | $ (9,375) | $ (31,250) | Donated Meals (Production Cost) | $ 1.25 | per donated meal | ||||

| Delivery Expense (Customer Meals) | $ (2,500) | $ (3,000) | $ (3,250) | $ (3,750) | $ (12,500) | Delivery Expense (Customer Meals) | $ 0.50 | per customer meal | ||||

| Delivery Expense (Donated Meals) | $ (1,250) | $ (1,500) | $ (1,625) | $ (1,875) | $ (6,250) | Delivery Expense (Donated Meals) | $ 0.25 | per donated meal | ||||

| Total | $ (10,000) | $ (12,000) | $ (13,000) | $ (15,000) | $ (50,000) | |||||||

| Total Variable Expenses | $ (31,250) | $ (37,500) | $ (40,625) | $ (46,875) | $ (156,250) | |||||||

| Contribution Margin | $ (31,250) | $ (37,500) | $ (40,625) | $ (46,875) | $ (156,250) | |||||||

| Fixed Expenses | ||||||||||||

| Fixed Production Overhead | $ (9,375) | $ (9,375) | $ (9,375) | $ (9,375) | $ (37,500) | Fixed Production Overhead | $ 37,500 | per year | ||||

| Fixed selling expenses (website, etc) | $ (7,250) | $ (7,250) | $ (7,250) | $ (7,250) | $ (29,000) | Fixed selling expenses (website, etc) | $ 7,250 | per quarter | ||||

| Fixed administrative expenses (office assistant) | $ (6,500) | $ (6,500) | $ (6,500) | $ (6,500) | $ (26,000) | Fixed administrative expenses (office assistant) | $ 26,000 | per year | ||||

| Total Fixed Expenses | $ (23,125) | $ (23,125) | $ (23,125) | $ (23,125) | $ (92,500) | |||||||

| Operating Profit | $ (54,375) | $ (60,625) | $ (63,750) | $ (70,000) | $ (248,750) | |||||||

| Contribution Margin per Customer Meal (Total Contribution Margin / Total Customer Meals) | ||||||||||||

| BE Units (-Total Fixed Costs / CM per Customer Meal) | Note: Make sure fixed costs are stated as a positive number for Break-even. | |||||||||||

| Margin of Safety (Total Customer Meals - Break-even Meals) |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started