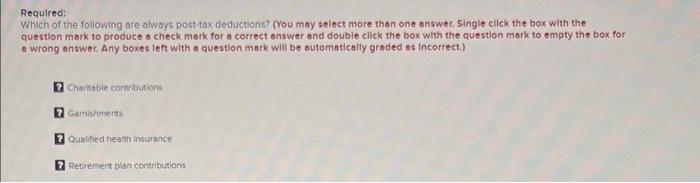

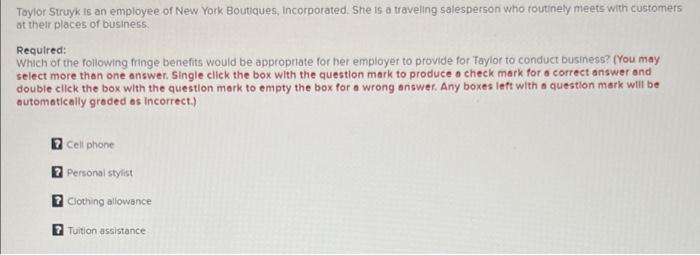

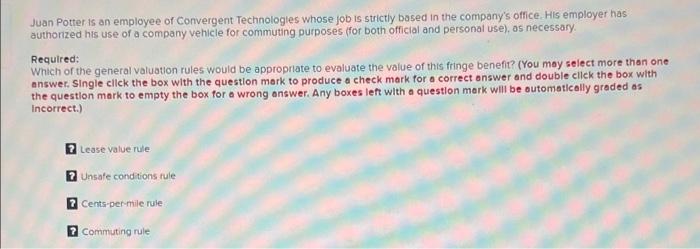

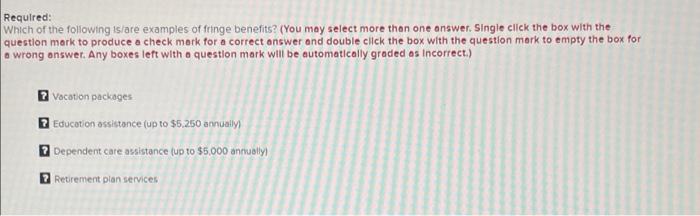

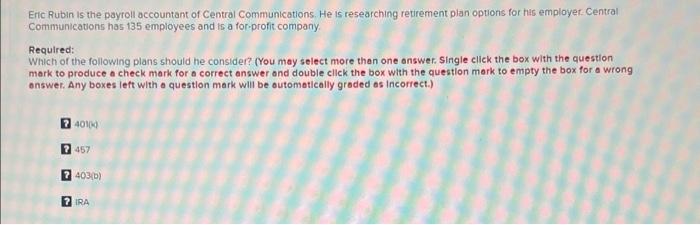

Required: Which of the following are always post-tax deductions? (You may select more than one answer. Single click the box with the question mark to produce o check mork for a correct answer and double click the box with the question mark to empty the box for o wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Charitable contributions Garnishments ? Qualified health Insurance 2 Retirement plan contributions Taylor Struyk is an employee of New York Boutiques, Incorporated. She is a traveling salesperson who routinely meets with customers at their places of business Required: Which of the following fringe benefits would be appropriate for her employer to provide for Taylor to conduct business? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Cellphone Personal stylist Clothing allowance Tuition assistance Juan Potter is an employee of Convergent Technologies whose job is strictly based in the company's office. His employer has authorized his use of a company vehicle for commuting purposes (for both official and personal use), os necessary Required: Which of the general valuation rules would be appropriate to evaluate the value of this fringe benefit? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be outomatically graded as Incorrect.) Lease value rule Unsafe conditions rule Cents-per-mile rule commuting rule 7 Required: Which of the following is/are examples of fringe benefits? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Vacation packages Education assistance (up to $5.250 annually Dependent care assistance (up to $5,000 annually! 2 Retirement plan services Eric Rubin is the payroll accountant of Central Communications. He is researching retirement plan options for his employer. Central Communications has 135 employees and is a for-profit company Required: Which of the following plans should he consider? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be outomatically graded as incorrect.) 40100 7457 7403) 2 IRA