Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: You are employed as the junior accountant at Linksfield Wholesalers, a registered VAT vendor. The current financial year end of the business is 3

Required: You are employed as the junior accountant at Linksfield Wholesalers, a registered VAT vendor. The

current financial year end of the business is December You have extracted the following

information relating to one of the business's assets below:

Vehicles are depreciated at pa on the diminishing balance method.

The above passenger vehicle was sold on October for R inclusive of VAT.

Management of Linksfield Wholesalers decided to replace the passenger vehicle with a delivery

vehicle and purchased a new Isuzu van on December for R inclusive of VAT. Linksfield

Wholesalers paid cash for the new vehicle.

The following balances were extracted from the trial balance as at December :

Vehicles: R

Accumulated depreciation: Vehicles R

Note: Show all your workings.

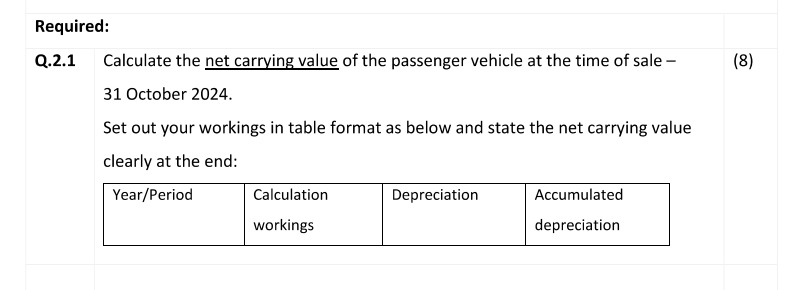

Q Calculate the net carrying value of the passenger vehicle at the time of sale

October

Set out your workings in table format as below and state the net carrying value

clearly at the end:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started