Question

You get to build the interest rate tree based on the rate curve and the interest rate volatility of 15%. Follow the iterative procedure as

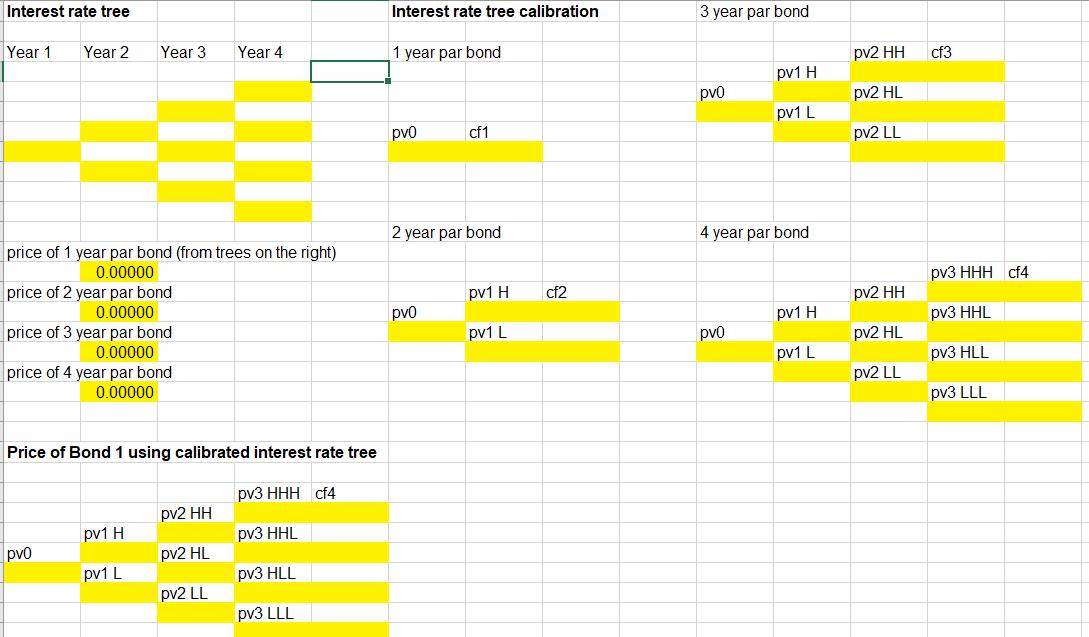

You get to build the interest rate tree based on the rate curve and the interest rate volatility of 15%. Follow the iterative procedure as described in the text. Remember that the possible rates in every period are separated by a factor of e^(2*sigma). For every period, take a guess for what the lowest rate might be, and compute the rest of them based on volatility. Then calculate the price of the same-maturity par bond based on these rates, in the workspace trees set up to the right. Use goal seek to tweak the rate until the price of the par bond is exactly 100 using the tree. Then move on to the next par bond, etc. until you fill in the entire rate tree. At the end, you should have a tree of interest rates that prices each par bond at exactly 100.

Interest rate tree Year 1 Year 2 price of 1 year par bond (from trees on the right) 0.00000 price of 2 year par bond 0.00000 Year 3 price of 3 year par bond 0.00000 price of 4 year par bond 0.00000 pv0 Price of Bond 1 using calibrated interest rate tree pv3 HHH cf4 pv3 HHL pv3 HLL pv3 LLL pv1 H pv1 L Year 4 pv2 HH pv2 HL pv2 LL Interest rate tree calibration 1 year par bond pv0 cf1 2 year par bond pv0 pv1 H pv1 L cf2 3 year par bond pv0 pv1 H pv1 L 4 year par bond pv0 pv1 H pv1 L pv2 HH pv2 HL pv2 LL pv2 HH pv2 HL pv2 LL cf3 pv3 HHH cf4 pv3 HHL pv3 HLL pv3 LLL

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Here is a 3period interest rate tree with 15 annual volatility that prices 1year 2yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started