Question

Required:Part A - ?Consolidation Question On 0 1 0 7 / 2 0 2 1 , ?S forzando Ltd acquired 1 0 0 % ?of

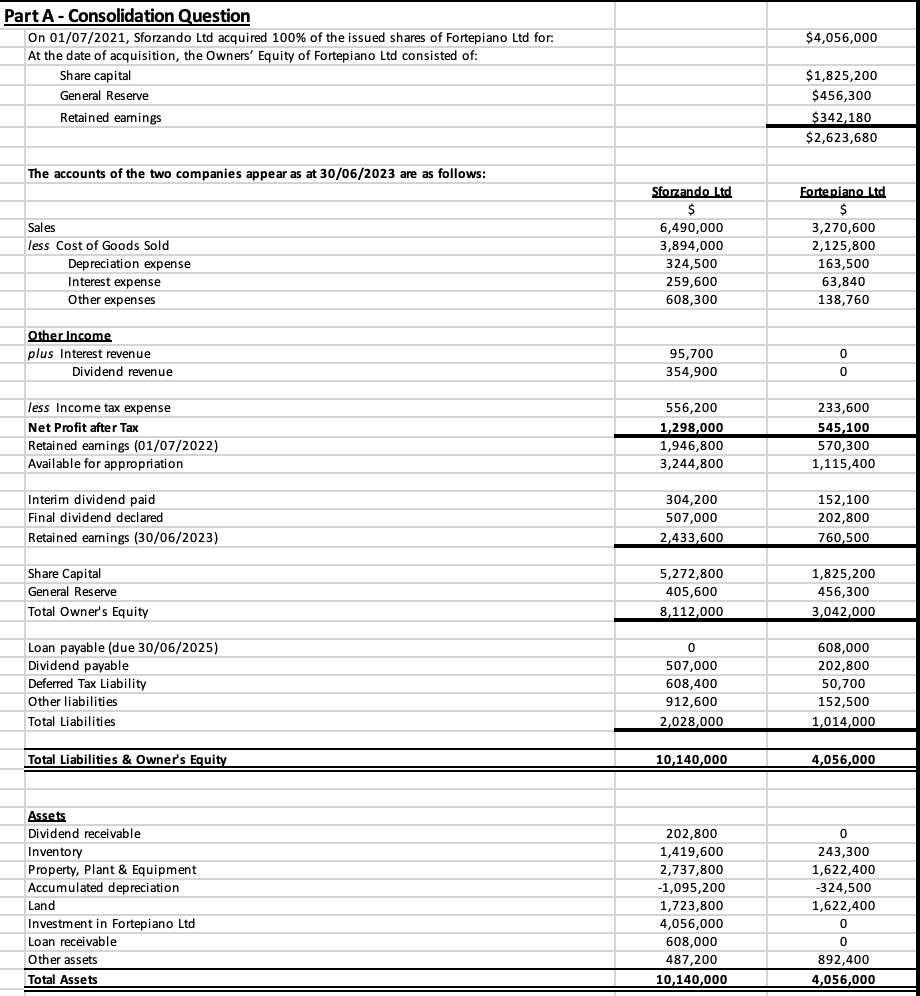

Required:Part A ?Consolidation Question

On ?S forzando Ltd acquired ?of the issued shares of Fortepiano Ltd for: At the date of acquisition, the Owners' Equity of Fortepiano Ltd consisted of:

Share capital

General Reserve

Retained earnings

The accounts of the two companies appear as at ?are as follows:

i ?Prepare the acquisition analysis at the date of acquisition.

ii ?Record the consolidated journal entries necessary to prepare consolidated accounts for the year ending

?for the group comprising Tie Ltd and Legato Ltd

iii ?Complete the consolidated worksheet for the year ending

?Entering the consolidated journal entries in Part ii ?above to the appropriate debit and credit

columns in the Consolidated Worksheet; and

?Clearly labelling the references for each of the adjustments in the Consolidated Worksheet; and

?Completing the Group figures in the Consolidated Worksheet

Part A - Consolidation Question On 01/07/2021, Sforzando Ltd acquired 100% of the issued shares of Fortepiano Ltd for: At the date of acquisition, the Owners' Equity of Fortepiano Ltd consisted of: Share capital General Reserve Retained earnings $4,056,000 $1,825,200 $456,300 $342,180 $2,623,680 The accounts of the two companies appear as at 30/06/2023 are as follows: Sales less Cost of Goods Sold Depreciation expense Interest expense Other expenses Other Income plus Interest revenue Dividend revenue Sforzando Ltd $ Fortepiano Ltd $ 6,490,000 3,270,600 3,894,000 2,125,800 324,500 163,500 259,600 608,300 63,840 138,760 95,700 0 354,900 0 less Income tax expense 556,200 233,600 Net Profit after Tax 1,298,000 545,100 Retained earnings (01/07/2022) 1,946,800 570,300 Available for appropriation 3,244,800 1,115,400 Interim dividend paid 304,200 152,100 Final dividend declared 507,000 202,800 Retained earnings (30/06/2023) 2,433,600 760,500 Share Capital 5,272,800 1,825,200 General Reserve 405,600 456,300 Total Owner's Equity 8,112,000 3,042,000 Loan payable (due 30/06/2025) 0 608,000 Dividend payable 507,000 202,800 Deferred Tax Liability 608,400 50,700 Other liabilities 912,600 152,500 Total Liabilities 2,028,000 1,014,000 Total Liabilities & Owner's Equity 10,140,000 4,056,000 Assets Dividend receivable 202,800 0 Inventory 1,419,600 243,300 Property, Plant & Equipment 2,737,800 1,622,400 Accumulated depreciation -1,095,200 -324,500 Land 1,723,800 1,622,400 Investment in Fortepiano Ltd 4,056,000 0 Loan receivable 608,000 0 Other assets Total Assets 487,200 892,400 10,140,000 4,056,000

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To provide a comprehensive response to your question on how to complete the consolidation process for Forzando Ltd and Fortepiano Ltd it is essential ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started