Question

Use the following continuously compounded zero rates and forward rates for Problems 8-9: 1 year zero rate is 3.50% or o$1 2 year zero

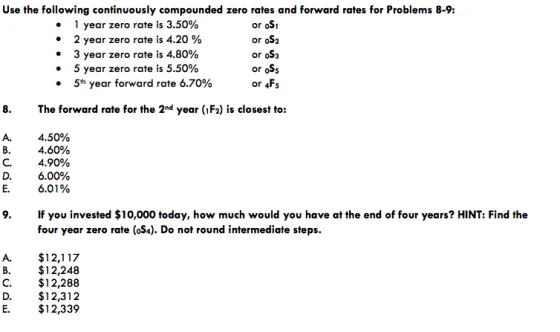

Use the following continuously compounded zero rates and forward rates for Problems 8-9: 1 year zero rate is 3.50% or o$1 2 year zero rate is 4.20 % or o$2 3 year zero rate is 4.80% or oS 5 year zero rate is 5.50% or oss 5th year forward rate 6.70% or 4Fs The forward rate for the 2nd year (1F) is closest to: 8. A. B. C. D. E. 9. A. B. C. D. E. 4.50% 4.60% 4.90% 6.00% 6.01% If you invested $10,000 today, how much would you have at the end of four years? HINT: Find the four year zero rate (oS4). Do not round intermediate steps. $12,117 $12,248 $12,288 $12,312 $12,339

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To solve these problems we will use the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Options Futures and Other Derivatives

Authors: John C. Hull

10th edition

013447208X, 978-0134472089

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App