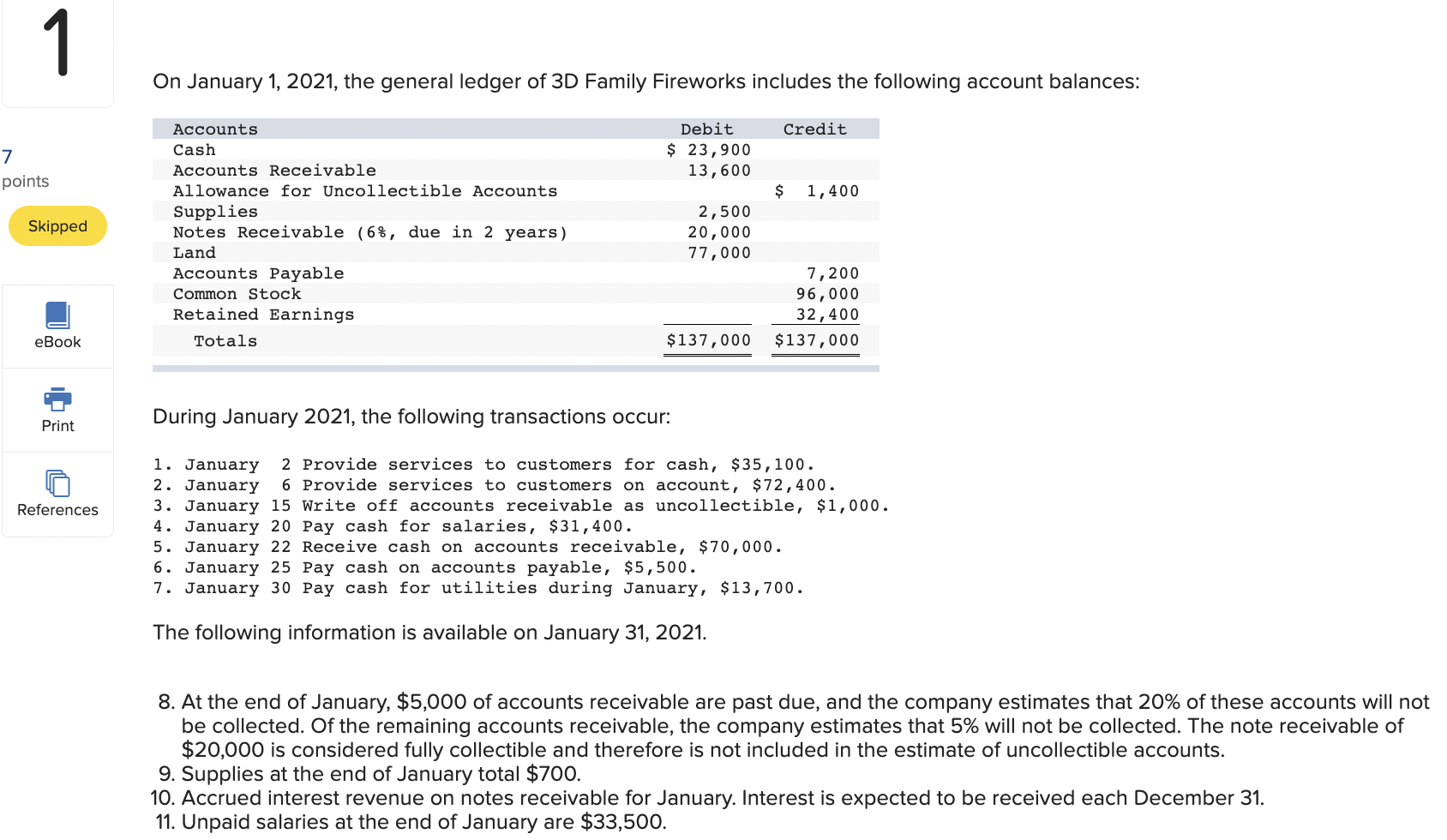

Question

REQUIREMENT 1: 1. Provide services to customers for cash, $35,100. 2. Provide services to customers on account, $72,400. 3. Write off accounts receivable as uncollectible,

REQUIREMENT 1:

1. Provide services to customers for cash, $35,100.

2. Provide services to customers on account, $72,400.

3. Write off accounts receivable as uncollectible, $1,000.

4. Pay cash for salaries, $31,400.

5. Receive cash on accounts receivable, $70,000.

6. Pay cash on accounts payable, $5,500.

7. Pay cash for utilities during January, $13,700.

8. At the end of January, $5,000 of accounts receivable are past due, and the company estimates that 20% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 5% will not be collected. The note receivable of $20,000 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts.

9. Supplies at the end of January total $700.

10. Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31.

11. Unpaid salaries at the end of January are $33,500.

12. Record the closure revenue accounts.

13. Record the closure expense accounts.

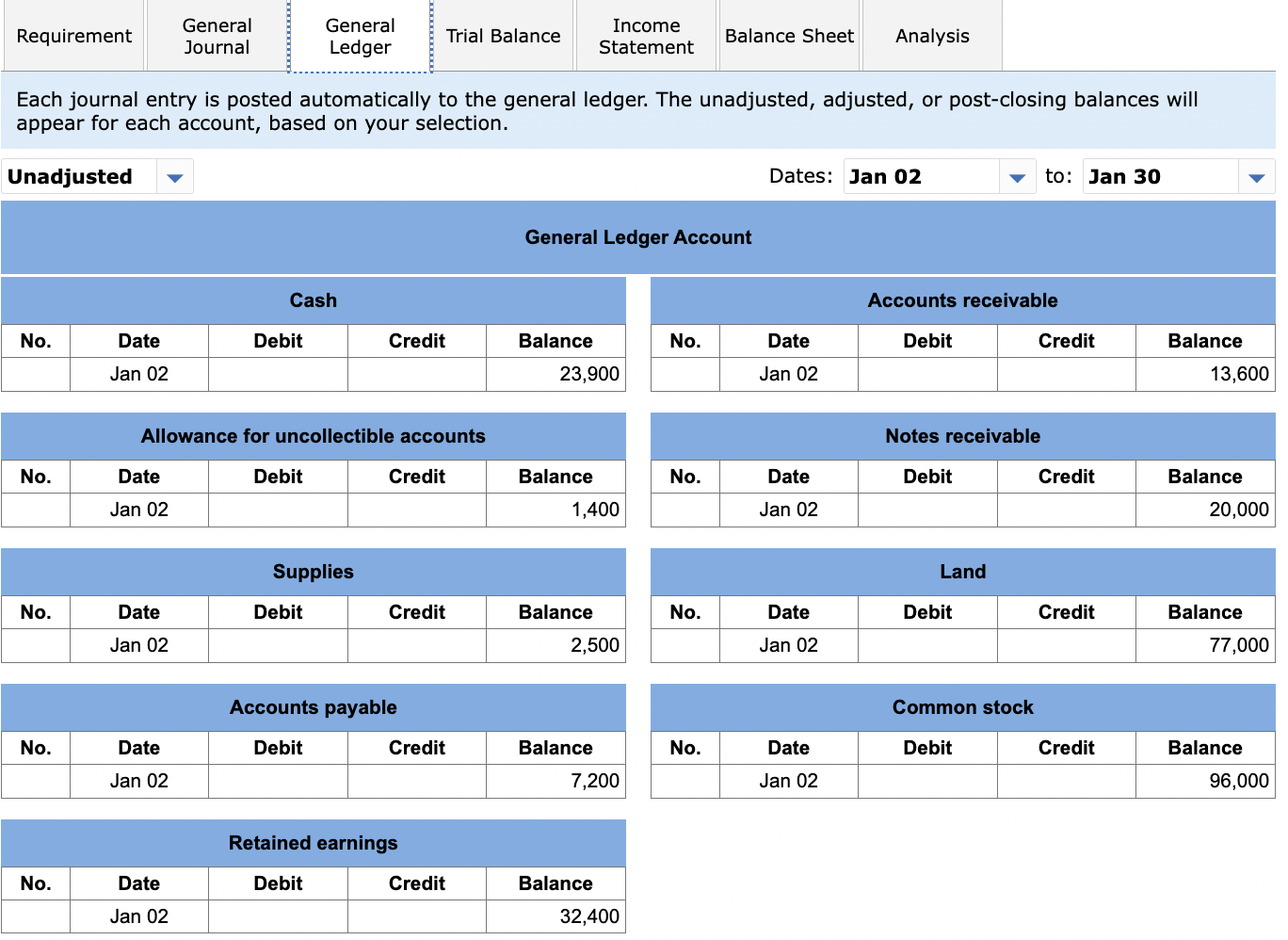

REQUIREMENT 2:

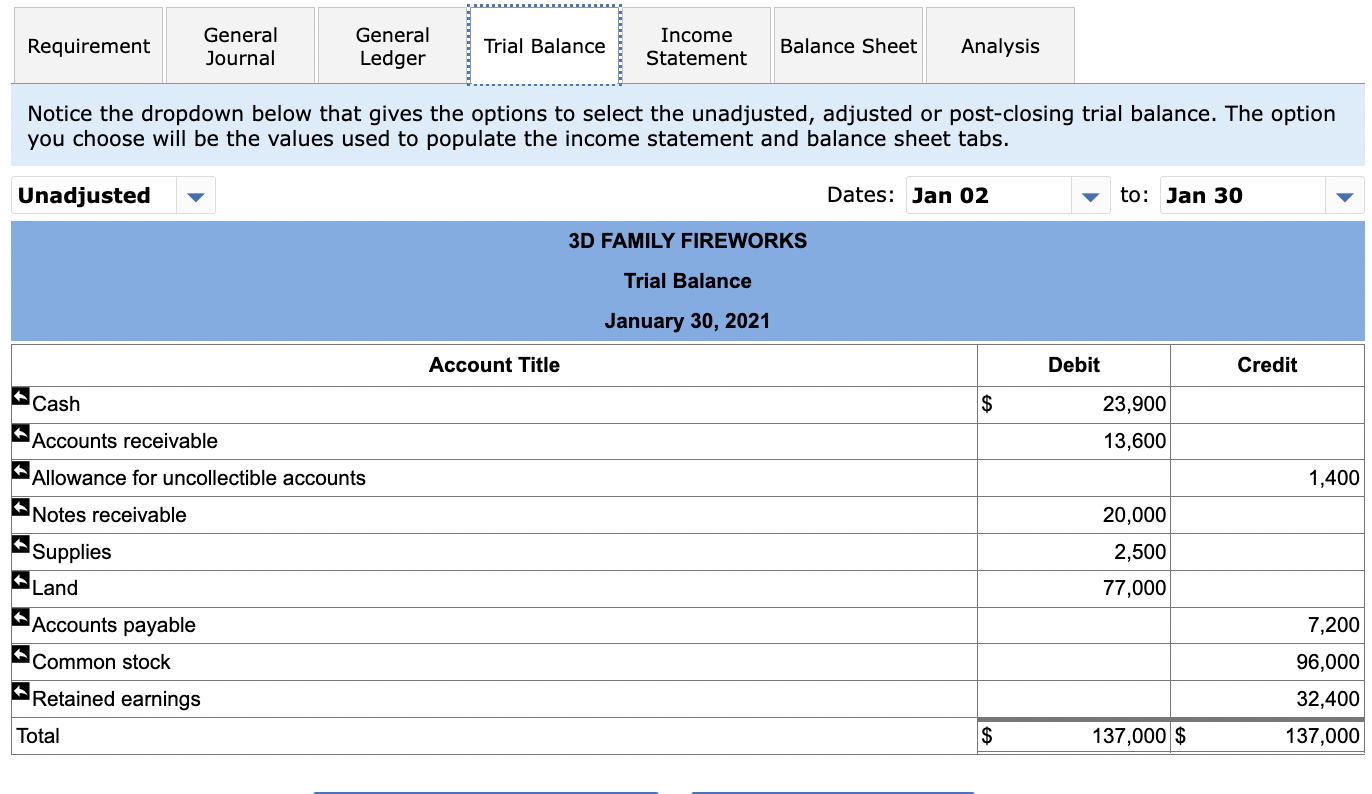

REQUIREMENT 3:

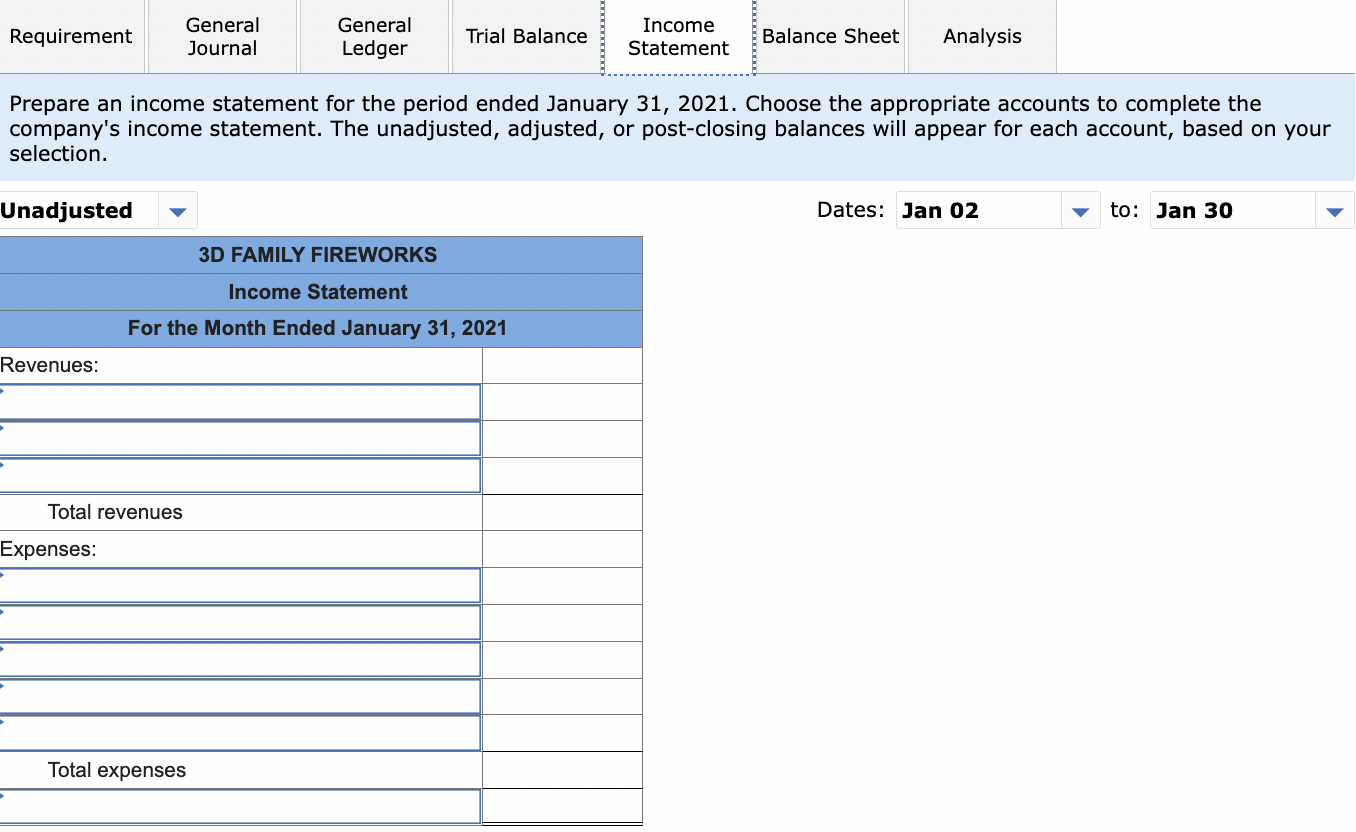

REQUIREMENT 4:

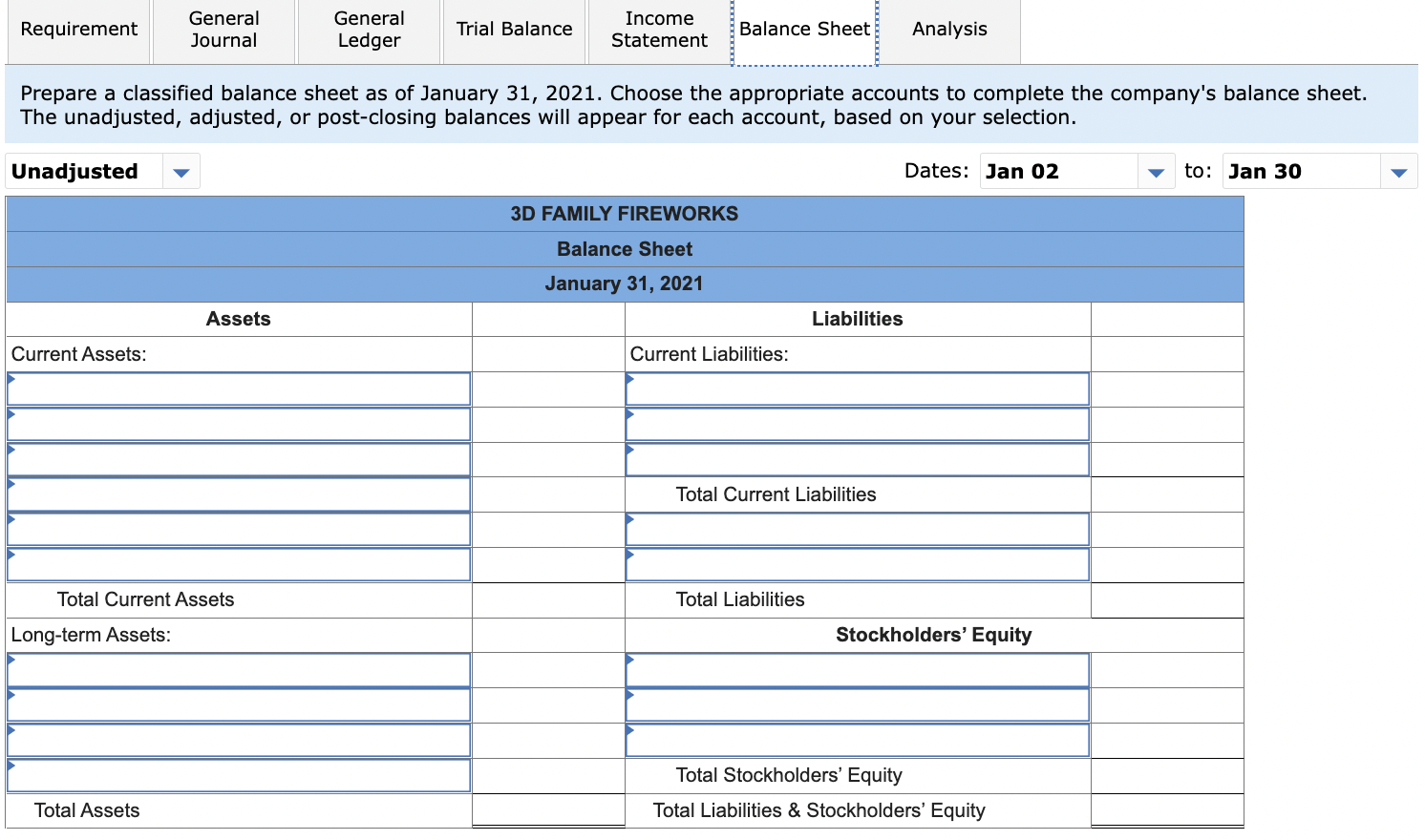

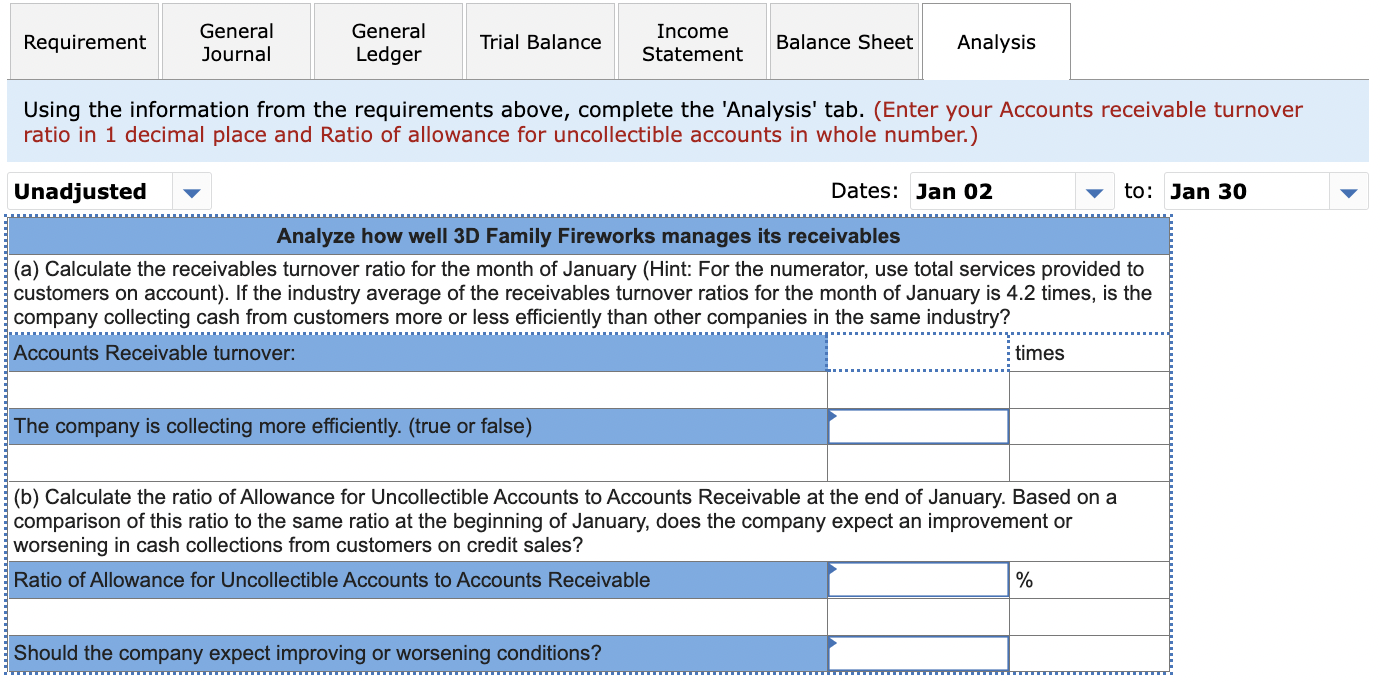

REQUIREMENT 5:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started