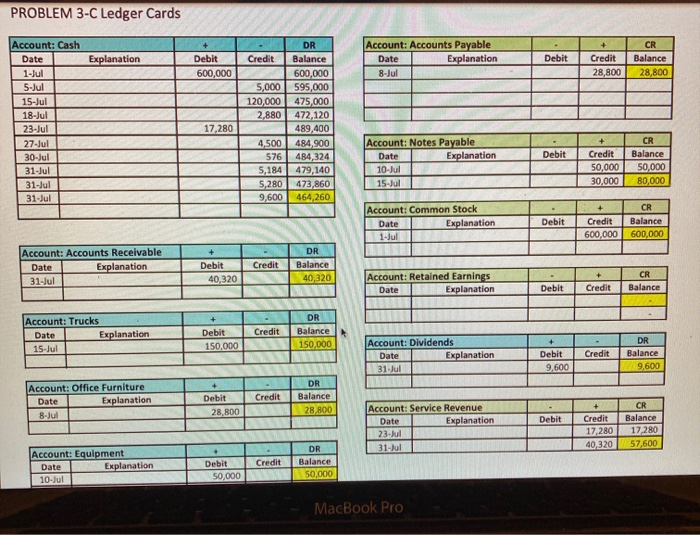

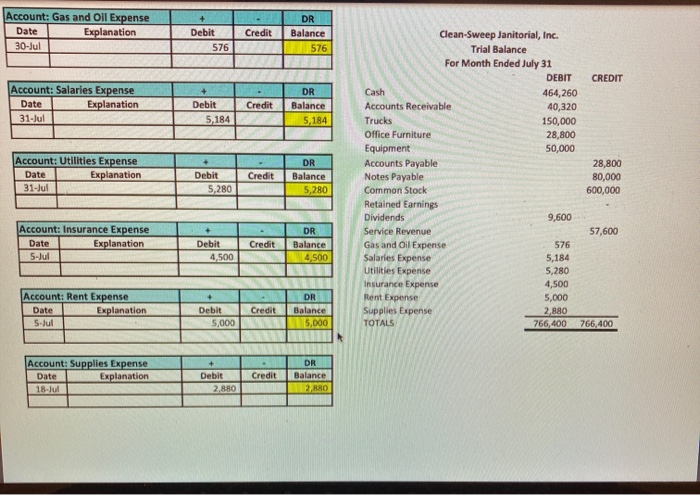

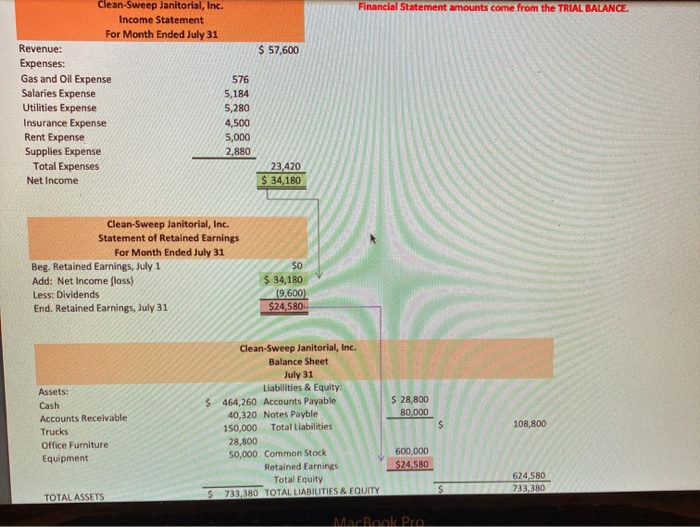

Requirement 1, 3, and 4 1. Journalize the transactions given for July in the general journal. 3. Prepare a trial balance as of July 31. 4. Prepare the financial statements for July using the trial balance Previous PROBLEM 3-C Ledger Cards Account: Accounts Payable Date Explanation 8-Jul Debit 600,000 Debit Credit 28,800 CR Balance 28,800 Account: Cash Date Explanation 1-Jul 5-Jul 15-Jul 18-Jul 23-Jul 27-Jul 30-Jul 31-Jul 31-Jul 31-Jul DR Credit Balance 600,000 5,000 595,000 120,000 475,000 2,880 472,120 489,400 4,500 484,900 576 484,324 5,184 479,140 5,280 473,860 9,600 464,260 17,280 Debit Account: Notes Payable Date Explanation 10-Jul 15-Jul Credit 50,000 30,000 CR Balance 50,000 80,000 Account: Common Stock Date Explanation 1.Jul Debit CR Credit Balance 600,000 600,000 Account: Accounts Receivable Date Explanation 31-Jul Credit Debit 40,320 DR Balance 40,320 + Account: Retained Earnings Date Explanation CR Balance Debit Credit Account: Trucks Date Explanation 15-Jul Credit Debit 150,000 DR Balance 150,000 Account: Dividends Date Explanation 31.Jul Credit Debit 9,600 DR Balance 9,600 Account: Office Furniture Date Explanation 8-Jul Debit Credit DR Balance 28 800 28,800 Debit Account: Service Revenue Date Explanation 23-Jul 31.Jul Credit 17,280 40 320 CR Balance 17,280 57,600 Account: Equipment Date Explanation 10-Jul Credit Debit 50,000 DR Balance 50,000 MacBook Pro Account: Gas and Oll Expense Date Explanation 30-Jul Credit Debit 576 DR Balance 576 Account: Salaries Expense Date Explanation 31-Jul Credit Debit 5,184 DR Balance 5,184 Account: Utilities Expense Date Explanation 31-Jul Credit Debit 5,280 DR Balance 5,280 Clean-Sweep Janitorial, Inc. Trial Balance For Month Ended July 31 DEBIT CREDIT Cash 464,260 Accounts Receivable 40,320 Trucks 150,000 Office Furniture 28,800 Equipment 50,000 Accounts Payable 28,800 Notes Payable 80,000 Common Stock 600,000 Retained Earnings Dividends 9,600 Service Revenue 57,600 Gas and Oil Expense 576 Salaries Expense 5,184 Utilities Expense 5,280 Insurance Expense 4,500 Rent Expense 5,000 Supplies Expense 2,880 TOTALS 766,400 766,400 Account: Insurance Expense Date Explanation 5-Jul DR Balance Credit Debit 4,500 4.500 + Account: Rent Expense Date Explanation 5.Jul Credit Debit 5,000 DR Balance 5.000 Account: Supplies Expense Date Explanation 18-Jul Credit Debit 2,880 DR Balance 2 ARO Financial Statement amounts come from the TRIAL BALANCE $ 57,600 Clean-Sweep Janitorial, Inc. Income Statement For Month Ended July 31 Revenue: Expenses: Gas and Oil Expense 576 Salaries Expense 5,184 Utilities Expense 5,280 Insurance Expense 4,500 Rent Expense 5,000 Supplies Expense 2,880 Total Expenses Net Income 23,420 $ 34,180 Clean-Sweep Janitorial, Inc. Statement of Retained Earnings For Month Ended July 31 Beg, Retained Earnings, July 1 Add: Net Income (loss) Less: Dividends End. Retained Earnings, July 31 SO $ 34,180 19,600) $24,580 $ 28,800 80.000 Assets: Cash Accounts Receivable Trucks Office Furniture Equipment Clean-Sweep Janitorial, Inc. Balance Sheet July 31 Liabilities & Equity: $ 464,260 Accounts Payable 40,320 Notes Payble 150,000 Total Liabilities 28,800 50,000 Common Stock Retained Earnings Total Equity $ 733,380 TOTAL LIABILITIES & EQUITY $ 108.800 108,800 600,000 $24.530 624,580 733 380 TOTAL ASSETS MacBook Pro Please upload Clean Sweep Janitorial Case Study (worth 5 bonus points) Requirement 1, 3, and 4 1. Journalize the transactions given for July in the general journal. 2. Post the journal entries to ledger accounts. (Provided here) Minimize File Preview Page > of 4 ZOOM +