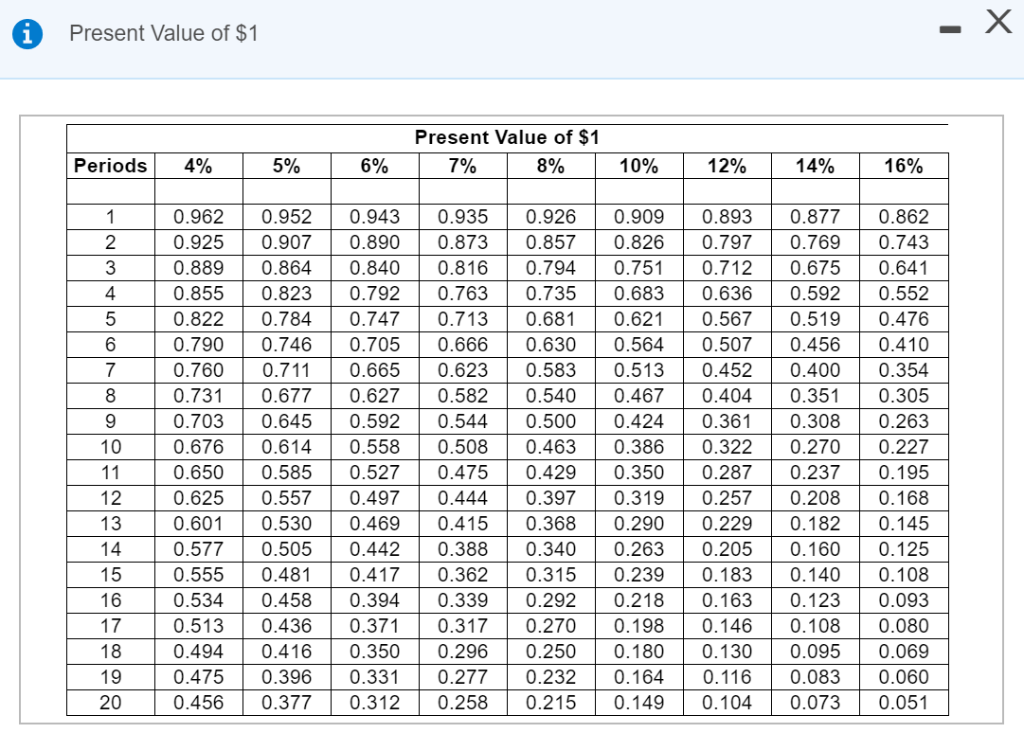

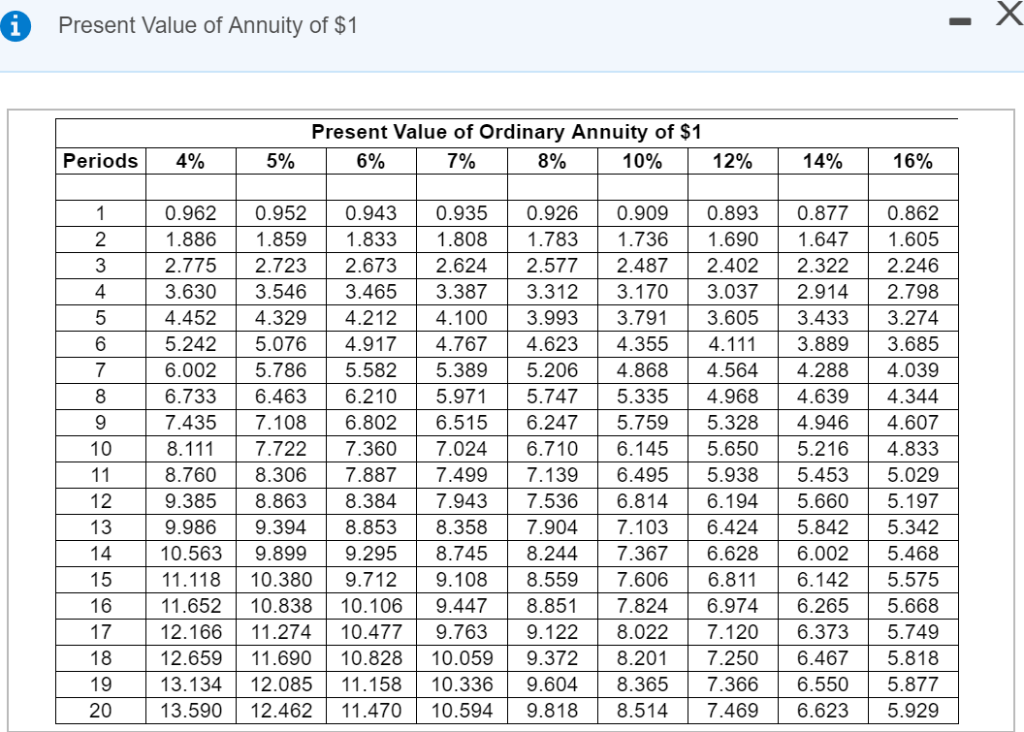

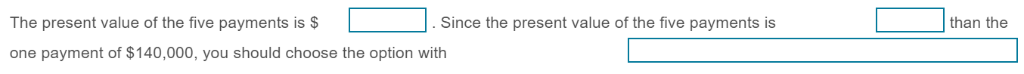

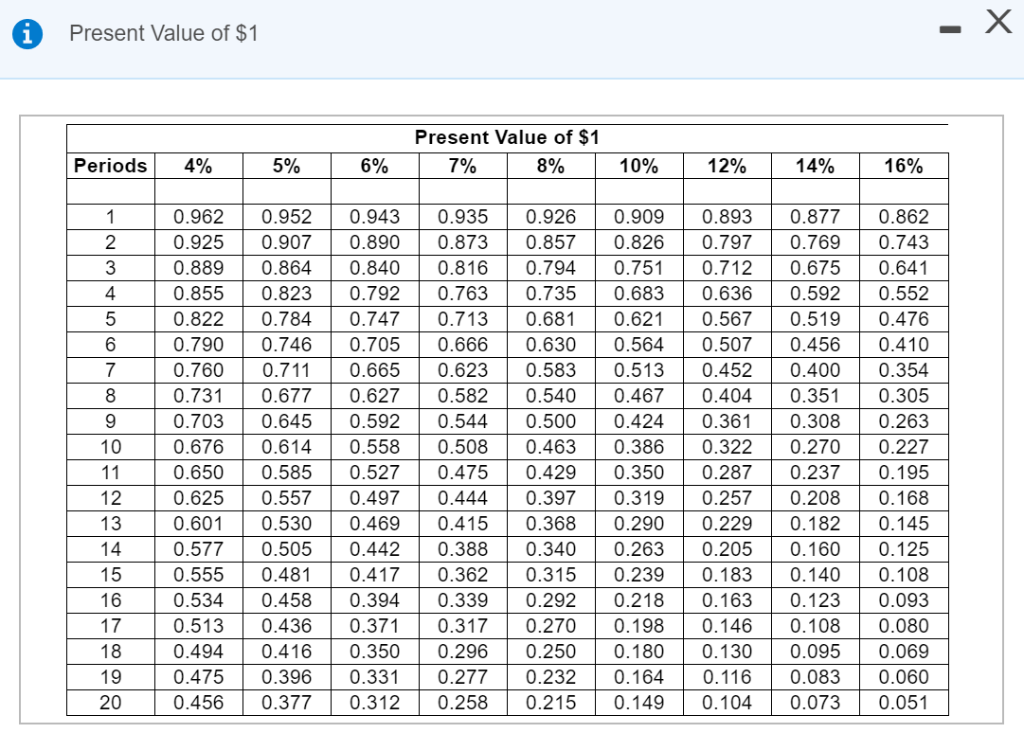

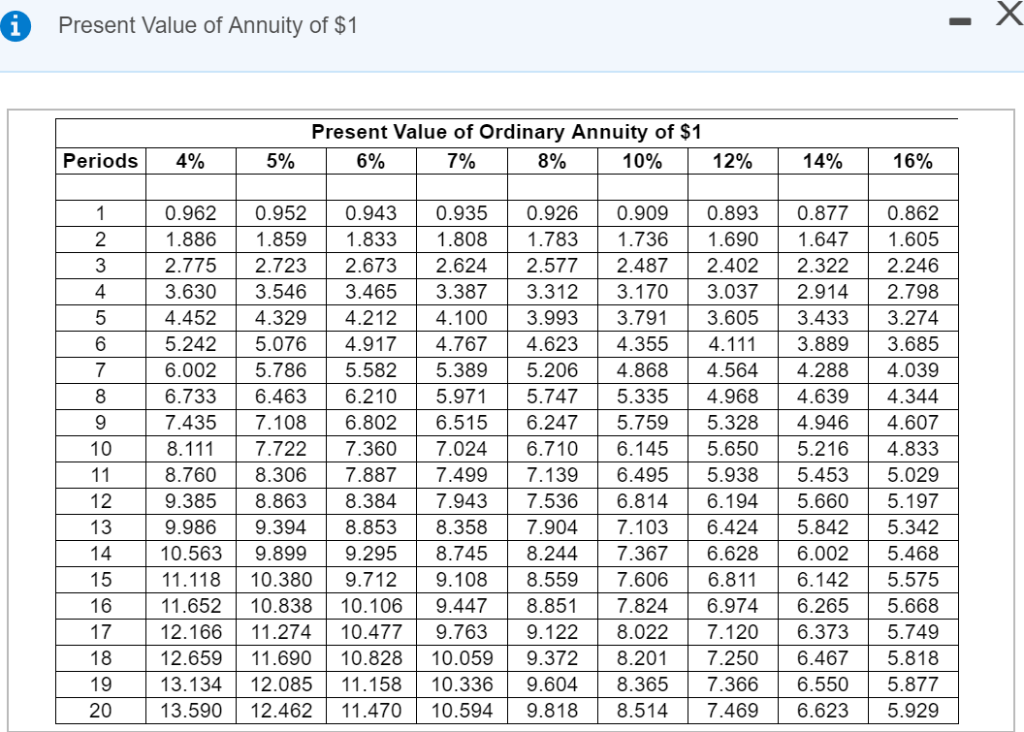

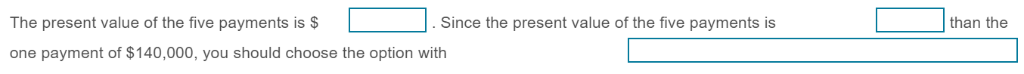

Requirement 1. Assuming a 6 % interest rate, which investment opportunity would you choose? (If using present value tables, use factor amounts rounded to three decimal places, X.XXX. Round your final answer to the nearest whole dollar.)

Option with one payment now or payments over the 5 years.

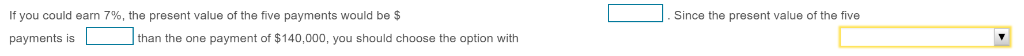

Requirement 2. If you could earn 7 %, would your choice change? (If using present value tables, use factor amounts rounded to three decimal places, X.XXX. Round your final answer to the nearest whole dollar.)

should choose the ption with one payment now or payments over the 5 years?

Requirement 3. Assuming a 7% interest rate, what would the cash flow in year 5 have to be in order for you to be indifferent to the two plans? (If using present value tables, use factor amounts rounded to three decimal places, X.XXX. Round your final answer to the nearest whole dollar.)

Which option is better receive $140,000 now or $40,000, $15,000, $20,000, $65,000, and $10,000, respectively, over the next five years? The cash flows are at the end of each year except for $140,000. (Click the icon to view Present Value of $1 table.) Click the icon to view Present Value of Ordinary Annuity of SI table 1 Present Value of $1 Present Value of $1 Periods | 4% 5% 6% 7% 5% 10% 12% 14% 16% 0.962 0.952 0.943 0.935 0.926 0.9090.893 0.8770.862 0.925 0.9070.8900.873 0.857 0.826 0.7970.7690.743 0.889 0.864 0.840 0.8160.794 0.7510.7120.675 0.641 0.855 0.823 0.7920.7630.735 0.683 0.636 0.5920.552 0.8220.784 0.747 0.713 0.681 0.621 0.567 0.519 0.476 0.790 0.746 0.705 0.666 0.630 0.5640.507 0.456 0.410 0.7600.71 0.665 0.6230.583 0.513 0.4520.400 0.354 0.731 0.677 0.627 0.582 0.540 0.467 0.404 0.3510.305 0.7030.645 0.592 0.5440.500 0.424 0.361 0.308 0.263 0.676 0.614 0.558 0.508 0.463 0.386 0.322 0.270 0.227 0.650 0.585 0.527 0.4750.429 0.350 0.287 0.2370.195 0.625 0.557 0.497 0.444 0.397 0.319 0.257 0.208 0.168 0.601 0.530 0.469 0.415 0.368 0.2900.229 0.182 0.145 0.5770.505 0.442 0.388 0.340 0.263 0.2050.160 0.125 0.555 0.481 0.417 0.362 0.315 0.2390.183 0.140 0.108 0.5340.458 0.3940.339 0.292 0.218 0.163 0.123 0.093 0.513 0.436 0.371 0.317 0.270 0.198 0.146 0.108 0.080 0.494 0.416 0.350 0.2960.250 0.180 0.130 0.095 0.069 0.475 0.396 0.331 0.2770.232 0.164 0.116 0.083 0.060 0.456 0.377 0.312 0.258 0.215 0.149 0.104 0.0730.051 4 6 17 19 20 Present Value of Annuity of $1 1 Present Value of Ordinary Annuity of $1 Periods | 4% 5% 5% 5% 10% 12% 14% 16% 0.962 0.952 0.943 0.9350.9260.909 0.893 0.8770.862 1.8861.8591.833 1.8081.783 1.736 1.690 1.6471.605 2.775 2.723 2.673 2.624 2.577 2.487 2.402 2.322 2.246 3.630 3.546 3.465 3.387 3.312 3.170 3.037 2.914 2.798 4.4524.329 4.212 4.1003.993 3.7913.6053.433 3.274 5.2425.076 4.917 4.7674.623 4.355 4.1113.889 3.685 6.0025.786 5.582 5.389 5.206 4.868 4.564 4.288 4.039 6.7336.463 6.210 5.9715.747 5.335 4.968 4.639 4.344 7.435 7.108 6.802 6.5156.2475.7595.328 4.946 4.607 8.117.722 7.360 7.0246.710 6.145 5.650 5.216 4.833 8.7608.306 7.887 7.4997.139 6.495 5.9385.453 5.029 9.385 8.863 8.384 7.943 7.5366.814 6.194 5.6605.197 9.9869.394 8.853 8.358 7.9047.103 6.4245.8425.342 10.5639.899 9.2958.7458.244 7.367 6.6286.002 5.468 11.11810.380 9.7129.1088.5597.606 6.8116.142 5.575 11.65210.838 10.106 9.447 8.851 7.824 6.974 6.265 5.668 12.16611.274 10.477 9.763 9.122 8.0227.120 6.373 5.749 12.65911.690 10.828 10.059 9.3728.201 7.250 6.4675.818 13.13412.085 11.158 10.3369.604 8.365 7.366 6.5505.877 13.590 12.462 11.47010.5949.818 8.514 7.4696.623 5.929 12 20 than the The present value of the five payments is $ one payment of $140,000, you should choose the option with . Since the present value of the five payments is If you could eam 7%, the present value of the five payments would be $ Since the present value of the five payments is than the one payment of $140,000, you should choose the option with If you could earn 7%, the cash flow in year 5 would have to be $ for you to be indifferent to the two plans