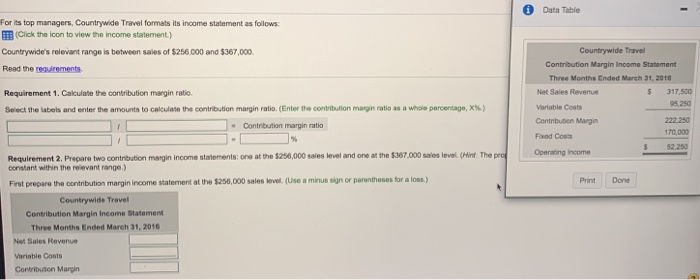

REQUIREMENT 1 Calculate the contribution margin ratio.

REQUIREMENT 2 prepare two contribution margin income statements : one at the $256,000 sales level and one at $367,000 sales level.

Data Table For its top managers, Countrywide Travel formats its income statement as follows (Click the icon to view the income statement.) Countrywide Travel Countrywide's relevant range is between sales of $256.000 and $367,000 Contribution Margin Income Statement Read the requirements Three Months Ended March 31, 2016 317,500 Net Sales Revenue Requirement 1. Calculate the contribution margin ratio. 95,250 Variable Costs Select the labels and enter the amounts to calculate the contribution margin ratio. (Enter the contribution margin ratio as a whole percentage, X%) Contributien Margin 222.250 Contribution margin ratio 170,000 Fxed Costs % 52.250 Requirement 2. Prepare two contribution margin income statements: one at the $256,000 sales level and one at the $367,000 sales level (Hint The pro constant within the relevant range.) Operating Income Print Done First prepare the contribution margin income statement at the $256,000 sales level (Use a minus sign or parentheses for a loss) Countrywide Travel Contribution Margin Income Statement Three Months Ended March 31, 2016 Net Sales Revenue Variable Costs Contributon Margin Requirements 1. Calculate the contribution margin ratio. 2. Prepare two contribution margin income statements: one at the $256,000 sales level and one at the $367,000 sales level. (Hint: The proportion of each sales dollar that goes toward variable costs is constant within the relevant range.) Print Done Data Table For its top managers, Countrywide Travel formats its income statement as follows (Click the icon to view the income statement.) Countrywide Travel Countrywide's relevant range is between sales of $256.000 and $367,000 Contribution Margin Income Statement Read the requirements Three Months Ended March 31, 2016 317,500 Net Sales Revenue Requirement 1. Calculate the contribution margin ratio. 95,250 Variable Costs Select the labels and enter the amounts to calculate the contribution margin ratio. (Enter the contribution margin ratio as a whole percentage, X%) Contributien Margin 222.250 Contribution margin ratio 170,000 Fxed Costs % 52.250 Requirement 2. Prepare two contribution margin income statements: one at the $256,000 sales level and one at the $367,000 sales level (Hint The pro constant within the relevant range.) Operating Income Print Done First prepare the contribution margin income statement at the $256,000 sales level (Use a minus sign or parentheses for a loss) Countrywide Travel Contribution Margin Income Statement Three Months Ended March 31, 2016 Net Sales Revenue Variable Costs Contributon Margin Requirements 1. Calculate the contribution margin ratio. 2. Prepare two contribution margin income statements: one at the $256,000 sales level and one at the $367,000 sales level. (Hint: The proportion of each sales dollar that goes toward variable costs is constant within the relevant range.) Print Done