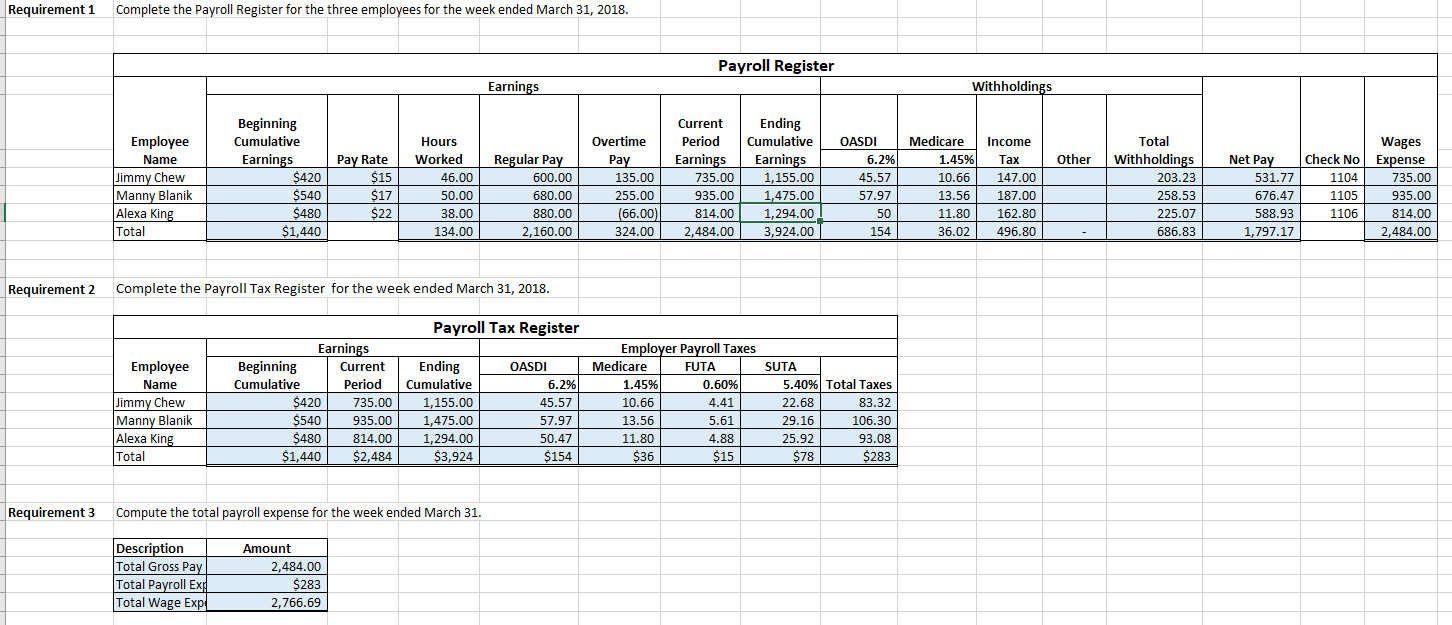

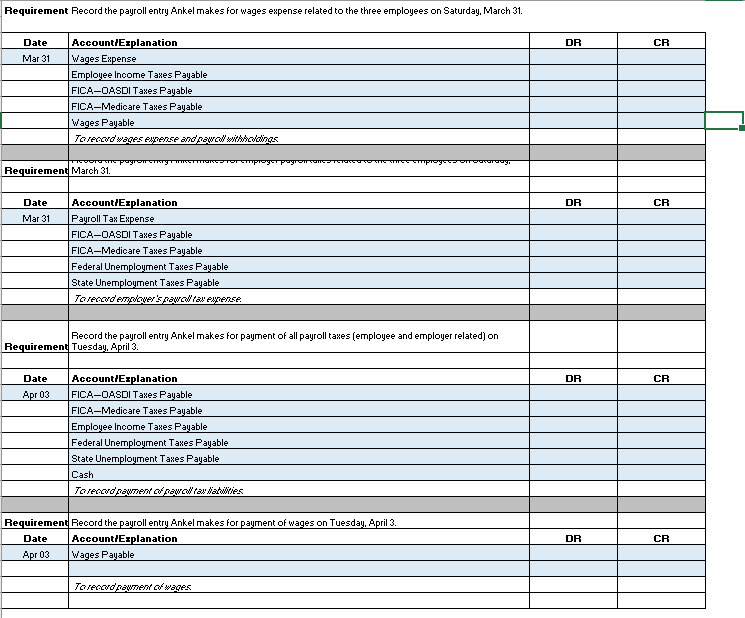

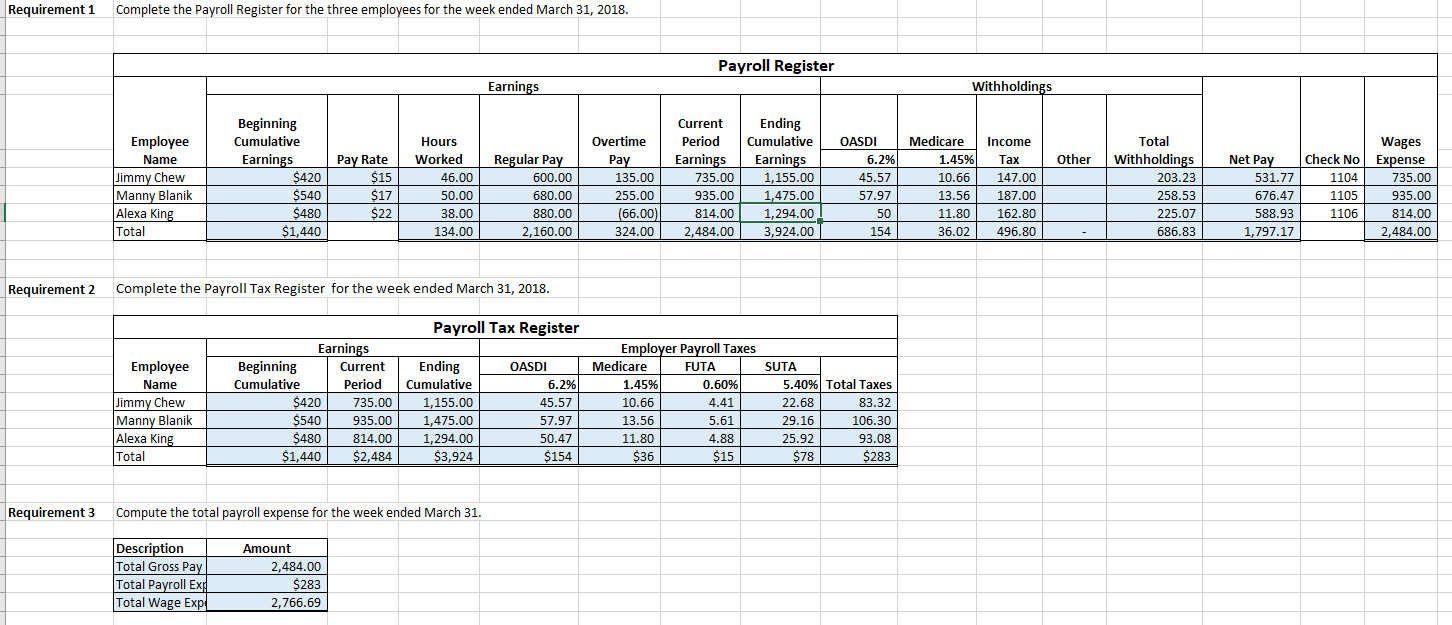

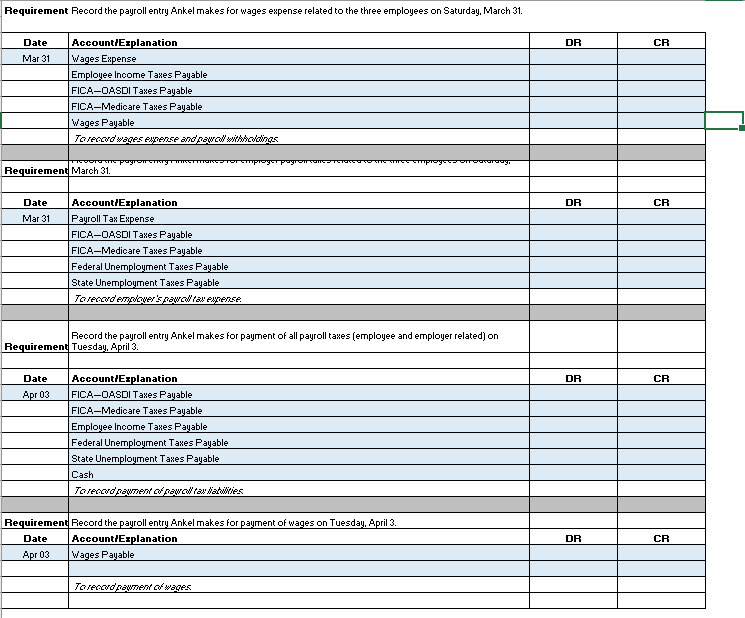

Requirement 1 Complete the Payroll Register for the three employees for the week ended March 31, 2018. Payroll Register Earnings Withholdings Other Employee Name Jimmy Chew Manny Blanik Beginning Cumulative Earnings $420 $540 $480 $1,440 Pay Rate $15 $17 $22 Hours Worked 46.00 50.00 38.00 134.00 Regular Pay 600.00 680.00 880.00 2,160.00 Overtime Pay 135.00 255.00 (66.00) 324.00 Current Period Earnings 735.00 935.00 814.00 2,484.00 Ending Cumulative Earnings 1,155.00 1,475.00 1,294.00 3,924.00 OASDI 6.296 45.57 57.97 50 154 Medicare 1.45% 10.66 13.56 11.80 36.02 Income Tax 147.00 187.00 162.80 496.80 Total Withholdings 203.23 258.53 225.07 686.83 Net Pay 531.77 676.47 588.93 1,797.17 Check No 1104 1105 1106 Wages Expense 735.00 935.00 814.00 2,484.00 Alexa King Total Requirement 2 Complete the Payroll Tax Register for the week ended March 31, 2018. Payroll Tax Register Employee Name Jimmy Chew Manny Blanik Earnings Beginning Current Cumulative Period $420 735.00 $540 935.00 $480 814.00 $1,440 $2,484 Ending Cumulative 1,155.00 1,475.00 1,294.00 $3,924 OASDI 6.29 45.57 57.97 50.47 $154 Employer Payroll Taxes Medicare FUTA 1.45% 0.60% 10.66 4.41 13.56 5.61 11.80 4.88 $36 $15 SUTA 5.40% Total Taxes 22.68 83.32 29.16 106.30 25.92 93.08 $78 Alexa King Total $283 Requirement 3 Compute the total payroll expense for the week ended March 31. Description Total Gross Pay Total Payroll Exp Total Wage Expl Amount 2,484.00 $283 2,766.69 Requirement Record the payroll entry Ankel makes for wages expense related to the three employees on Saturday, March 31. DR CR Date Mar 31 Account/Explanation Wages Expense Employee Income Taxes Payable FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Wages Payable Toreewdweges expense and now widings poyo TRIGITTORIOTT rost programare Fonoare Requirement March 31. DR CR Date Mar 31 Account/Explanation Payroll Tax Expense FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable Torencd exter's powolna emerse. Record the payroll entry Ankelmakes for payment of all payroll taxes (employee and employer related) on Requirement Tuesday, April 3. DR CR Date Apr 03 Account/Explanation FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Income Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable Cash Toreodzowent podrar tatues Requirement Record the payroll entry Ankelmakes for payment of wages on Tuesday, April 3. Date Account/Explanation Apr 03 Wages Payable DR CR Teresavdhawment wates