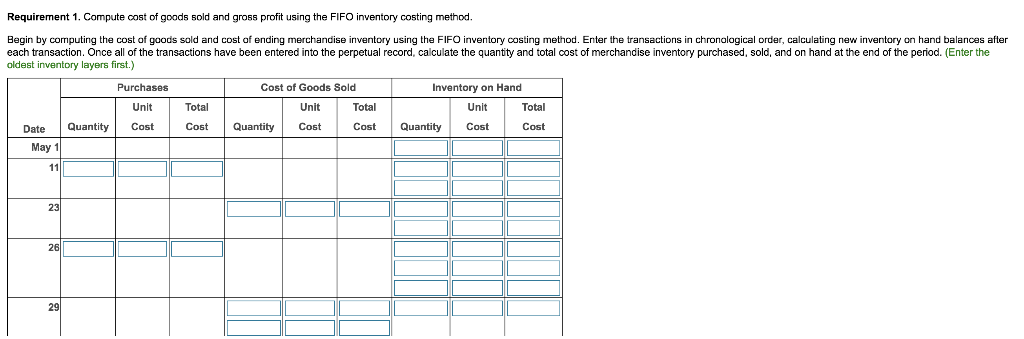

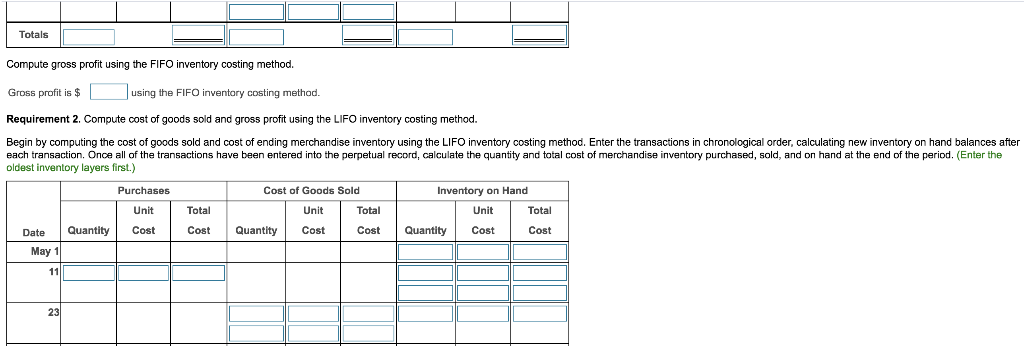

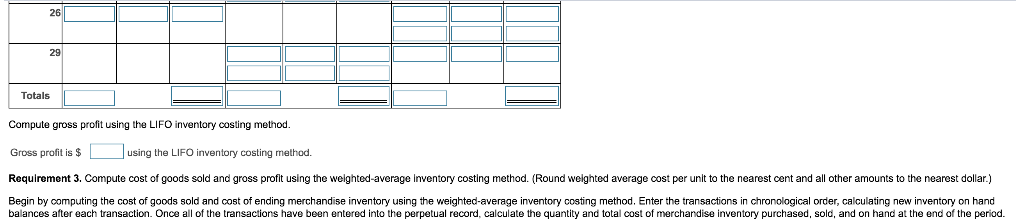

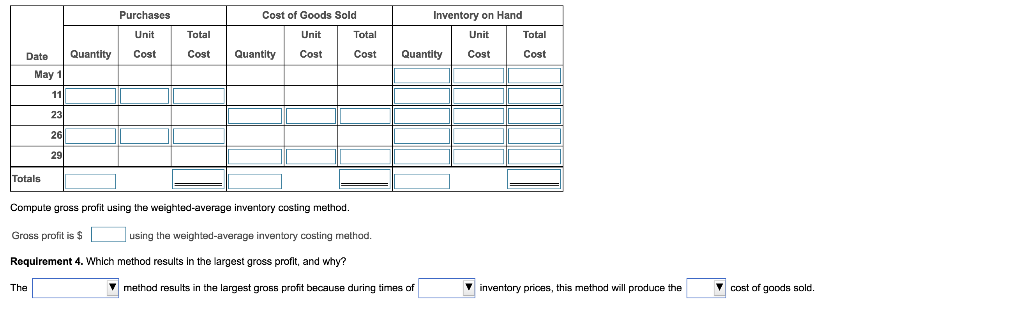

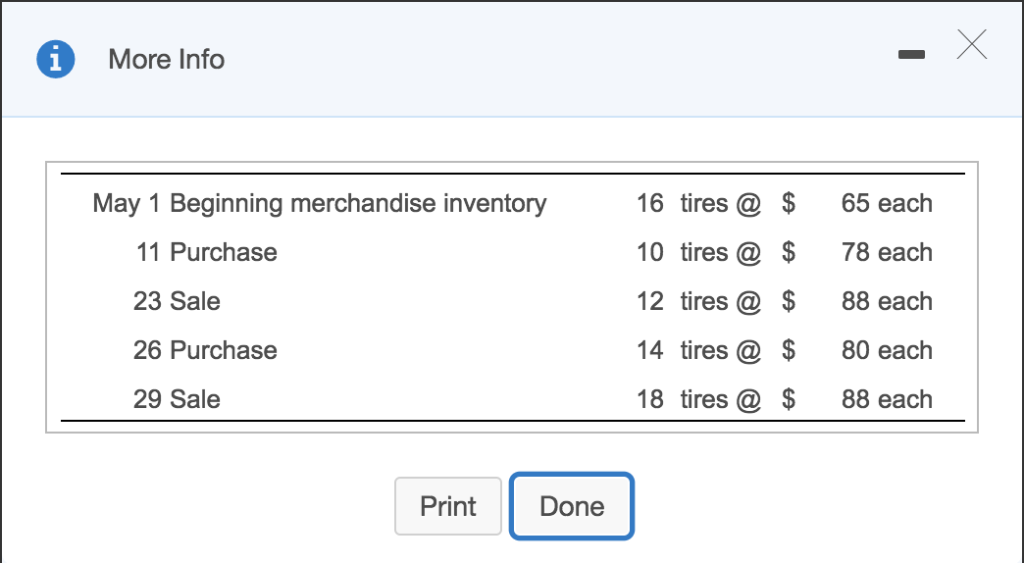

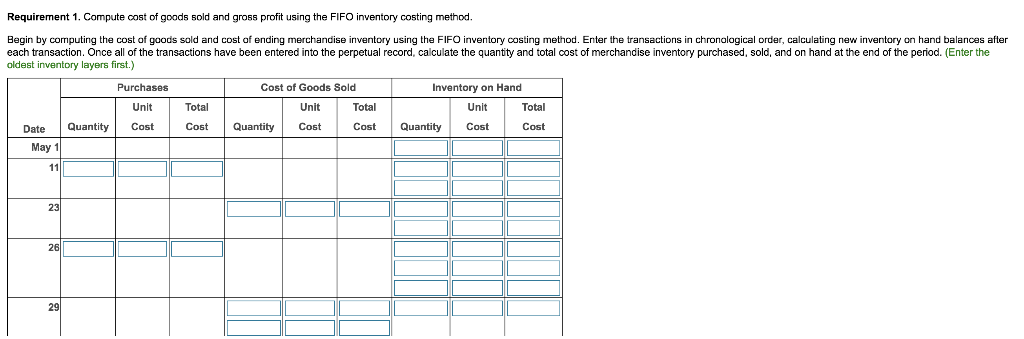

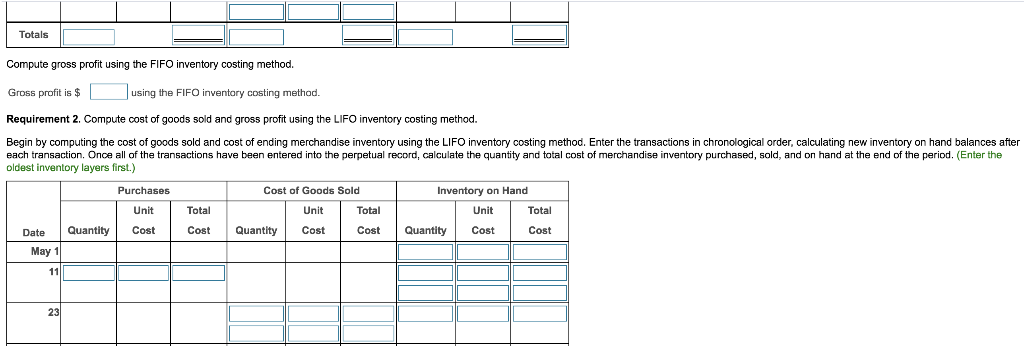

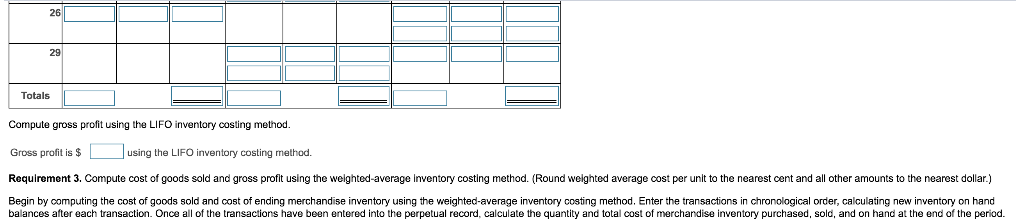

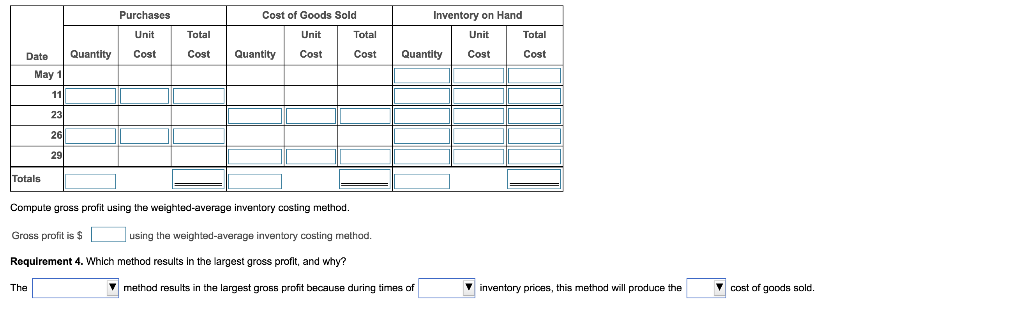

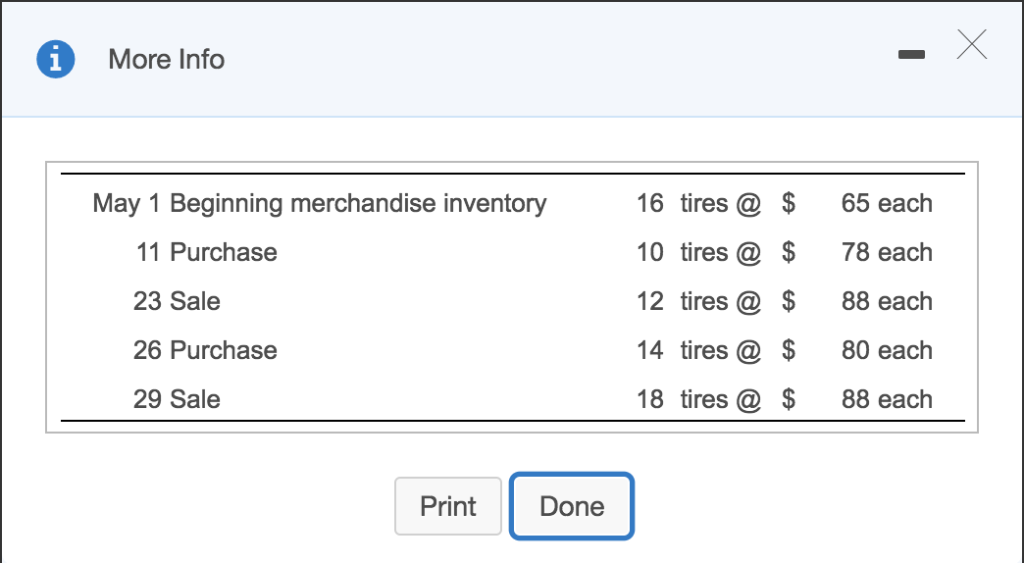

Requirement 1. Compute cost of goods sold and gross profit using the FIFO inventory costing method Begin by computing the cost of goods sold and cost af ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronalogical order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantty and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date QantityCostCostQuantity CostCost Quantity Cost Cost May 1 29 Totals Compute gross profit using the FIFO inventory costing method. Gross profit is $ Requirement 2. Compute cost of goods sold and gross profit using the LIFO inventory costing method. using theF IFO inventary costing method. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the LIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactionshave been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date QuantityCost Cost Quantity Cost CostQyCost Cost May 1 26 29 Totals Compute gross profit using the LIFO inventory costing method Gross profit is $ Requirement 3. Compute cost of goods sold and gross profit using the welghted-average inventory costing method. (Round welghted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted-average inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand using the LIFO inventory costing method. balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity CostQuantitytCost May 1 26 Totals Compute gross profit using the weighted-average inventory costing method Gross profit is using the weighted-average inventory costing methad. Requirement 4. Which method results in the largest gross profit, and why? The Vmethad results in the largest gross profit because during times of inventory prices, this method will produce thecost of goods sold. i More Info -X 16 tires @ 65 each 10 tires @ $ 78 each 12 tires@ $ 88 each 14 tires@ $ 18 tires @$ 88 each May 1 Beginning merchandise inventory 11 Purchase 23 Sale 26 Purchase 29 Sale 80 each Print Done