Answered step by step

Verified Expert Solution

Question

1 Approved Answer

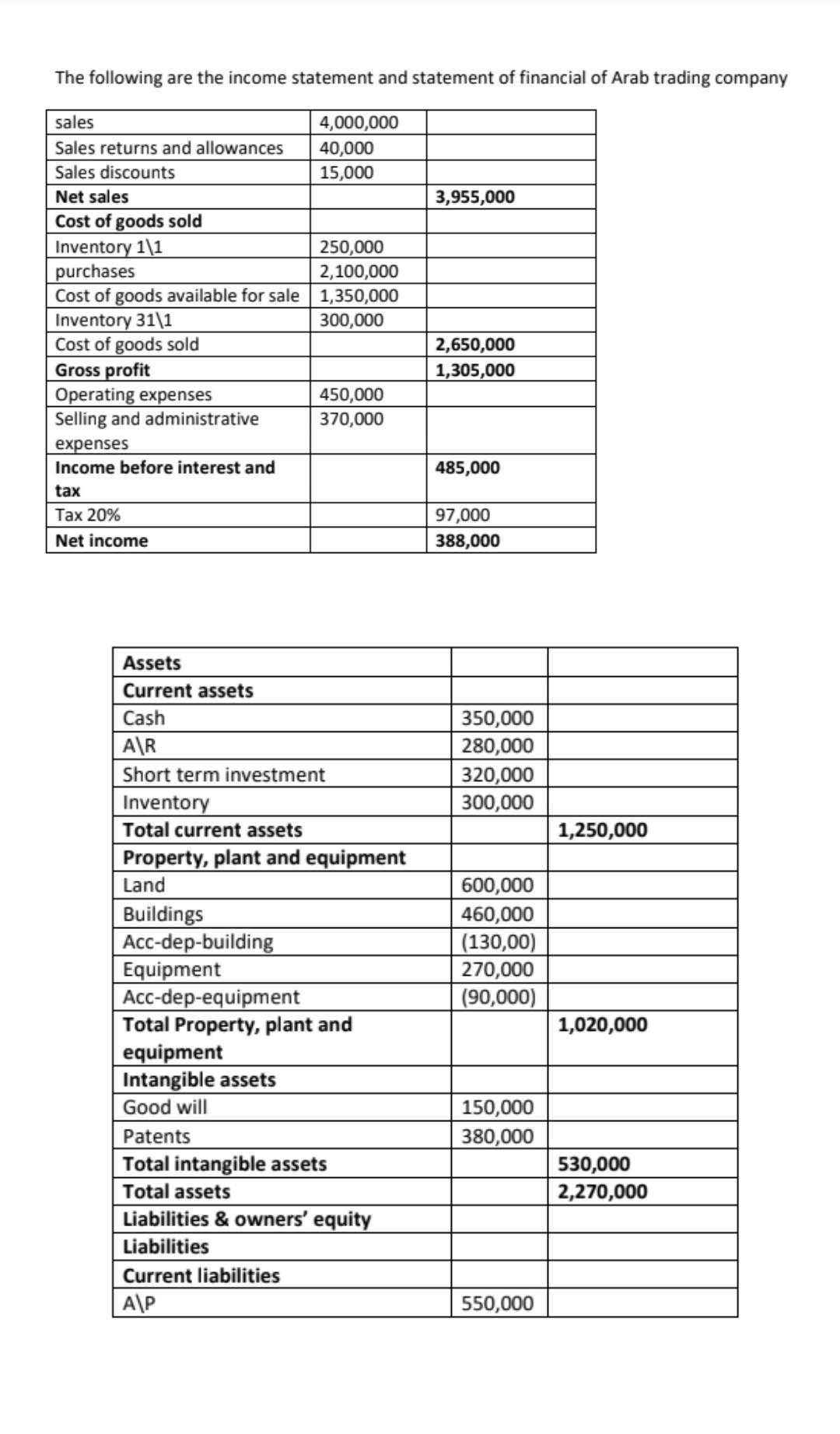

Requirement: 1. Determine the assertions violations for all notes using table in your answer The following are the income statement and statement of financial of

Requirement: 1. Determine the assertions violations for all notes using table in your answer

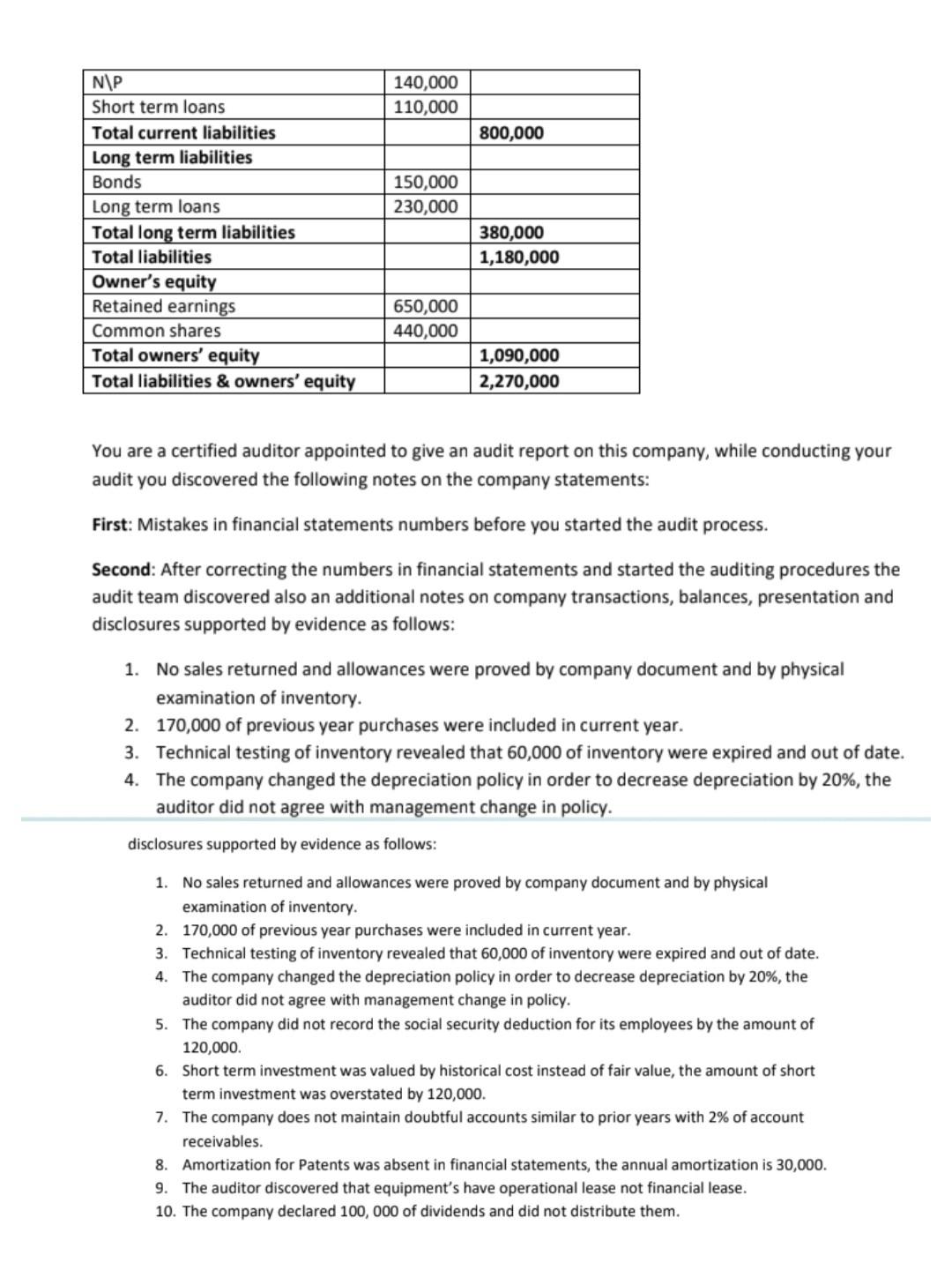

The following are the income statement and statement of financial of Arab trading company You are a certified auditor appointed to give an audit report on this company, while conducting your audit you discovered the following notes on the company statements: First: Mistakes in financial statements numbers before you started the audit process. Second: After correcting the numbers in financial statements and started the auditing procedures the audit team discovered also an additional notes on company transactions, balances, presentation and disclosures supported by evidence as follows: 1. No sales returned and allowances were proved by company document and by physical examination of inventory. 2. 170,000 of previous year purchases were included in current year. 3. Technical testing of inventory revealed that 60,000 of inventory were expired and out of date. 4. The company changed the depreciation policy in order to decrease depreciation by 20%, the auditor did not agree with management change in policy. disclosures supported by evidence as follows: 1. No sales returned and allowances were proved by company document and by physical examination of inventory. 2. 170,000 of previous year purchases were included in current year. 3. Technical testing of inventory revealed that 60,000 of inventory were expired and out of date. 4. The company changed the depreciation policy in order to decrease depreciation by 20%, the auditor did not agree with management change in policy. 5. The company did not record the social security deduction for its employees by the amount of 120,000. 6. Short term investment was valued by historical cost instead of fair value, the amount of short term investment was overstated by 120,000 . 7. The company does not maintain doubtful accounts similar to prior years with 2% of account receivables. 8. Amortization for Patents was absent in financial statements, the annual amortization is 30,000. 9. The auditor discovered that equipment's have operational lease not financial lease. 10. The company declared 100,000 of dividends and did not distribute themStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started