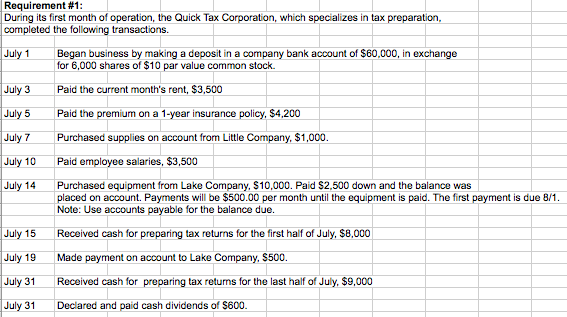

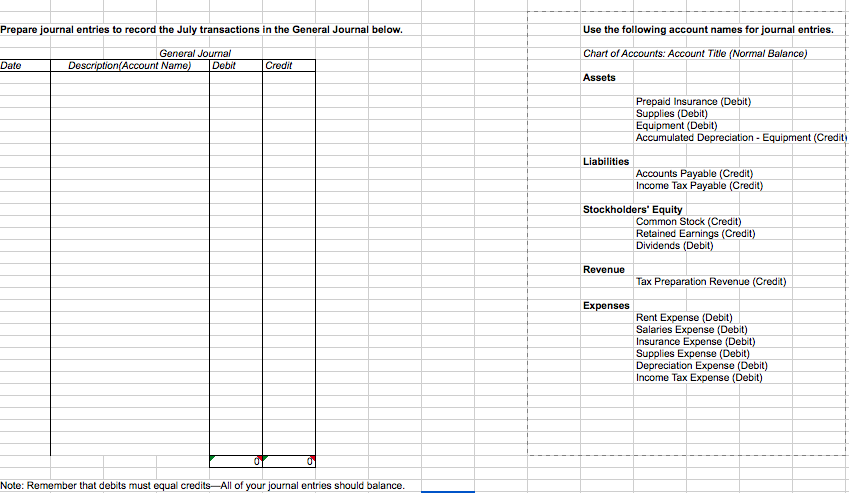

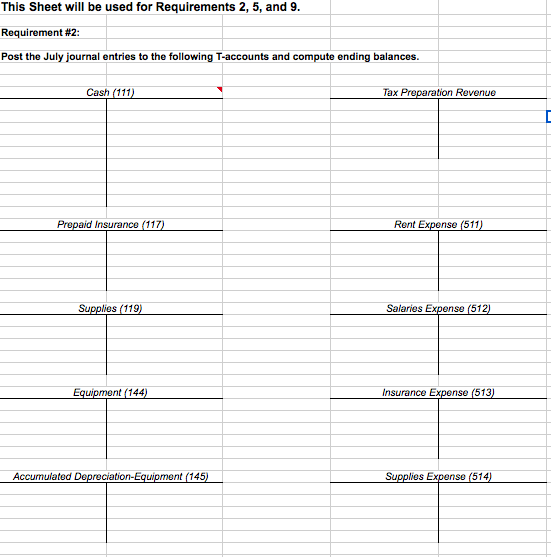

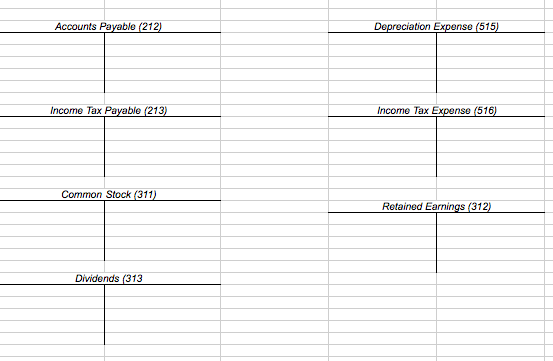

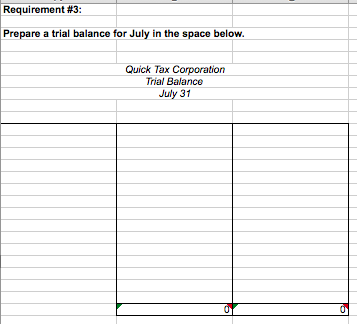

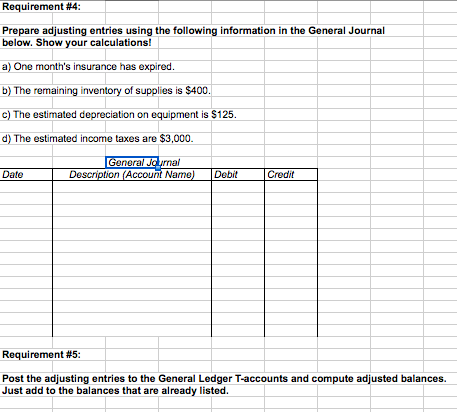

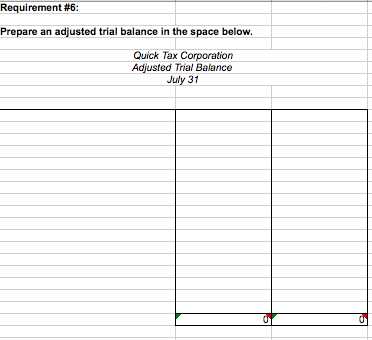

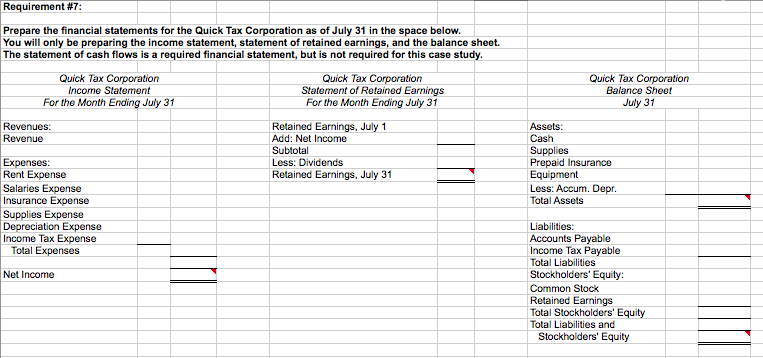

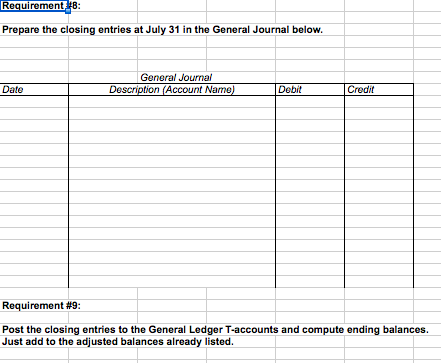

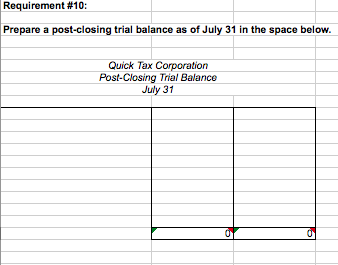

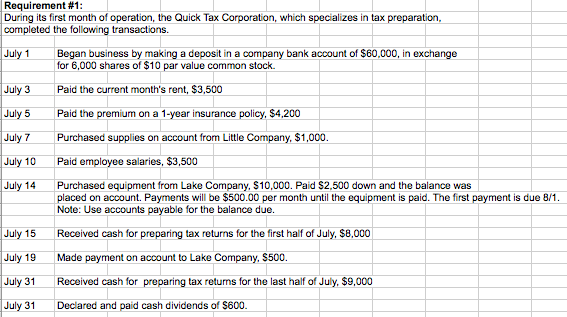

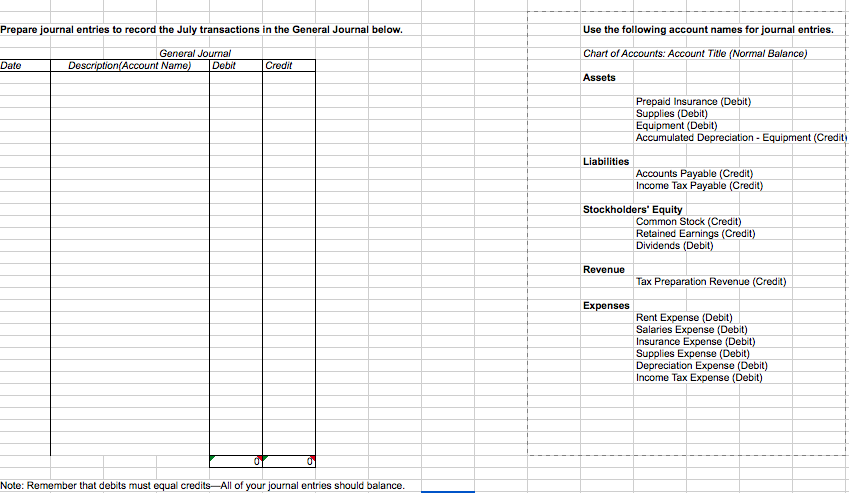

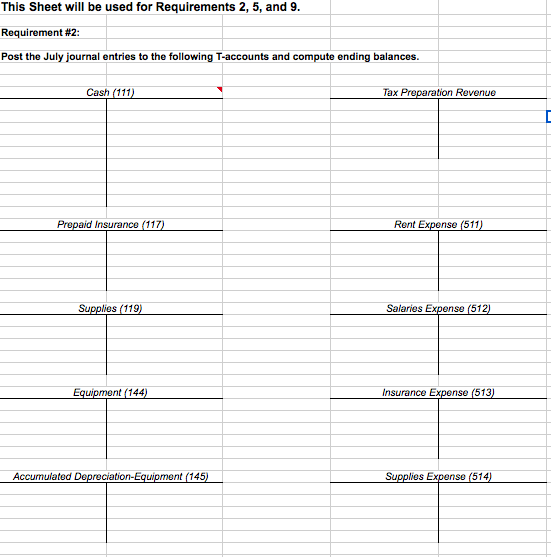

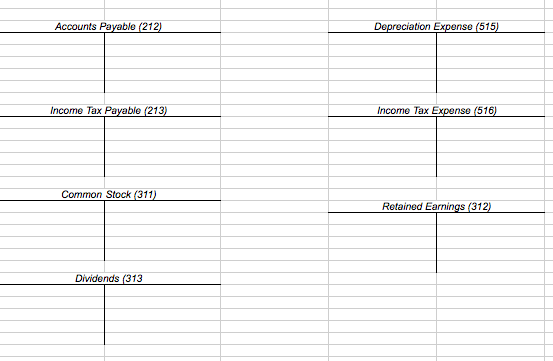

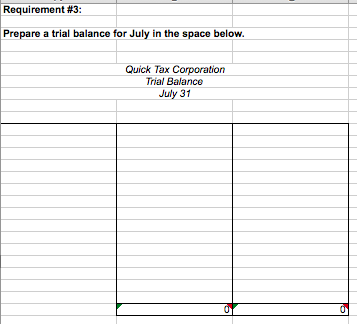

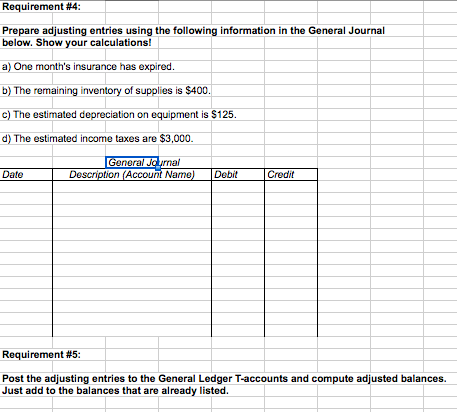

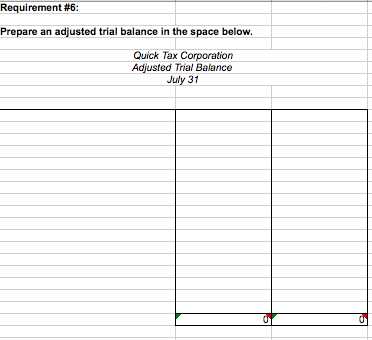

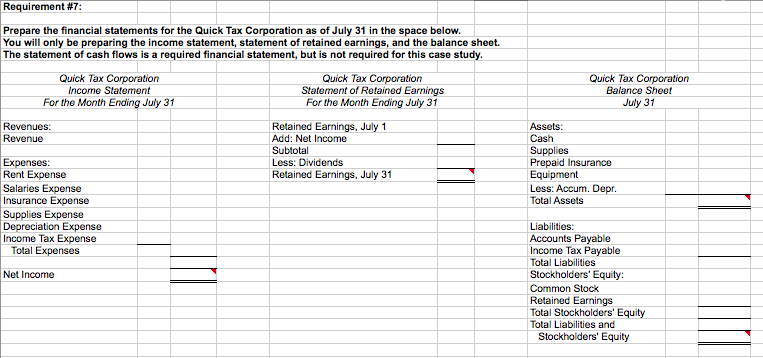

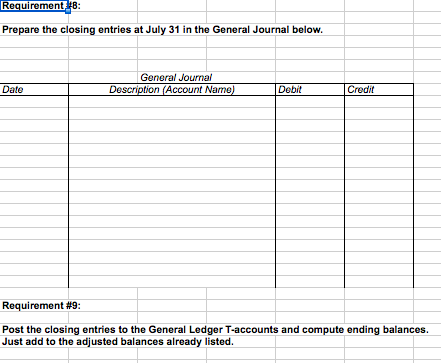

Requirement #1: During its first month of operation, the Quick Tax Corporation, which specializes in tax preparation, completed the following transactions. July 1 July 3 July 5 July 7 July 10 July 14 Began business by making a deposit in a company bank account of $60,000, in exchange for 6,000 shares of $10 par value common stock Paid the current month's rent, $3,500 Paid the premium on a 1-year insurance policy, $4,200 Purchased supplies on account from Little Company, $1,000. Paid employee salaries, $3,500 Purchased equipment from Lake Company, S10,000. Paid $2,500 down and the balance was placed on account. Payments will be $500.00 per month until the equipment is paid. The first payment is due 8/1. Note: Use accounts payable for the balance due. Received cash for preparing tax returns for the first half of July, $8,000 Made payment on account to Lake Company, $500. Received cash for preparing tax returns for the last half of July, $9,000 Declared and paid cash dividends of $600. July 15 July 19 July 31 July 31 Prepare journal entries to record the July transactions in the General Journal below. Use the following account names for journal entries. General Journal Description Account Name) Debit Chart of Accounts: Account Title (Normal Balance) Date Credit Assets Prepaid Insurance (Debit) Supplies (Debit) Equipment (Debit) Accumulated Depreciation - Equipment (Credit Liabilities Accounts Payable (Credit) Income Tax Payable (Credit) Stockholders' Equity Common Stock (Credit) Retained Earnings (Credit) Dividends (Debit) Revenue Tax Preparation Revenue (Credit) Expenses Rent Expense (Debit) Salaries Expense (Debit) Insurance Expense (Debit) Supplies Expense (Debit) Depreciation Expenso (Debit) Income Tax Expense (Debit) Note: Remember that debits must equal credits-All of your journal entries should balance. This Sheet will be used for Requirements 2, 5, and 9. Requirement #2: Post the July journal entries to the following T-accounts and compute ending balances. Cash (111) Tax Preparation Revenue Prepaid Insurance (117) Rent Expense (511) Supplies (119) Salarios Expense (512) Equipment (144) Insurance Expense (513) Accumulated Depreciation Equipment (145) Supplies Expenso (514) Accounts Payablo (212) Depreciation Expense (515) Income Tax Payable (213) Income Tax Expense (516) Common Stock (311) Retainod Earnings (312) Dividends (313 Requirement #3: Prepare a trial balance for July in the space below. Quick Tax Corporation Trial Balance July 31 0 Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of supplies is $400. c) The estimated depreciation on equipment is $125. d) The estimated income taxes are $3,000. General Journal Description (Account Name) Date Debit Credit Requirement #5: Post the adjusting entries to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. Requirement #6: Prepare an adjusted trial balance in the space below. Quick Tax Corporation Adjusted Trial Balance July 31 Requirement #7: Quick Tax Corporation Balance Shoot July 31 Prepare the financial statements for the Quick Tax Corporation as of July 31 in the space below. You will only be preparing the income statement, statement of retained earnings, and the balance sheet. The statement of cash flows is a required financial statement, but is not required for this case study. Quick Tax Corporation Quick Tax Corporation Income Statement Statement of Rotained Earnings For the Month Ending July 31 For the Month Ending July 31 Revenues: Retained Earnings, July 1 Revenue Add: Net Income Subtotal Expenses: Less: Dividends Rent Expense Retained Earnings, July 31 Salaries Expense Insurance Expense Supplies Expense Depreciation Expense Income Tax Expense Total Expenses Assets: Cash Supplies Prepaid Insurance Equipment Less: Accum. Depr. Total Assets Net Income Liabilities: Accounts Payable Income Tax Payable Total Liabilities Stockholders' Equity: Common Stock Retainod Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity Requirement: Prepare the closing entries at July 31 in the General Journal below. General Journal Description (Account Name) Date Debit Credit Requirement #9: Post the closing entries to the General Ledger T-accounts and compute ending balances. Just add to the adjusted balances already listed. Requirement #10: Prepare a post-closing trial balance as of July 31 in the space below. Quick Tax Corporation Post-Closing Trial Balance July 31 0