Answered step by step

Verified Expert Solution

Question

1 Approved Answer

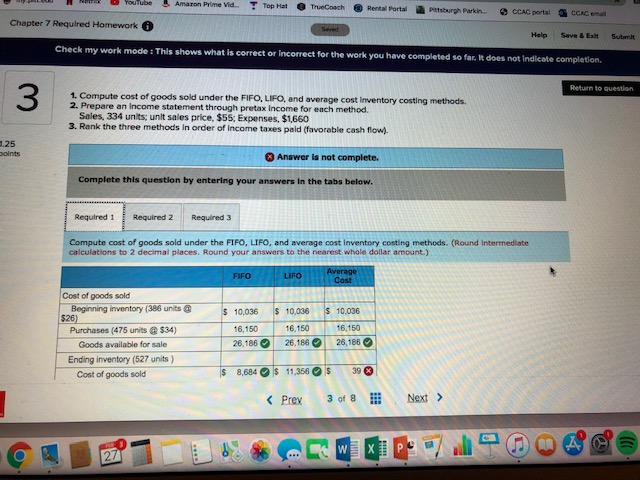

requirement 1) ending inventory and COGS for average cost? requirement 2) FIFO, LIFO, and avg cost values ALL Youtube Amazon Prime Vid... T Top Hat

requirement 1) ending inventory and COGS for average cost?

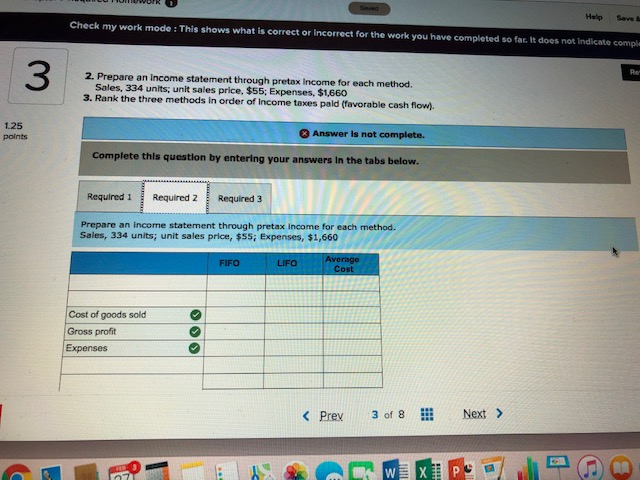

requirement 2) FIFO, LIFO, and avg cost values

ALL Youtube Amazon Prime Vid... T Top Hat TrueCoach Rental Portal Partsburgh Parkin.. CCAC portal CCC Chapter 7 Required Homework A Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods 2. Prepare an Income statement through pretax income for each method. Sales, 334 units: unit sales price, $55: Expenses, $1,660 3. Rank the three methods in order of income taxes pald (favorable cash flow). .25 Doints Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. (Round Intermediate calculations to 2 decimal places. Round your answers to the nearest whale dollar amount.) FIFO LIFO $ 10,036 Cost of goods sold Beginning inventory (386 units @ $26) Purchases (475 units $34) Goods available for sale Ending inventory (527 units) Cost of goods sold 16,150 26,186 $ 10,036 16,150 26,186 S 10.036 16,150 26,186 $ 8,684 $ 11,3565 39 CU HUMWOIRE Help Svet Check my work mode: This shows what is correct or Incorrect for the work you have completed so far. It does not indicate comple 2. Prepare an Income statement through pretax income for each method. Sales, 334 units; unit sales price, $55: Expenses, $1,660 3. Rank the three methods in order of income taxes pald (favorable cash flow). 1.25 points Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an income statement through pretax income for each method. Sales, 334 units; unit sales price, $55; Expenses, $1,660 FIFO Average Cost Cost of goods sold Gross profit Expenses ALL Youtube Amazon Prime Vid... T Top Hat TrueCoach Rental Portal Partsburgh Parkin.. CCAC portal CCC Chapter 7 Required Homework A Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods 2. Prepare an Income statement through pretax income for each method. Sales, 334 units: unit sales price, $55: Expenses, $1,660 3. Rank the three methods in order of income taxes pald (favorable cash flow). .25 Doints Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. (Round Intermediate calculations to 2 decimal places. Round your answers to the nearest whale dollar amount.) FIFO LIFO $ 10,036 Cost of goods sold Beginning inventory (386 units @ $26) Purchases (475 units $34) Goods available for sale Ending inventory (527 units) Cost of goods sold 16,150 26,186 $ 10,036 16,150 26,186 S 10.036 16,150 26,186 $ 8,684 $ 11,3565 39 CU HUMWOIRE Help Svet Check my work mode: This shows what is correct or Incorrect for the work you have completed so far. It does not indicate comple 2. Prepare an Income statement through pretax income for each method. Sales, 334 units; unit sales price, $55: Expenses, $1,660 3. Rank the three methods in order of income taxes pald (favorable cash flow). 1.25 points Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an income statement through pretax income for each method. Sales, 334 units; unit sales price, $55; Expenses, $1,660 FIFO Average Cost Cost of goods sold Gross profit ExpensesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started