Requirement 1:

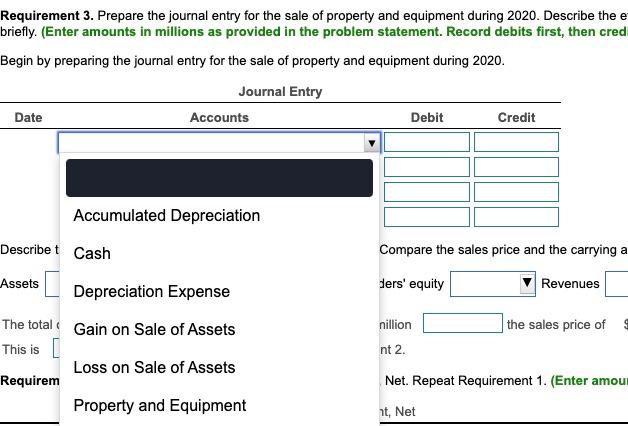

Entry choices

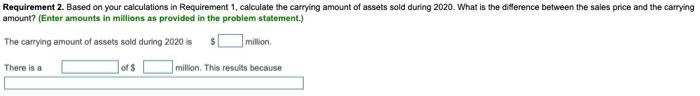

Requirement 2:

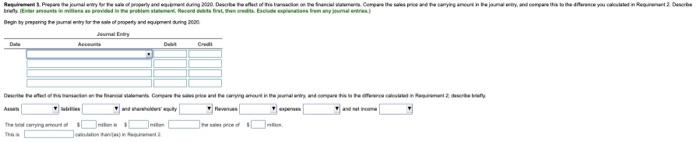

Requirement 3:

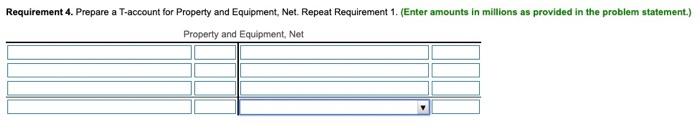

Requirement 4:

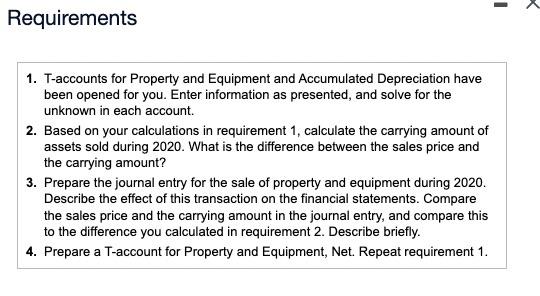

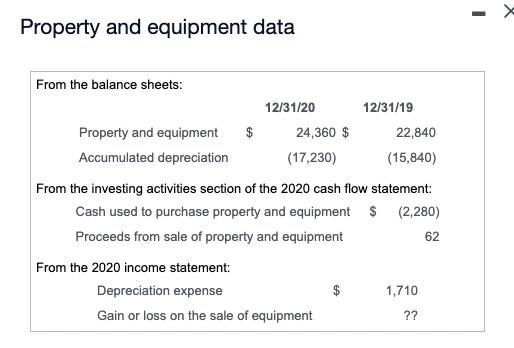

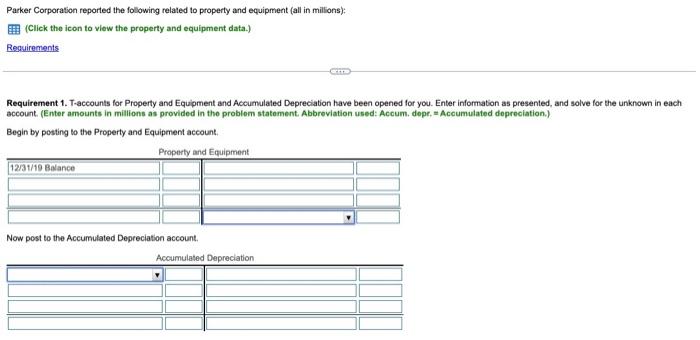

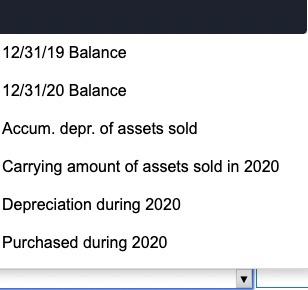

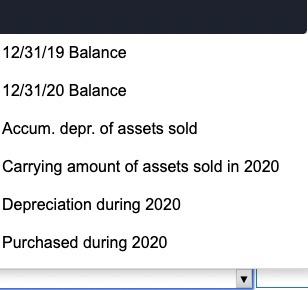

- Requirements 1. T-accounts for Property and Equipment and Accumulated Depreciation have been opened for you. Enter information as presented, and solve for the unknown in each account. 2. Based on your calculations in requirement 1, calculate the carrying amount of assets sold during 2020. What is the difference between the sales price and the carrying amount? 3. Prepare the journal entry for the sale of property and equipment during 2020. Describe the effect of this transaction on the financial statements. Compare the sales price and the carrying amount in the journal entry, and compare this to the difference you calculated in requirement 2. Describe briefly. 4. Prepare a T-account for Property and Equipment, Net. Repeat requirement 1. Property and equipment data From the balance sheets: 12/31/20 12/31/19 Property and equipment 24,360 $ 22,840 Accumulated depreciation (17,230) (15,840) From the investing activities section of the 2020 cash flow statement: Cash used to purchase property and equipment $ (2,280) Proceeds from sale of property and equipment From the 2020 income statement: Depreciation expense 1,710 Gain or loss on the sale of equipment 62 ?? Parker Corporation reported the following related to property and equipment (all in milions): Click the icon to view the property and equipment data.) Requirements Requirement 1. T-accounts for Property and Equipment and Accumulated Depreciation have been opened for you. Enter information as presented and solve for the unknown in each account (Enter amounts in millions as provided in the problem statement Abbreviation used: Accum. dopr. - Accumulated depreciation) Begin by posting to the Property and Equipment account, Property and Equipment 12/31/10 Bilance Now post to the Accumulated Depreciation account, Accumulated Depreciation 12/31/19 Balance 12/31/20 Balance Accum. depr. of assets sold Carrying amount of assets sold in 2020 Depreciation during 2020 Purchased during 2020 Requirement 2. Based on your calculations in Requirement 1, calculate the carrying amount of assets sold during 2020. What is the difference between the sales price and the carrying amount? (Enter amounts in millions as provided in the problem statement.) The carrying amount of assets sold during 2020 is million There is a of $ million. This results because Requirement 3. Prepare the journal entry for the sale of property and equipment during 2020. Describe the e briefly. (Enter amounts in millions as provided in the problem statement. Record debits first, then cred Begin by preparing the journal entry for the sale of property and equipment during 2020. Journal Entry Date Accounts Debit Credit Accumulated Depreciation Describet Cash Compare the sales price and the carrying a ders' equity Revenues nillion the sales price of Assets Depreciation Expense The total Gain on Sale of Assets This is [ Loss on Sale of Assets Requirem Property and Equipment nt 2. Net. Repeat Requirement 1. (Enter amou at, Net ural 2000, aute tilitatesmate pa he fanarayana ari til treatma releana iruttar uter area in the art tea y humal untras) y mpang te y is tn aries of property and pairing 200 arrest ay| Baat | Dentelewe wat die Hear) Requirement 4. Prepare a T-account for Property and Equipment, Net. Repeat Requirement 1. (Enter amounts in millions as provided in the problem statement.) Property and Equipment, Net 12/31/19 Balance 12/31/20 Balance Accum. depr. of assets sold Carrying amount of assets sold in 2020 Depreciation during 2020 Purchased during 2020