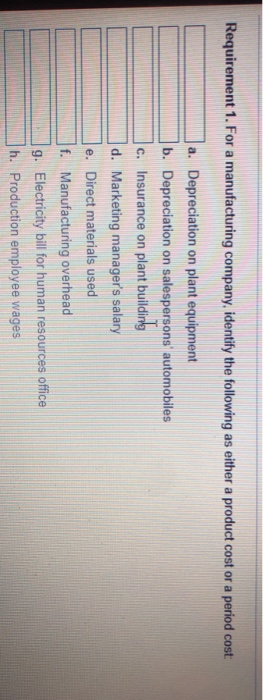

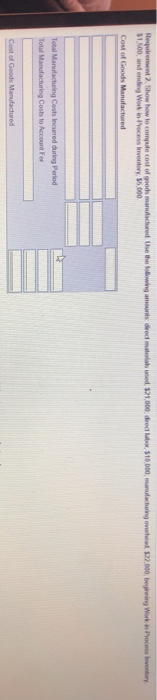

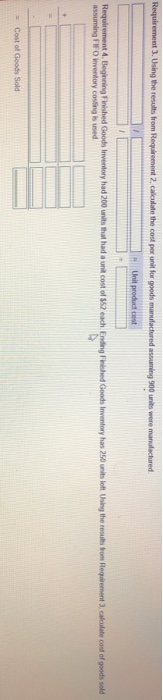

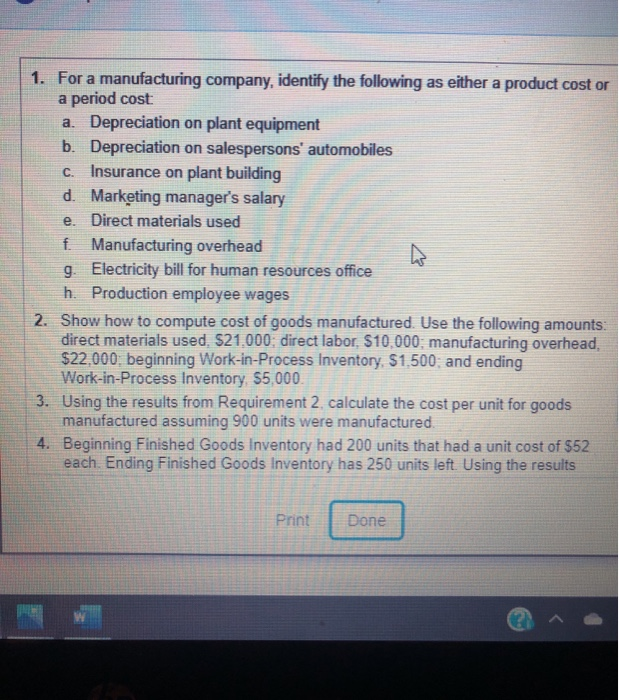

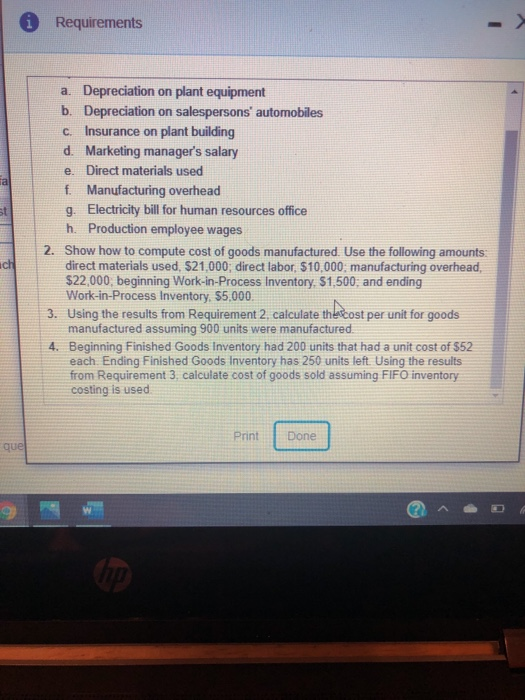

Requirement 1. For a manufacturing company, identify the following as either a product cost or a period cost: a. Depreciation on plant equipment b. Depreciation on salespersons automobiles c. Insurance on plant building d. Marketing manager's salary e. Direct materials used f. Manufacturing overhead g. Electricity bill for human resources office h. Production employee wages Requirement 2. Show how to compute cost of goods manufactured Use the following $1.500, and ending Work in Process inventory 35.000 use d 521.000 director 510.000 manufacturing 22.000 beginning Work in Process ory Cost of Good Manufactured Total Manufacturing Costs incurred during Period Total Manufacturing Costs to Account For Cost of Goods Manufactured Requirement 3. Using the results from Requirement 2 calculate the cost per unit for goods manufactured in 900 units were manufactured Requirement 4. Beginning Finished Goods drventory had 200 units that had a un cost of assuming O vertory cong is used each nigh ed Goods Inventory has 250 units left Using the results from Hegalement calculate cost of goods sold Cost of Goods Sold 1. For a manufacturing company, identify the following as either a product cost or a period cost a. Depreciation on plant equipment b. Depreciation on salespersons' automobiles C. Insurance on plant building d. Marketing manager's salary e. Direct materials used f Manufacturing overhead g. Electricity bill for human resources office h. Production employee wages 2. Show how to compute cost of goods manufactured. Use the following amounts: direct materials used, $21,000: direct labor, $10,000; manufacturing overhead, $22.000, beginning Work-in-Process Inventory, $1,500: and ending Work-in-Process Inventory $5,000. 3. Using the results from Requirement 2. calculate the cost per unit for goods manufactured assuming 900 units were manufactured 4. Beginning Finished Goods Inventory had 200 units that had a unit cost of $52 each. Ending Finished Goods Inventory has 250 units left. Using the results Print Done * Requirements a. Depreciation on plant equipment b. Depreciation on salespersons' automobiles C. Insurance on plant building d. Marketing manager's salary e. Direct materials used f Manufacturing overhead 9. Electricity bill for human resources office h. Production employee wages 2. Show how to compute cost of goods manufactured. Use the following amounts: direct materials used, $21,000, direct labor, $10,000, manufacturing overhead, $22,000, beginning Work-in-Process Inventory, $1,500, and ending Work-in-Process Inventory, $5,000. 3. Using the results from Requirement 2. calculate the cost per unit for goods manufactured assuming 900 units were manufactured 4. Beginning Finished Goods Inventory had 200 units that had a unit cost of $52 each Ending Finished Goods Inventory has 250 units left. Using the results from Requirement 3 calculate cost of goods sold assuming FIFO inventory costing is used Print Done