Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirement 1. For each depreciation method, prepare a depreciation schedule showing asset cost, depreciation expense, accumulated depreciation, and asset book value for each year

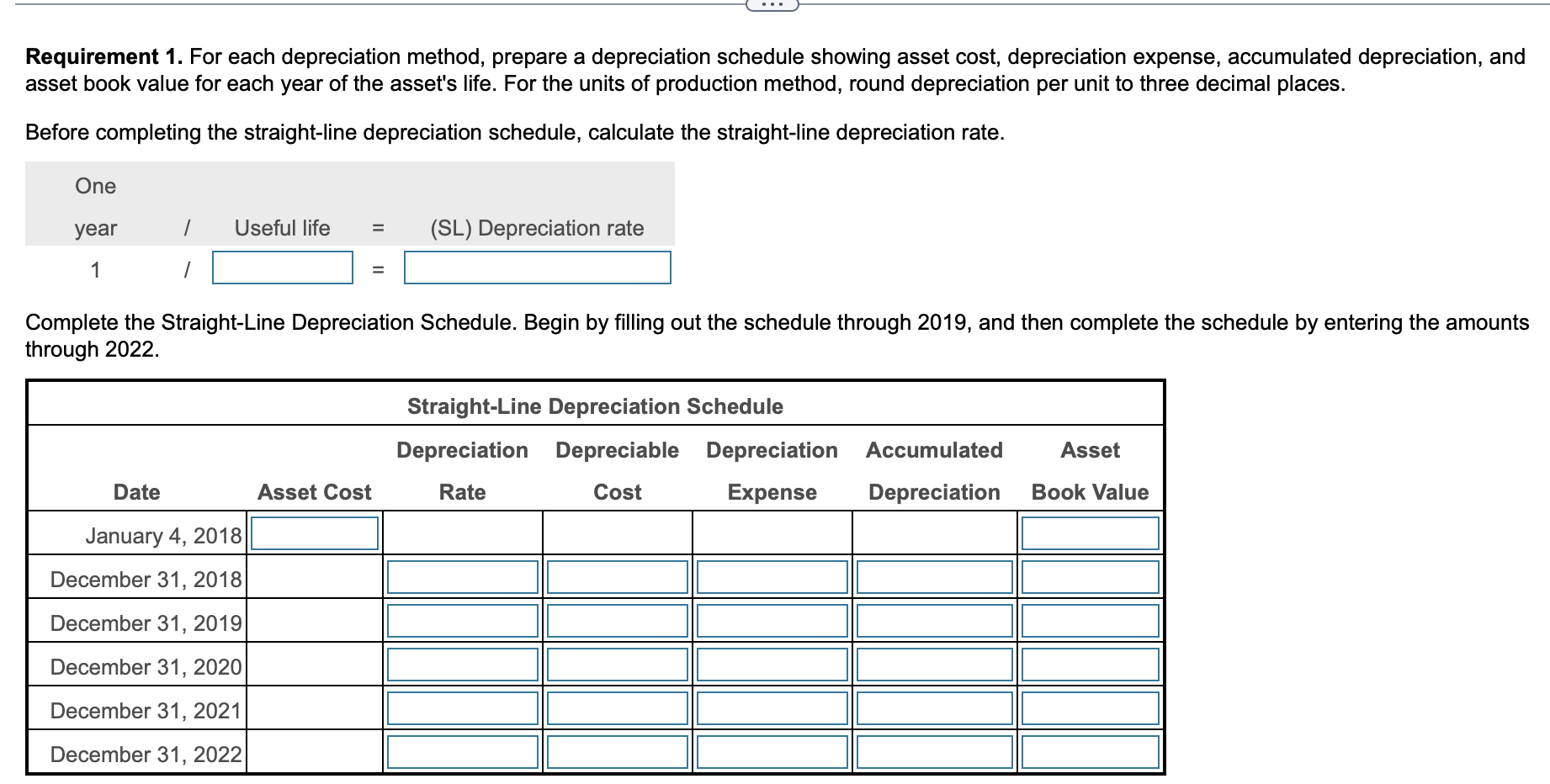

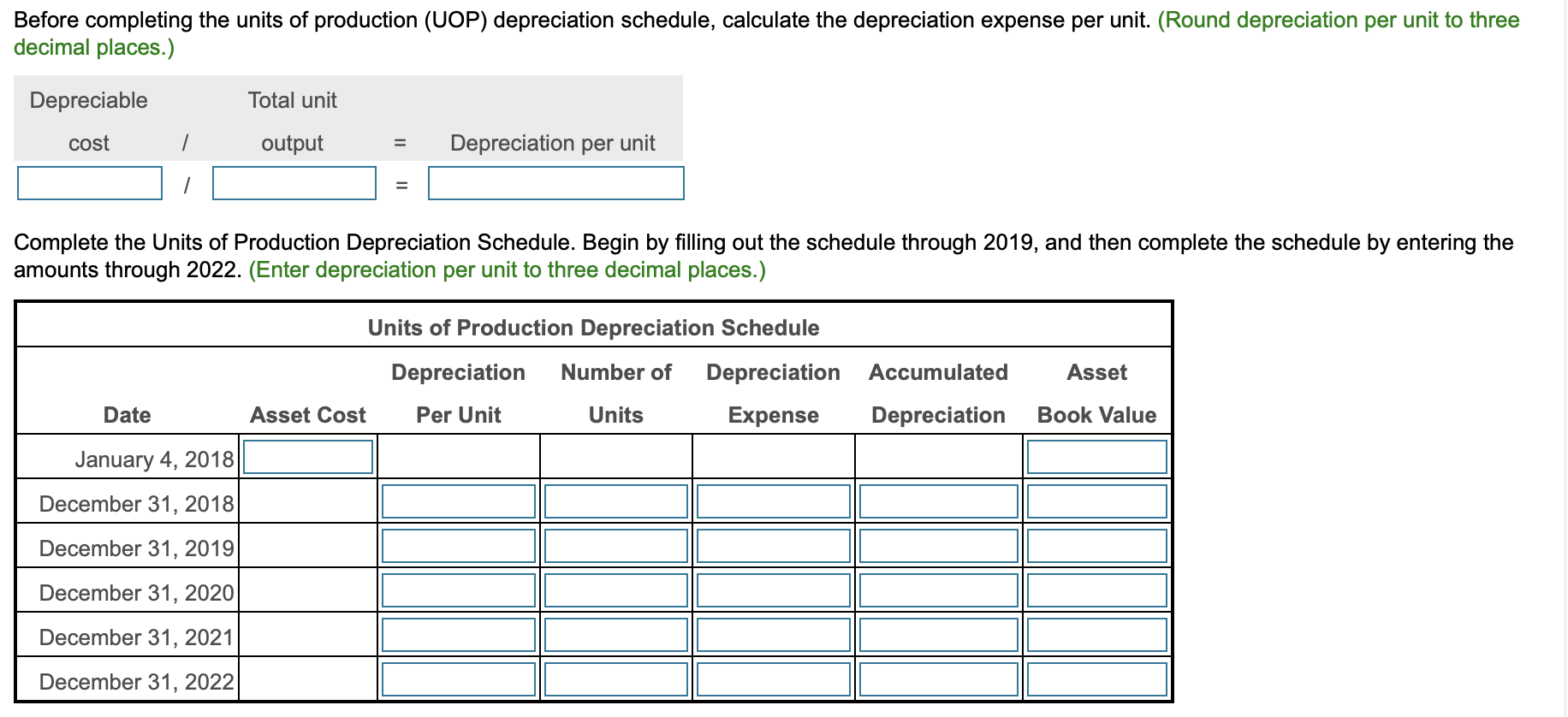

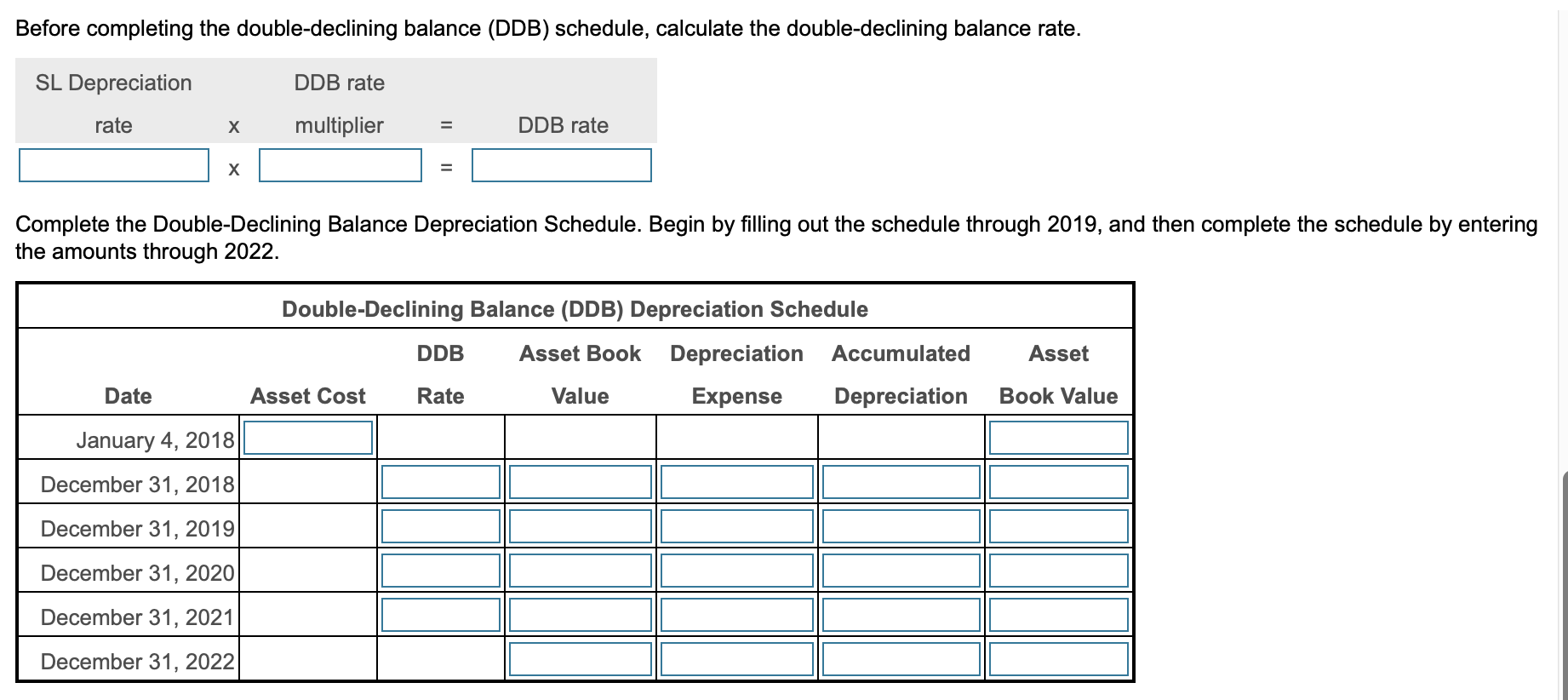

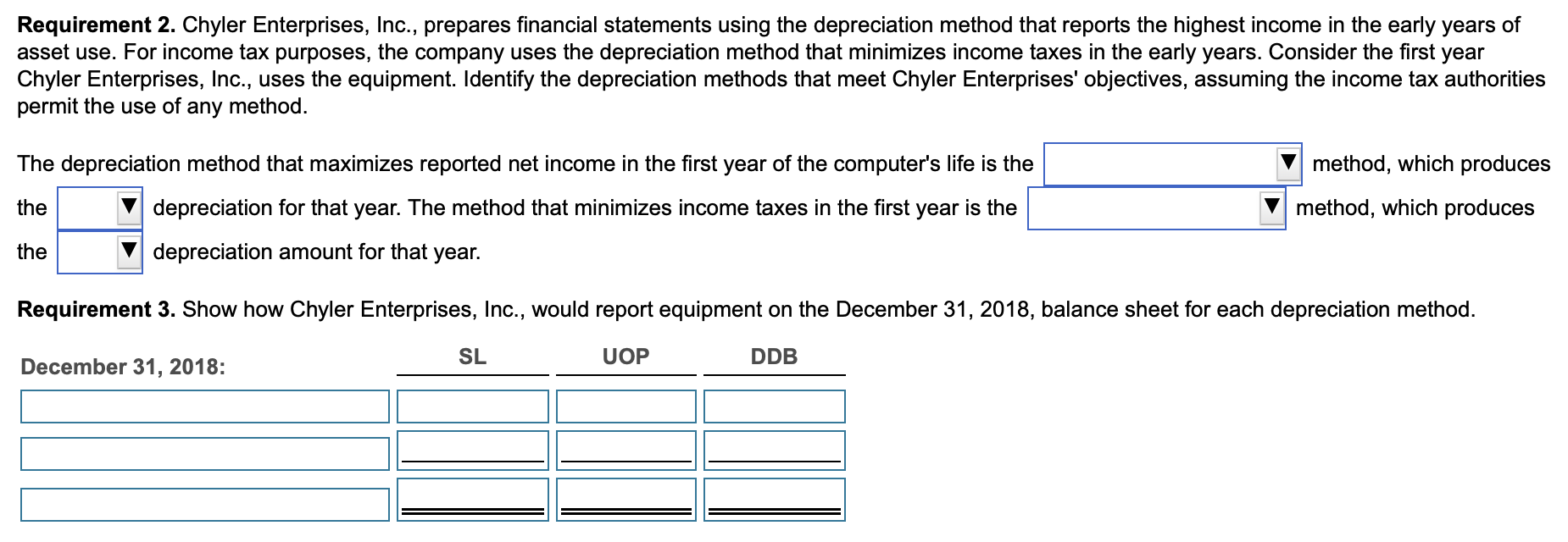

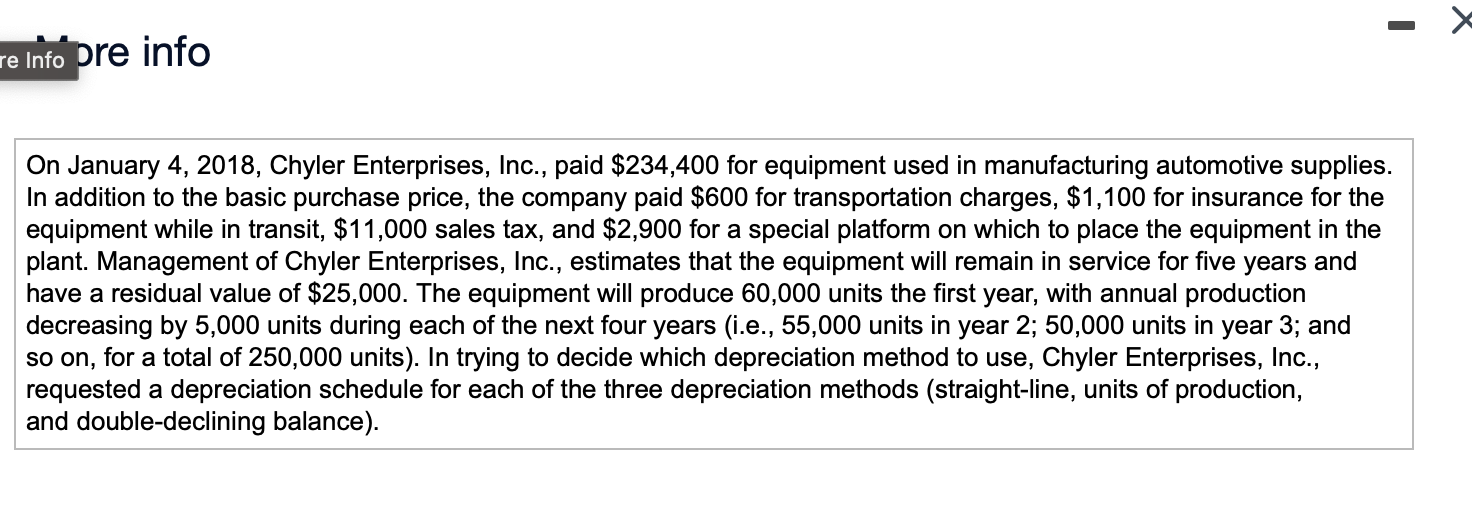

Requirement 1. For each depreciation method, prepare a depreciation schedule showing asset cost, depreciation expense, accumulated depreciation, and asset book value for each year of the asset's life. For the units of production method, round depreciation per unit to three decimal places. Before completing the straight-line depreciation schedule, calculate the straight-line depreciation rate. One year 1 Useful life = (SL) Depreciation rate Complete the Straight-Line Depreciation Schedule. Begin by filling out the schedule through 2019, and then complete the schedule by entering the amounts through 2022. Date January 4, 2018 December 31, 2018 December 31, 2019 December 31, 2020 December 31, 2021 December 31, 2022 Asset Cost Straight-Line Depreciation Schedule Depreciation Depreciable Depreciation Accumulated Cost Expense Depreciation Book Value Rate Asset Before completing the units of production (UOP) depreciation schedule, calculate the depreciation expense per unit. (Round depreciation per unit to three decimal places.) Depreciable cost Total unit output Date January 4, 2018 December 31, 2018 December 31, 2019 December 31, 2020 December 31, 2021 December 31, 2022 = Depreciation per unit Complete the Units of Production Depreciation Schedule. Begin by filling out the schedule through 2019, and then complete the schedule by entering the amounts through 2022. (Enter depreciation per unit to three decimal places.) = Asset Cost Units of Production Depreciation Schedule Depreciation Number of Depreciation Expense Per Unit Units Accumulated Depreciation Book Value Asset Before completing the double-declining balance (DDB) schedule, calculate the double-declining balance rate. SL Depreciation rate X X DDB rate multiplier Date January 4, 2018 December 31, 2018 December 31, 2019 December 31, 2020 December 31, 2021 December 31, 2022 Complete the Double-Declining Balance Depreciation Schedule. Begin by filling out the schedule through 2019, and then complete the schedule by entering the amounts through 2022. DDB rate Double-Declining Balance (DDB) Depreciation Schedule Asset Cost DDB Rate Asset Book Depreciation Accumulated Expense Value Asset Depreciation Book Value Requirement 2. Chyler Enterprises, Inc., prepares financial statements using the depreciation method that reports the highest income in the early years of asset use. For income tax purposes, the company uses the depreciation method that minimizes income taxes in the early years. Consider the first year Chyler Enterprises, Inc., uses the equipment. Identify the depreciation methods that meet Chyler Enterprises' objectives, assuming the income tax authorities permit the use of any method. The depreciation method that maximizes reported net income in the first year of the computer's life is the the depreciation for that year. The method that minimizes income taxes in the first year is the the depreciation amount for that year. Requirement 3. Show how Chyler Enterprises, Inc., would report equipment on the December 31, 2018, balance sheet for each depreciation method. UOP DDB December 31, 2018: method, which produces method, which produces SL re Info pre info On January 4, 2018, Chyler Enterprises, Inc., paid $234,400 for equipment used in manufacturing automotive supplies. In addition to the basic purchase price, the company paid $600 for transportation charges, $1,100 for insurance for the equipment while in transit, $11,000 sales tax, and $2,900 for a special platform on which to place the equipment in the plant. Management of Chyler Enterprises, Inc., estimates that the equipment will remain in service for five years and have a residual value of $25,000. The equipment will produce 60,000 units the first year, with annual production decreasing by 5,000 units during each of the next four years (i.e., 55,000 units in year 2; 50,000 units in year 3; and so on, for a total of 250,000 units). In trying to decide which depreciation method to use, Chyler Enterprises, Inc., requested a depreciation schedule for each of the three depreciation methods (straight-line, units of production, and double-declining balance).

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Depreciation Schedules 1 StraightLine Depreciation a Depreciation Rate Useful Life SL ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started