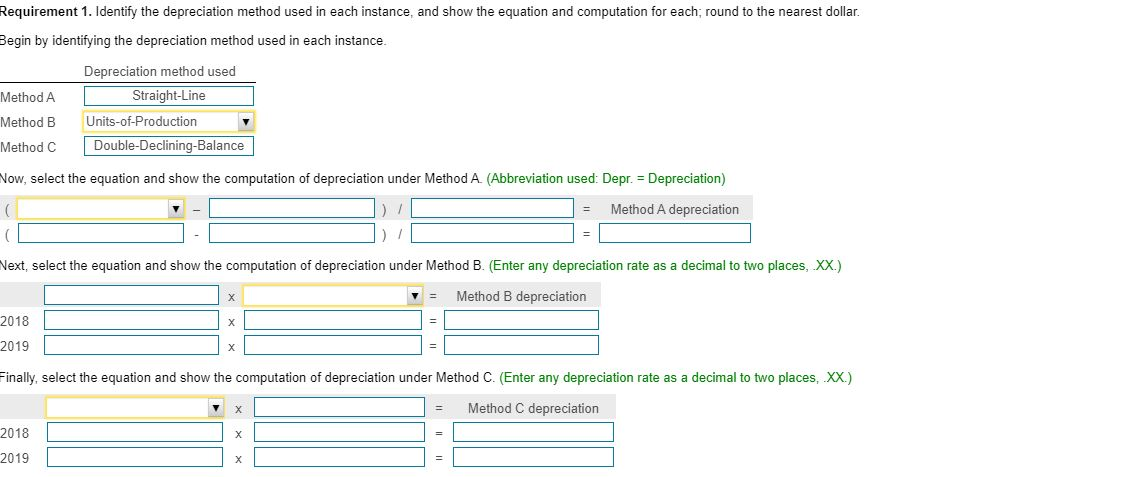

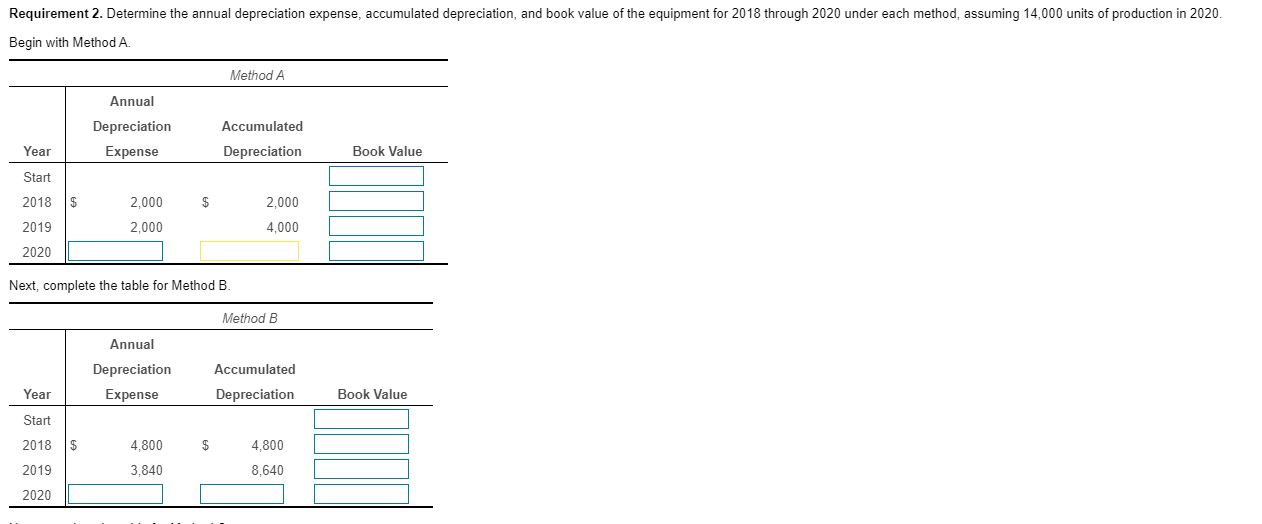

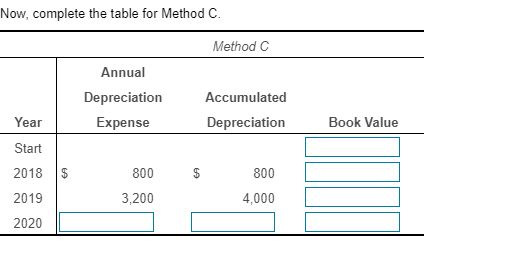

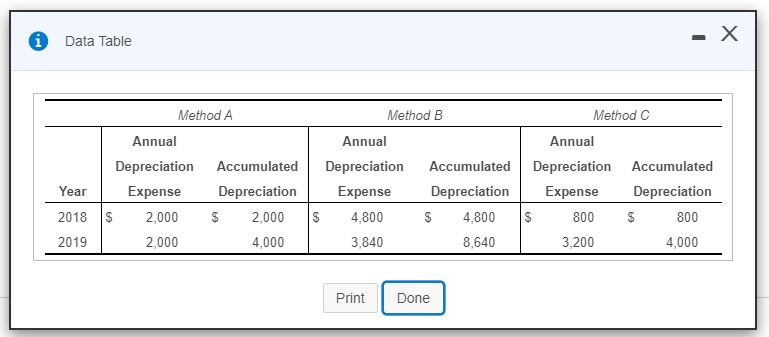

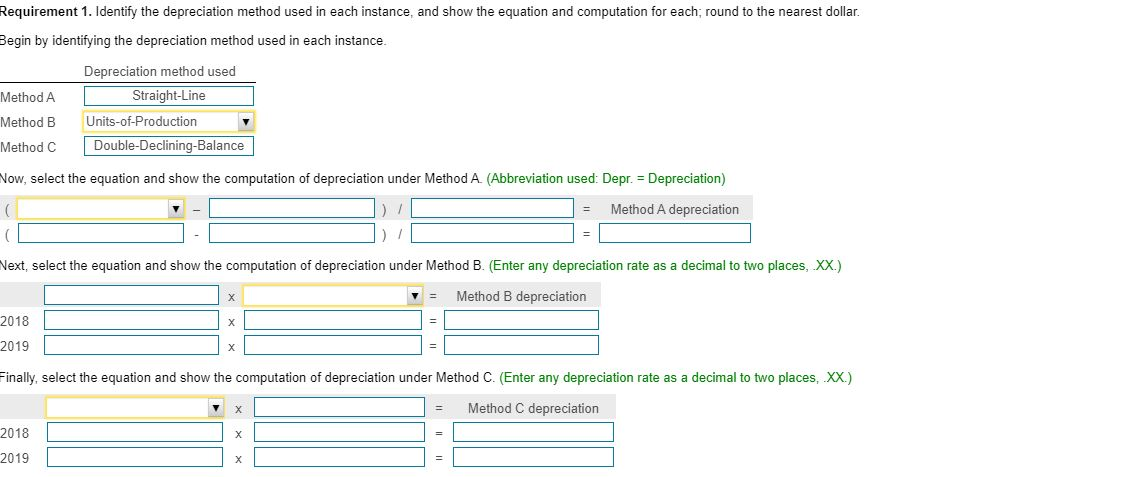

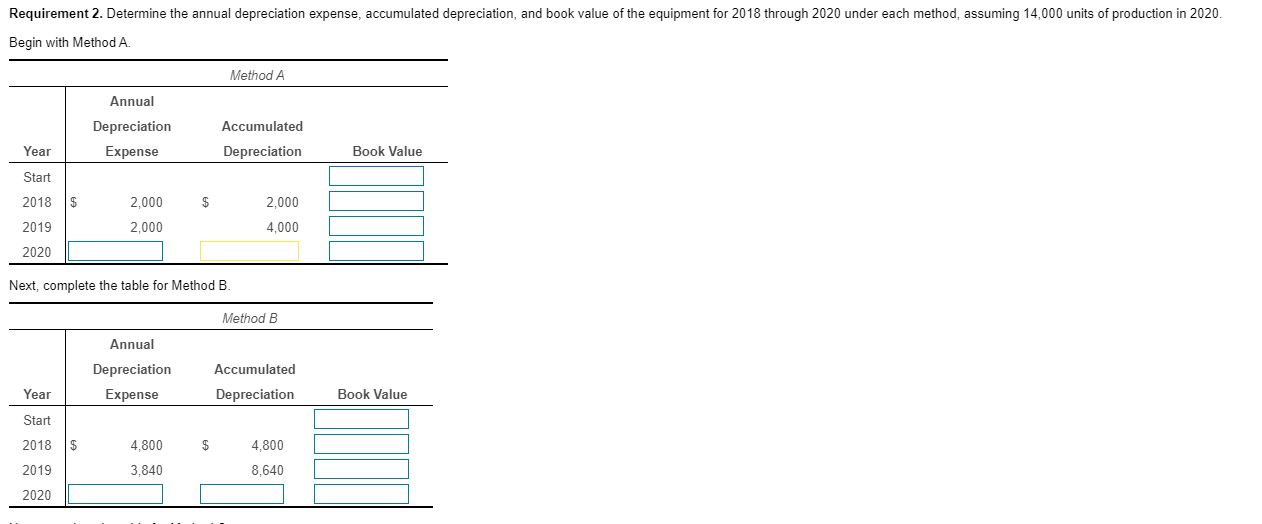

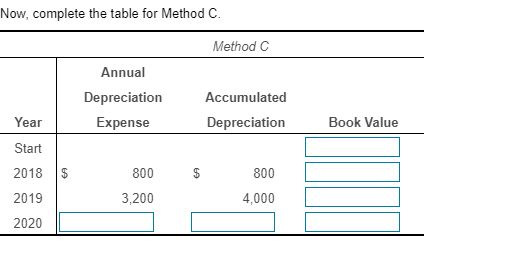

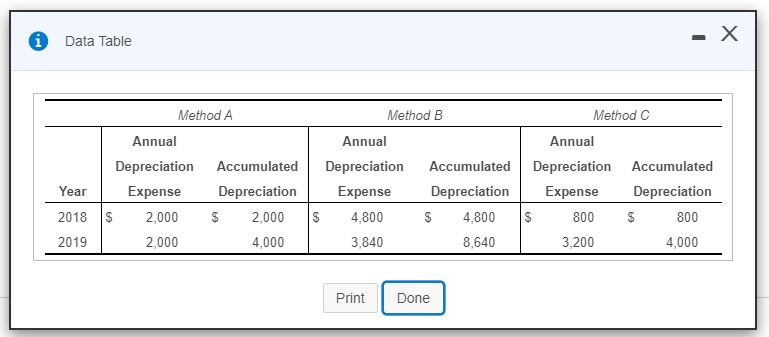

Requirement 1. Identify the depreciation method used in each instance, and show the equation and computation for each; round to the nearest dollar. Begin by identifying the depreciation method used in each instance, Depreciation method used Method A Straight-Line Method B Units-of-Production Method C Double-Declining-Balance Now, select the equation and show the computation of depreciation under Method A (Abbreviation used: Depr. = Depreciation) = Method A depreciation Next, select the equation and show the computation of depreciation under Method B. (Enter any depreciation rate as a decimal to two places, XX.) = Method B depreciation 2018 2019 Finally, select the equation and show the computation of depreciation under Method C. (Enter any depreciation rate as a decimal to two places, XX.) = Method C depreciation 2018 2019 Requirement 2. Determine the annual depreciation expense, accumulated depreciation, and book value of the equipment for 2018 through 2020 under each method, assuming 14,000 units of production in 2020. Begin with Method A Method A Annual Depreciation Expense Accumulated Depreciation Year Book Value Start 2018 $ 2,000 2,000 2,000 4,000 2019 2020 Next, complete the table for Method B. Method B Annual Depreciation Expense Accumulated Depreciation Year Book Value $ Start 2018 2019 2020 4,800 3.840 4,800 8.640 Now, complete the table for Method C. Method C Annual Depreciation Expense Accumulated Depreciation Book Value Year Start 2018 2019 2020 $ 800 3,200 800 4,000 i Data Table Method C Method A Annual Depreciation Accumulated Expense Depreciation $ 2,000 $ 2,000 2,000 4,000 Method B Annual Depreciation Accumulated Expense Depreciation 4,800 $ 4,800 3,840 8,640 Year Annual Depreciation Expense 800 3,200 Accumulated Depreciation $ 800 4,000 2018 2019 Print Done Requirement 1. Identify the depreciation method used in each instance, and show the equation and computation for each; round to the nearest dollar. Begin by identifying the depreciation method used in each instance, Depreciation method used Method A Straight-Line Method B Units-of-Production Method C Double-Declining-Balance Now, select the equation and show the computation of depreciation under Method A (Abbreviation used: Depr. = Depreciation) = Method A depreciation Next, select the equation and show the computation of depreciation under Method B. (Enter any depreciation rate as a decimal to two places, XX.) = Method B depreciation 2018 2019 Finally, select the equation and show the computation of depreciation under Method C. (Enter any depreciation rate as a decimal to two places, XX.) = Method C depreciation 2018 2019 Requirement 2. Determine the annual depreciation expense, accumulated depreciation, and book value of the equipment for 2018 through 2020 under each method, assuming 14,000 units of production in 2020. Begin with Method A Method A Annual Depreciation Expense Accumulated Depreciation Year Book Value Start 2018 $ 2,000 2,000 2,000 4,000 2019 2020 Next, complete the table for Method B. Method B Annual Depreciation Expense Accumulated Depreciation Year Book Value $ Start 2018 2019 2020 4,800 3.840 4,800 8.640 Now, complete the table for Method C. Method C Annual Depreciation Expense Accumulated Depreciation Book Value Year Start 2018 2019 2020 $ 800 3,200 800 4,000 i Data Table Method C Method A Annual Depreciation Accumulated Expense Depreciation $ 2,000 $ 2,000 2,000 4,000 Method B Annual Depreciation Accumulated Expense Depreciation 4,800 $ 4,800 3,840 8,640 Year Annual Depreciation Expense 800 3,200 Accumulated Depreciation $ 800 4,000 2018 2019 Print Done