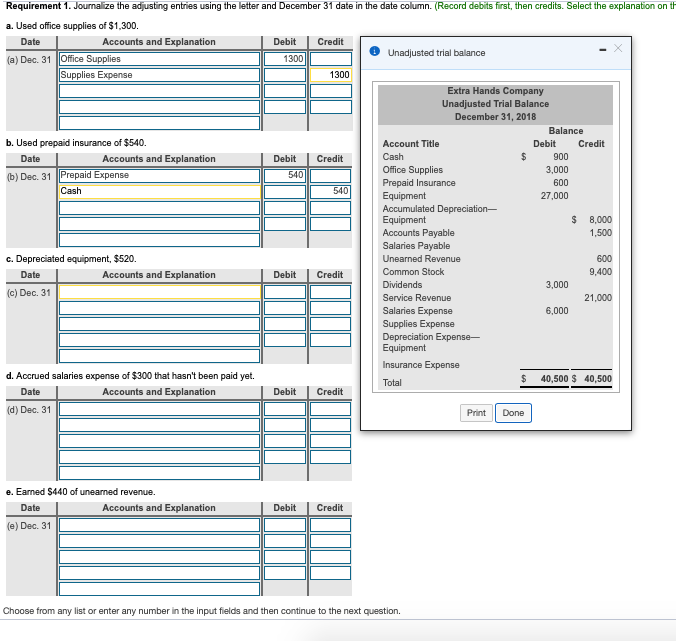

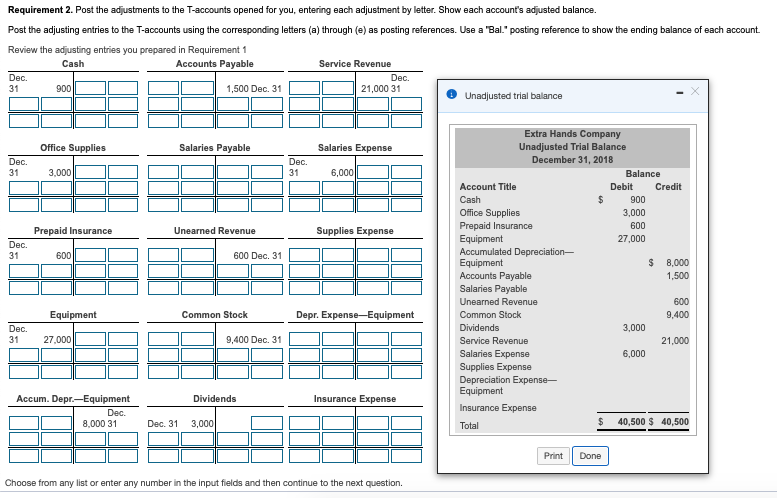

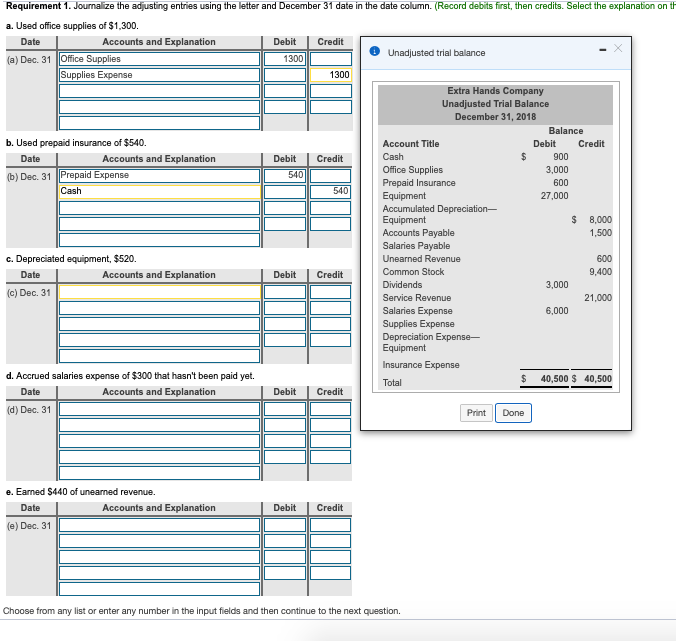

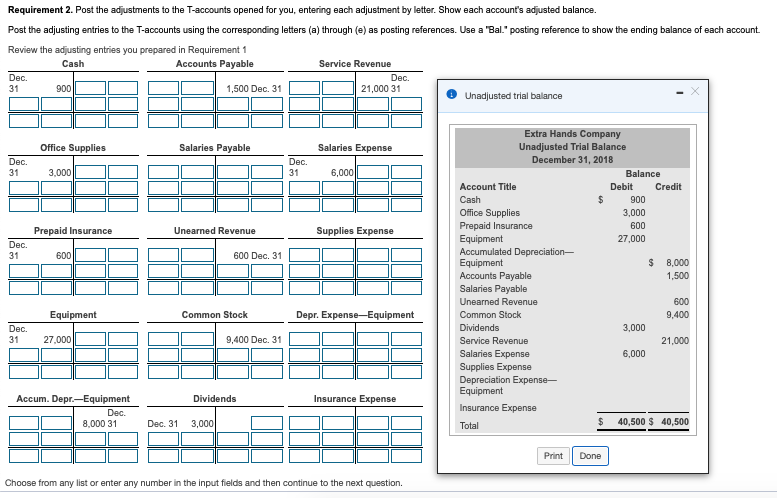

Requirement 1. Journalize the adusting entries using the letter and December 31 date in the date column. (Record debits first, then credits. Select the explanation on t a. Used office supplies of $1,300 Accounts and Explanation Debit Credit Unadjusted trial balance 1300 (a) Dec. 31 Office Supplies Supplies Expense 1300 Extra Hands Company Unadjusted Trial Balance December 31, 2018 Balance b. Used prepaid insurance of $540. Account Title Debit Date Accounts and Explanation Debit Credit Office Supplies Prepaid Insurance 3,000 (b) Dec. 31 Prepaid Expense 540 27,000 $ 8,000 1,500 Accounts Payable Salaries Payable Unearned Revenue Common Stock Date Debit Credit 9,400 3,000 (c) Dec. 31 Service Revenue Salaries Expense Supplies Expense 21,000 6,000 Insurance Expense d. Accrued salaries expense of $300 that hasn't been paid yet. $ 40,500 S 40,500 Date Accounts and Explanation Debit Credit (d) Dec. 31 Print Done e. Eaned $440 of unearned revenue. Date Accounts and Explanation Debit Credit (e) Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 2. Post the adjustments to the T-accounts opened for you, entering each adjustment by letter. Show each account's adjusted balance. Post the adjusting entries to the T-accounts using the corresponding letters (a) through (e) as posting references. Use a Bal.' posting reference to show the ending balance of each account. Review the adjusting entries you prepared in Requirement 1 Cash Accounts Payable Service Revenue Dec. 31900 1,500 Dec. 31 21,000 31 Unadjusted trial balance Extra Hands Company Unadjusted Trial Balance December 31, 2018 Office Supplies Salaries Payable Salaries Expense Dec. 31 Dec. 31 3,000 6,000 Balance Account Title Cash Office Supplies Prepaid Insurance Debit Credit $ 900 3,000 600 27,000 Prepaid Insurance Unearned Revenue Supplies Expense 600 Dec. 31 $ 8,000 1,500 Accounts Payable Salaries Payable Unearned Revenue Common Stock 600 9,400 Equipment Common Stock Depr. Expense- Equipment Dec. 3,000 127 0008,400 Dce 3 9,400 Dec. 31 Service Revenue Salaries Expense Supplies Expense 21,000 6,000 Accum. Depr-Equipment Dec. Dividends Insurance Expense Insurance Expense 8.000 31e, 3,0001 $ 40,500 S 40,500 Dec. 31 Print Done Choose from any list or enter any number in the input fields and then continue to the next