Question

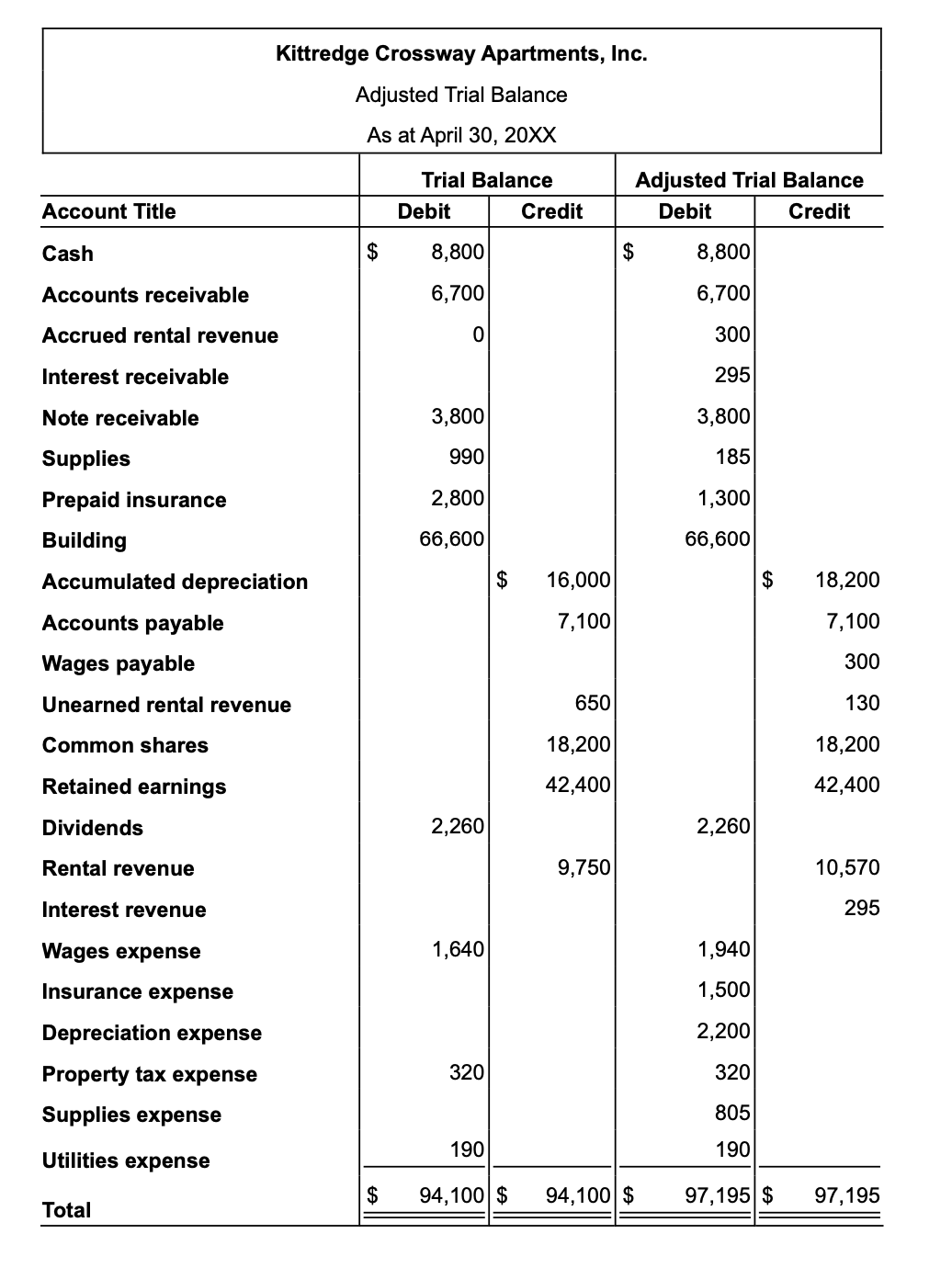

Requirement 1. Make the adjusting entries that account for the differences between the two trial balances. The first difference occurs in the Accrued Rental Revenue

Requirement 1. Make the adjusting entries that account for the differences between the two trial balances.

The first difference occurs in the Accrued Rental Revenue account. Record the adjustment to Accrued Rental Revenue and the related account. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

The second difference occurs in the Interest Receivable account. Record the adjustment to Interest Receivable and the related account. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

The third difference occurs in the Supplies account. Record the adjustment to Supplies and the related account. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

The fourth difference occurs in the Prepaid Insurance account. Record the adjustment to Prepaid Insurance and the related account. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

The fifth difference occurs in the Accumulated Depreciation account. Record the adjustment to Accumulated Depreciation and the related account. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

The sixth difference occurs in the Wages Payable account. Record the adjustment to Wages Payable and the related account. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

The seventh difference occurs in the Unearned Rental Revenue account. Record the adjustment to Unearned Rental Revenue and the related account. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Requirement 2. Compute

Kittredge Crossway

Apartments Inc.'s total assets, total liabilities, total equity, and net income. Prove your answer with the accounting equation.

Use the adjusted trial balance provided to compute

Kittredge Crossway's

total assets, total liabilities, total equity, and net income.

| Total Assets. . . . . . . . . . . . . . . . . . . . . . . . . . . | |

|---|---|

| Total Liabilities. . . . . . . . . . . . . . . . . . . . . . . . . | |

| Total Shareholders' Equity. . . . . . . . . . . . . . . | |

| Net Income. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

Part 9

To prove your answer, use the accounting equation of Assets = Liabilities + Shareholders' Equity. Complete the equation to prove your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started