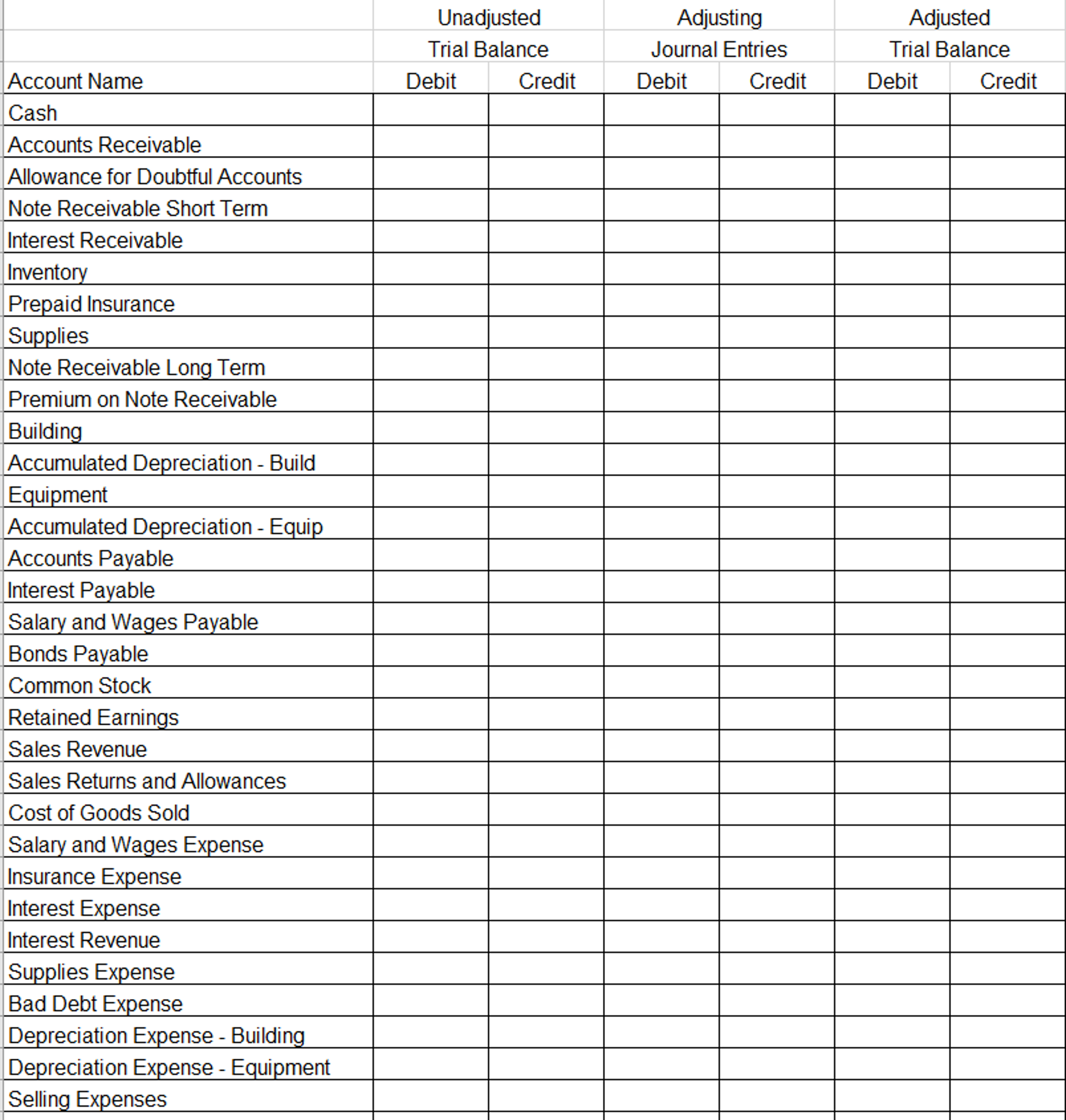

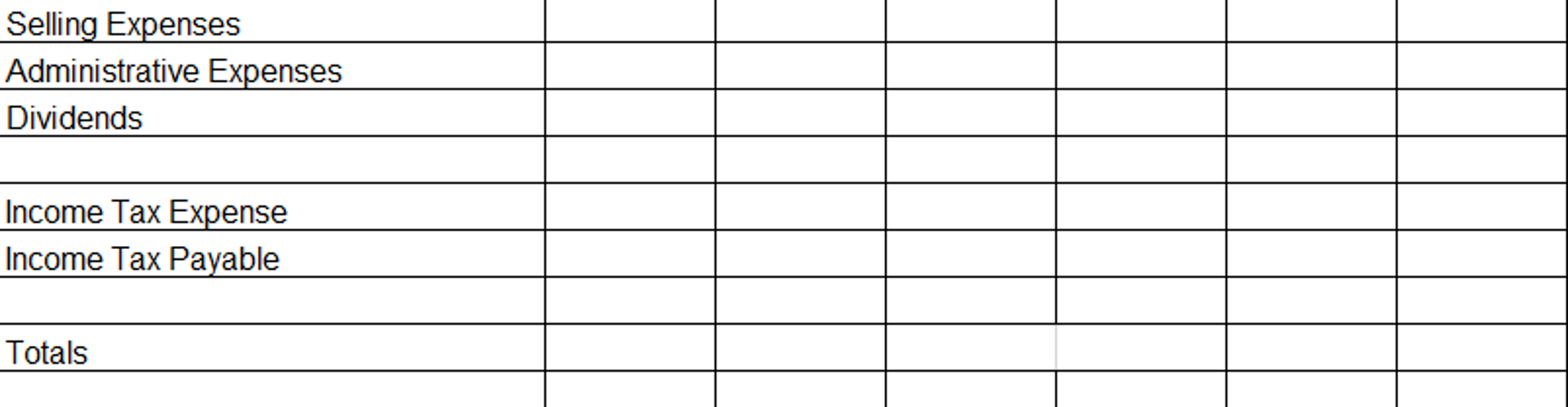

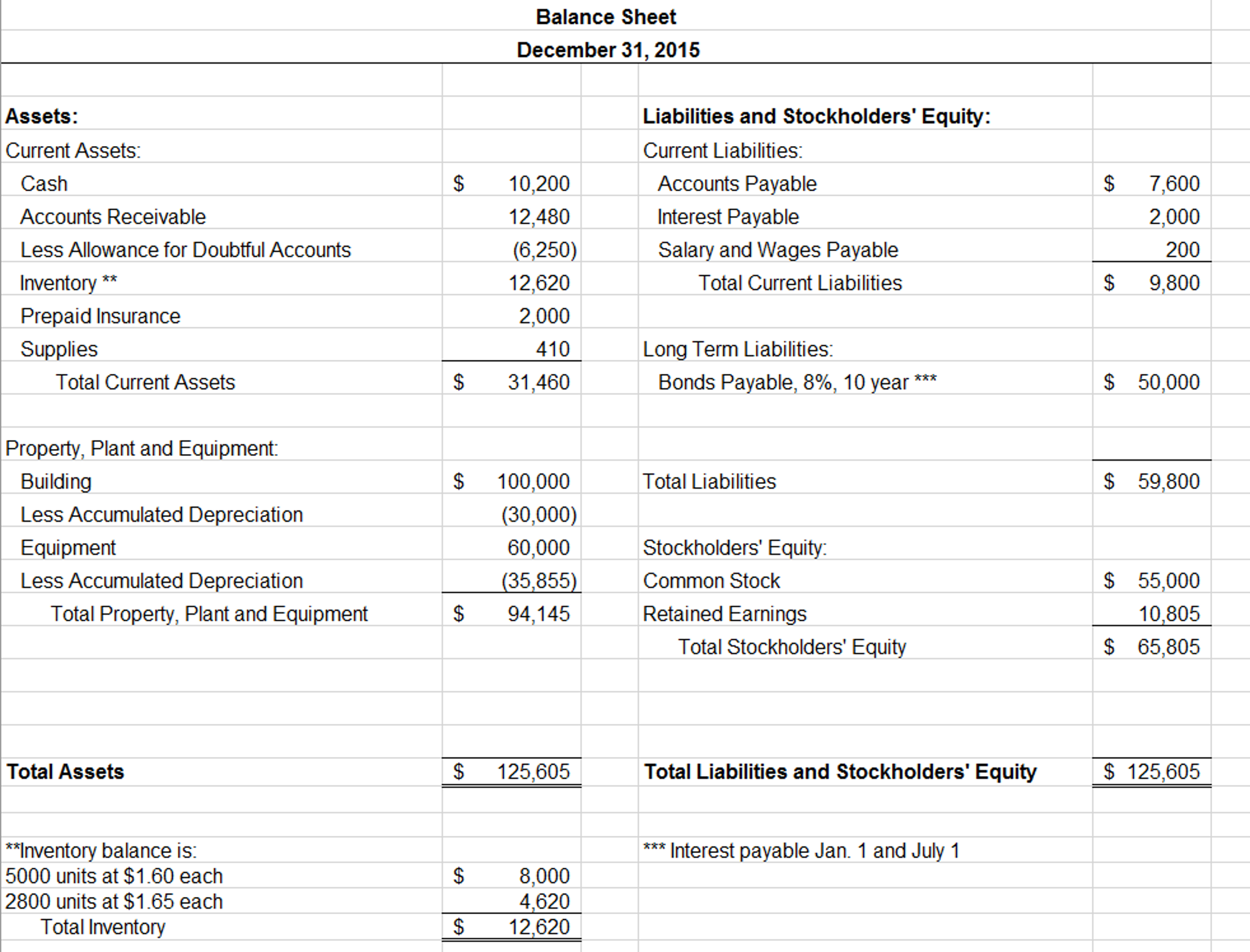

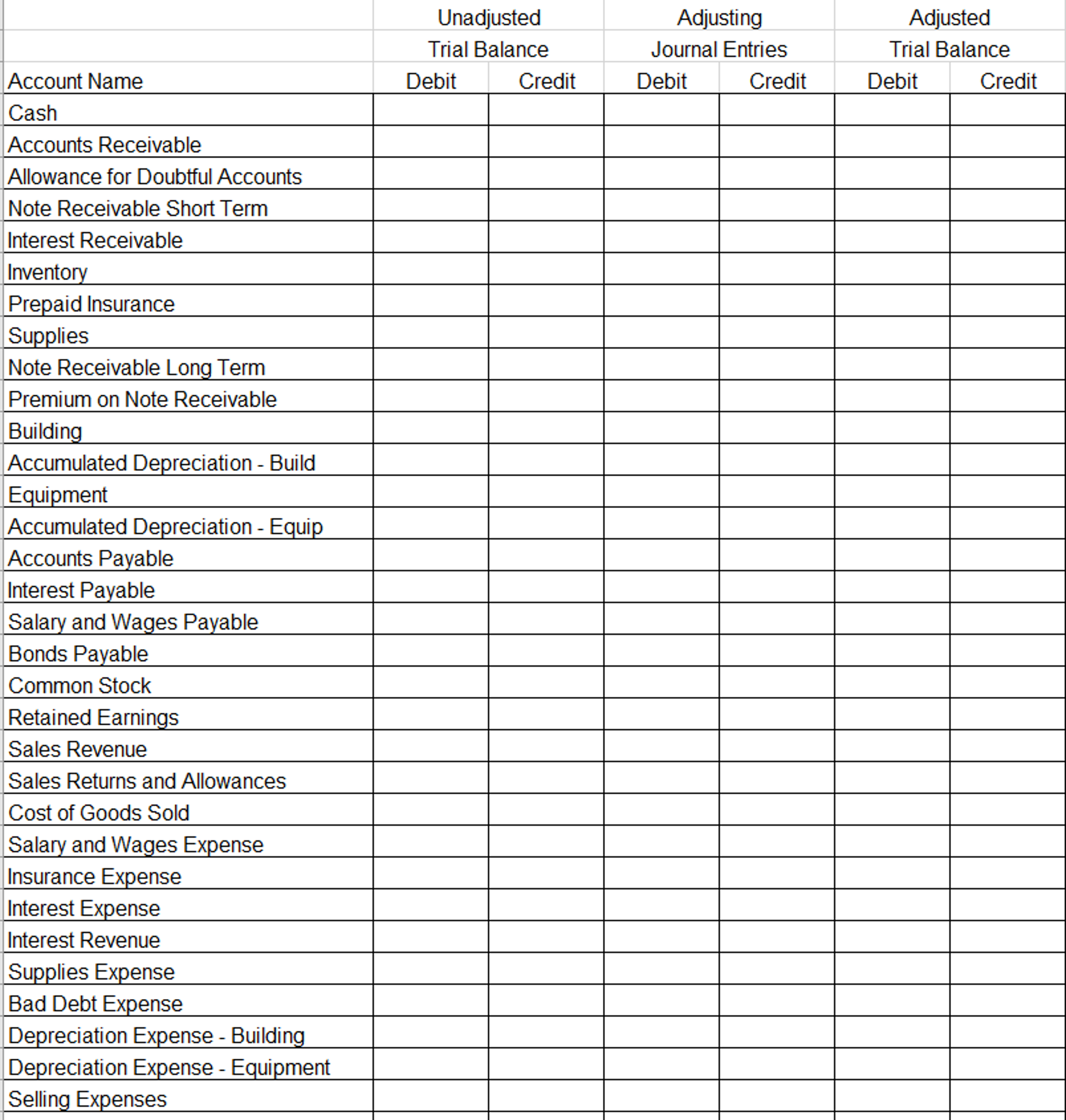

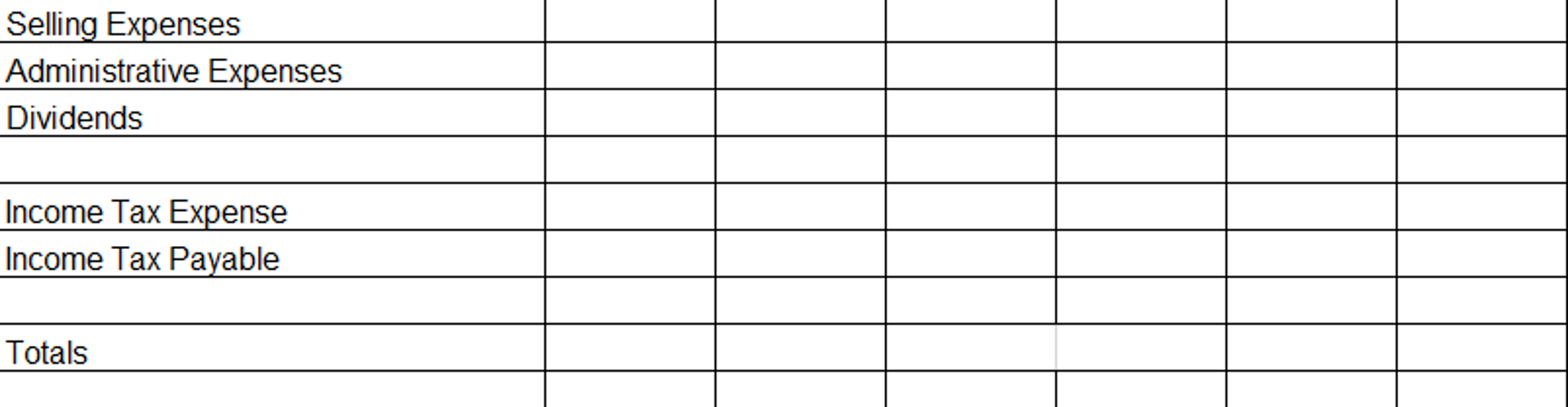

Requirement 1: Only need prepare the journal entries 3, 5, 6, 11,13,17, 19, 21, 22 (1. All sales, sales returns, purchases, and purchase returns of inventory are on account unless stated otherwise. 2. Inventory is accounted for using the perpetual inventory method and FIFO. 3. All salary and wages are considered selling expenses.4. Dresser does not offer sales discounts to its customers and does not take advantage of any purchase discounts offered by its suppliers.)

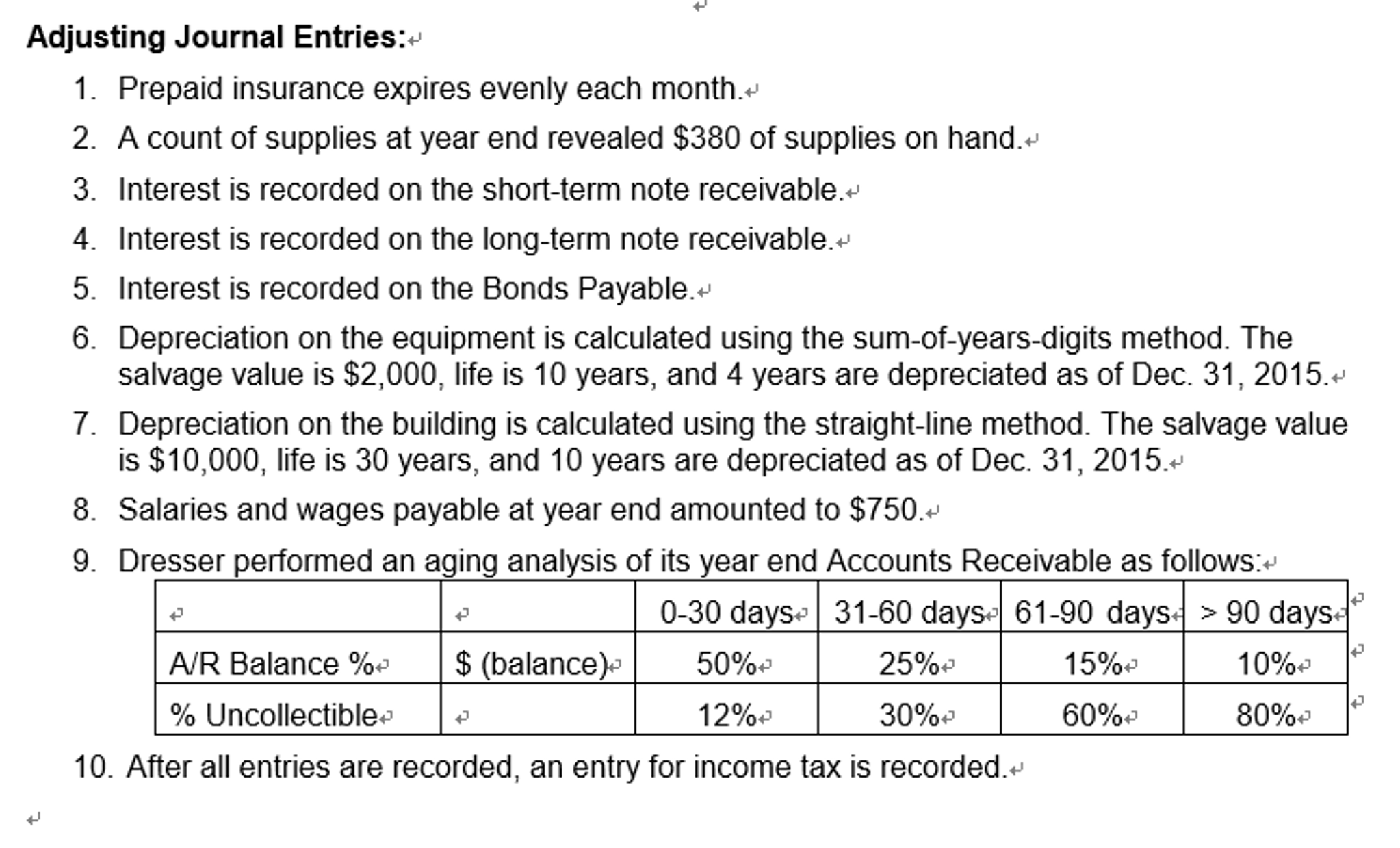

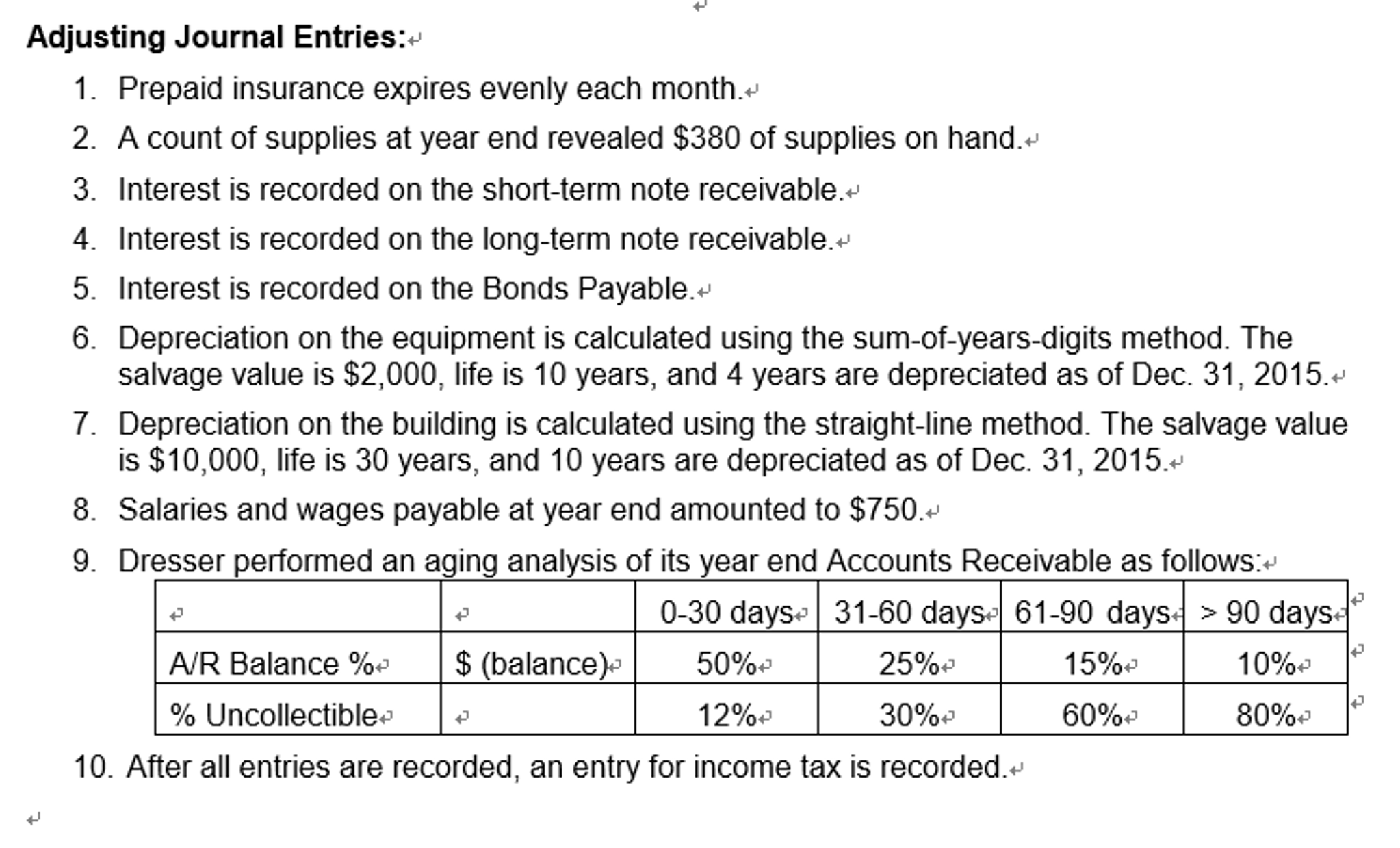

Requirement 2: Prepare the adjusting journal entries presented on the? worksheet.

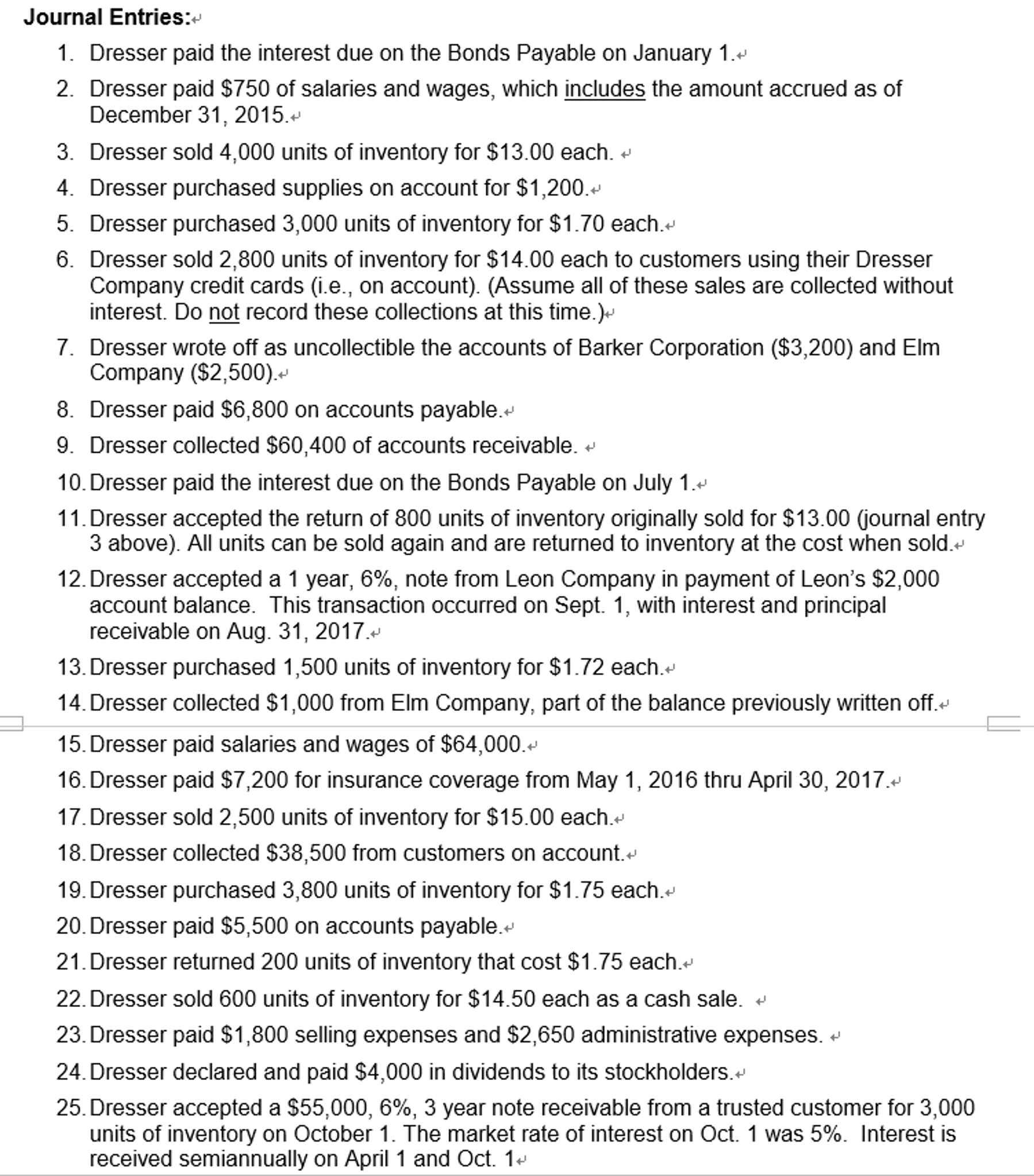

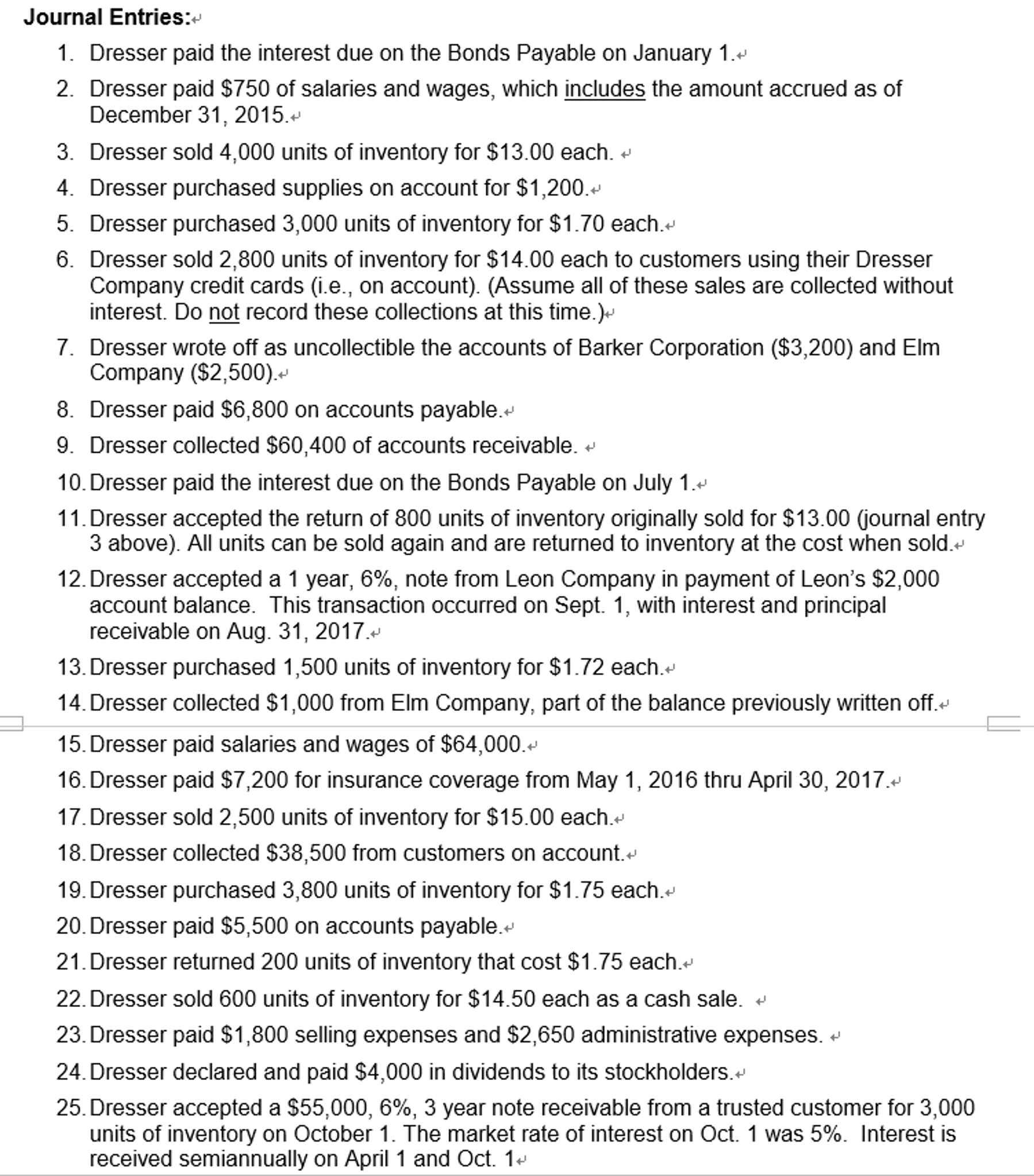

Journal Entries: 1. Dresser paid the interest due on the Bonds Payable on January 1.+ 2. Dresser paid $750 of salaries and wages, which includes the amount accrued as of December 31, 2015. 3. Dresser sold 4,000 units of inventory for $13.00 each. * 4. Dresser purchased supplies on account for $1,200 5. Dresser purchased 3,000 units of inventory for $1.70 each. 6. Dresser sold 2,800 units of inventory for $14.00 each to customers using their Dresser Company credit cards (i.e., on account). (Assume all of these sales are collected without interest. Do not record these collections at this time.)^ 7. Dresser wrote off as uncollectible the accounts of Barker Corporation ($3,200) and Elm Company ($2,500). 8. Dresser paid $6,800 on accounts payable. 9. Dresser collected $60,400 of accounts receivable. 10. Dresser paid the interest due on the Bonds Payable on July 1. 11. Dresser accepted the return of 800 units of inventory originally sold for $13.00 (journal entry 3 above). All units can be sold again and are returned to inventory at the cost when sold.* 12. Dresser accepted a 1 year, 6%, note from Leon Company in payment of Leon's $2,000 account balance. This transaction occurred on Sept. 1, with interest and principal receivable on Aug. 31, 2017.* 13. Dresser purchased 1,500 units of inventory for $1.72 each. 14. Dresser collected $1,000 from Elm Company, part of the balance previously written off. 15. Dresser paid salaries and wages of $64,000.* 16. Dresser paid $7,200 for insurance coverage from May 1, 2016 thru April 30, 2017.* 17. Dresser sold 2,500 units of inventory for $15.00 each.* 18. Dresser collected $38,500 from customers on account. 19. Dresser purchased 3,800 units of inventory for $1.75 each.* 20. Dresser paid $5,500 on accounts payable. 21. Dresser returned 200 units of inventory that cost $1.75 each.* 22. Dresser sold 600 units of inventory for $14.50 each as a cash sale. 23. Dresser paid $1,800 selling expenses and $2,650 administrative expenses. * 24. Dresser declared and paid $4,000 in dividends to its stockholderS. 25-Dresser accepted a $55,000, 6%, 3 year note receivable from a trusted customer for 3,000 units of inventory on October 1 . The market rate of interest on Oct. 1 was 5%. Interest is received semiannually on April 1 and Oct. 1