Requirement 1 options (will or will not) (consider or does not consider) (will or will not) (was or was not)

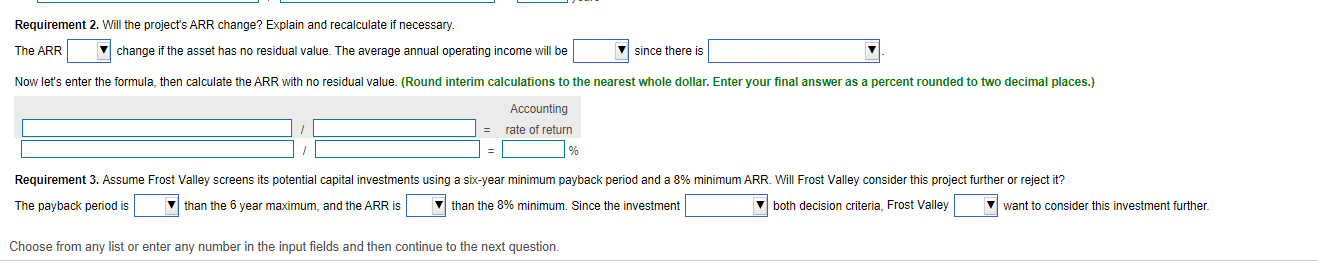

Requirement 2 (will or will not) (lower or higher or the same) (more depreciation expense or less depreciation expense, or the same depreciation expense)

Requirement 3 (shorter or longer) (higher or lower) (meets or does not meet) (will or will not)

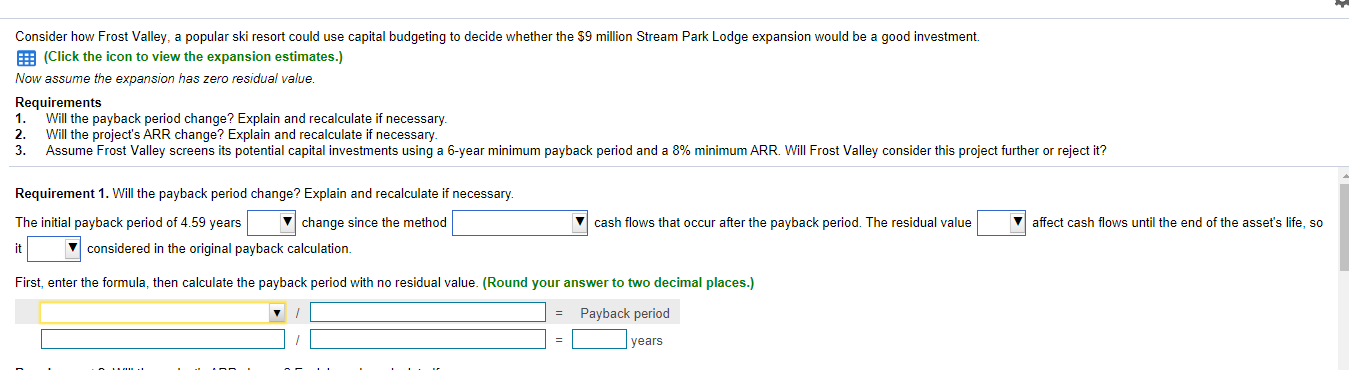

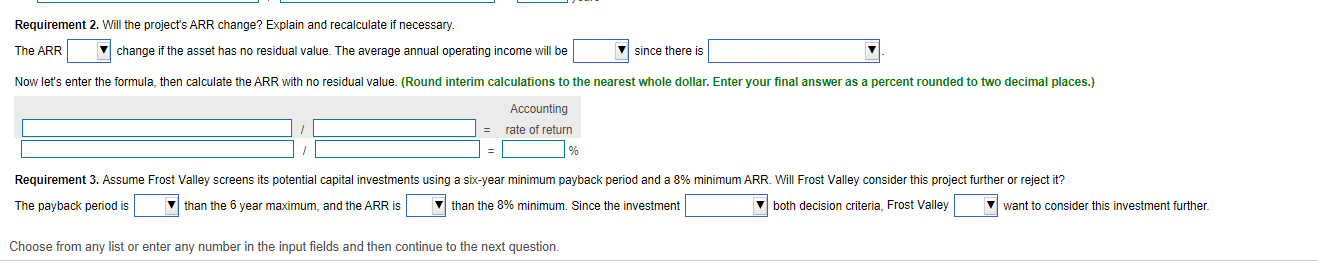

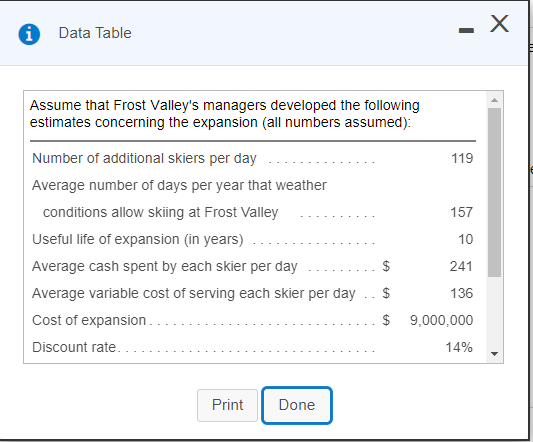

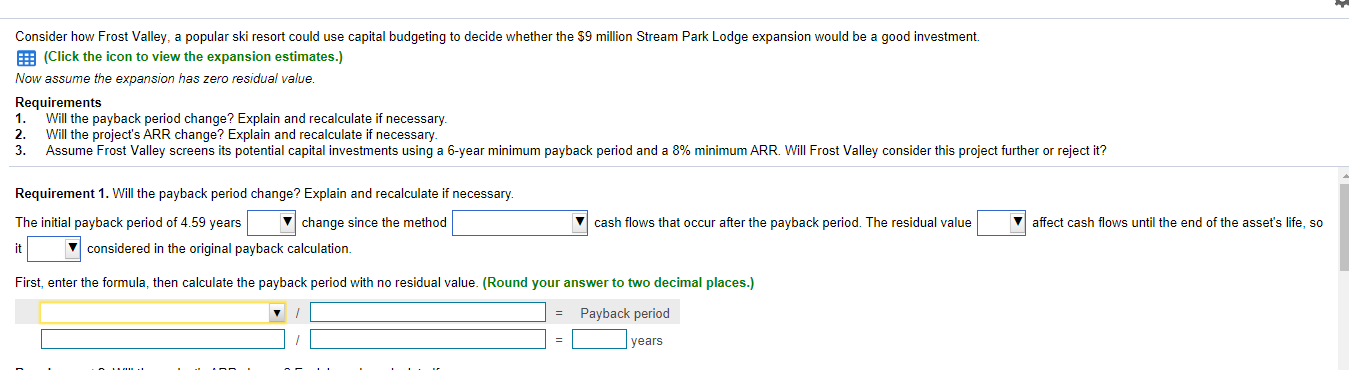

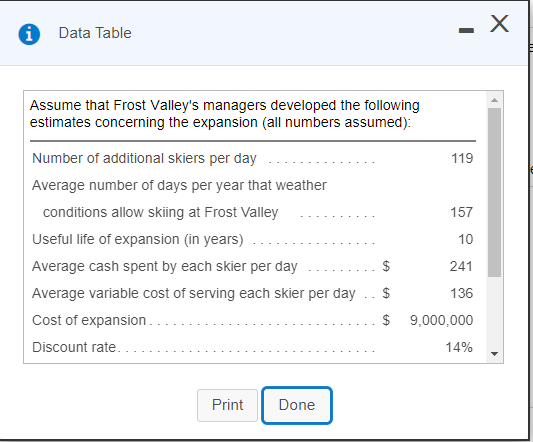

Consider how Frost Valley, a popular ski resort could use capital budgeting to decide whether the $9 million Stream Park Lodge expansion would be a good investment. (Click the icon to view the expansion estimates.) Now assume the expansion has zero residual value. Requirements Will the payback period change? Explain and recalculate if necessary. 2. Will the project's ARR change? Explain and recalculate if necessary. 3. Assume Frost Valley screens its potential capital investments using a 6-year minimum payback period and a 8% minimum ARR. Will Frost Valley consider this project further or reject it? 1. Requirement 1. Will the payback period change? Explain and recalculate if necessary. The initial payback period of 4.59 years change since the method it considered in the original payback calculation. cash flows that occur after the payback period. The residual value Vaffect cash flows until the end of the asset's life, so First, enter the formula, then calculate the payback period with no residual value. (Round your answer to two decimal places.) Payback period years Requirement 2. Will the project's ARR change? Explain and recalculate if necessary. The ARR change if the asset has no residual value. The average annual operating income will be since there is Now let's enter the formula, then calculate the ARR with no residual value. (Round interim calculations to the nearest whole dollar. Enter your final answer as a percent rounded to two decimal places.) Accounting = rate of return Requirement 3. Assume Frost Valley screens its potential capital investments using a six-year minimum payback period and a 8% minimum ARR. Will Frost Valley consider this project further or reject it? The payback period is V than the 6 year maximum, and the ARR is than the 8% minimum. Since the investment both decision criteria. Frost Valley want to consider this investment further Choose from any list or enter any number in the input fields and then continue to the next question. x Data Table Assume that Frost Valley's managers developed the following estimates concerning the expansion (all numbers assumed): 119 157 10 Number of additional skiers per day Average number of days per year that weather conditions allow skiing at Frost Valley Useful life of expansion (in years) Average cash spent by each skier per day Average variable cost of serving each skier per day Cost of expansion Discount rate. 241 136 $ $ $ 9,000,000 14% Print Done