Question

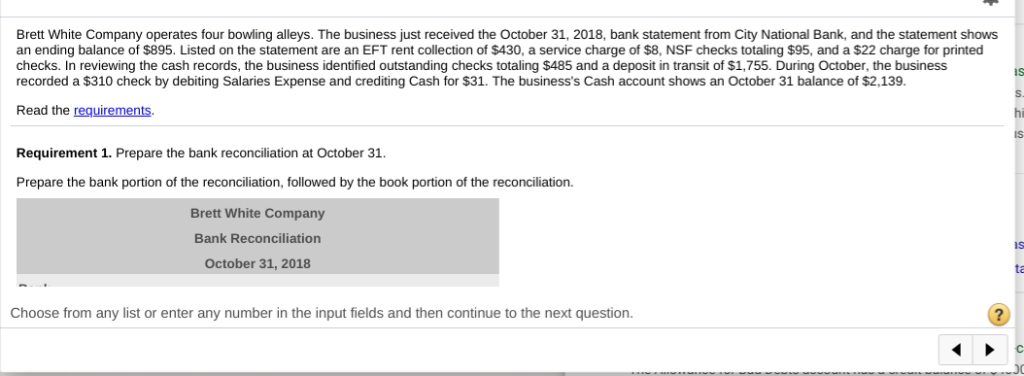

- Requirement 1: Prepare the bank reconciliation at October 31. Prepare the bank portion of the reconciliation, followed by the book portion of the reconciliation.

- Requirement 1: Prepare the bank reconciliation at October 31.

Prepare the bank portion of the reconciliation, followed by the book portion of the reconciliation.

-Requirement 2: Journalize any transactions required from the bank reconciliation.

Begin with the EFT collection.

Journalize the entry to correct the error.

Journalize the adjustment for the NSF check.

Journalize the charge for printed checks. (Do not record the bank service charges, that will be done in the next step. Assume the cost of printed checks is a bankexpense.)

Journalize the service charges.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started