Answered step by step

Verified Expert Solution

Question

1 Approved Answer

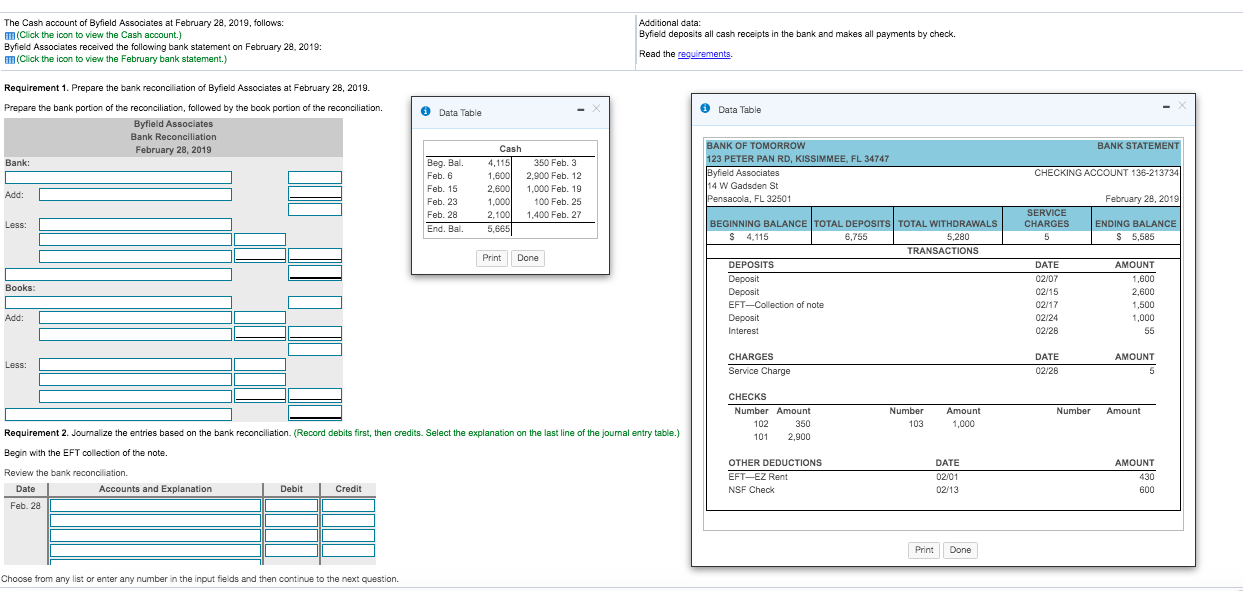

Requirement 1. Prepare the bank reconciliation of Byfield Associates at February 28,2019. Prepare the bank portion of the bank reconciliation, followed by the book portion

Requirement 1. Prepare the bank reconciliation of Byfield Associates at February 28,2019. Prepare the bank portion of the bank reconciliation, followed by the book portion of the bank reconciliation.

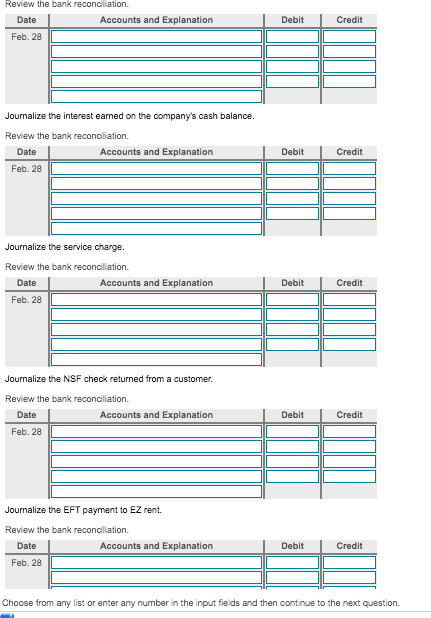

Additional data: Byfield deposits all cash receipts in the bank and makes all payments by check The Cash account of Byfield Associates at February 28, 2019, follows: (Click the icon to view the Cash account.) Byfield Associates received the following bank statement on February 28, 2019 (Click the icon to view the February bank statement.) Read the requirements Requirement 1. Prepare the bank reconciliation of Byfield Associates at February 28, 2019. Prepare the bank portion of the reconciliation, followed by the book portion of the reconciliation Data Table Data Table Byfleld Associates Bank Reconciliation BANK OF TOMORROW BANK STATEMENT Cash February 28, 2019 123 PETER PAN RD, KISSIMMEE, FL 34747 Beg. Bal. Bank: 4,115 350 Feb. 3 Byfield Associates 14 W Gadsden St Pensacola, FL 32501 CHECKING ACCOUNT 136-213734 Feb. 6 1,600 2,900 Feb. 12 Feb. 15 2,600 1,000 Feb. 19 Add: February 28, 2019 Feb. 23 1,000 100 Feb. 25 SERVICE 2,100 5,665 Feb. 28 1,400 Feb. 27 BEGINNING BALANCE TOTAL DEPOSITS TOTAL WITHDRAWALS S 4,115 Less ENDING BALANCE S 5,585 CHARGES End. Bal 6,755 5.280 5 TRANSACTIONS Print Done DEPOSITS DATE AMOUNT Deposit 02/07 1,600 Books: Deposit EFT-Collection of note 02/15 2,600 1,500 02/17 Deposit 02/24 1,000 Add: Interest 02/28 55 DATE CHARGES AMOUNT Less: Service Charge 02/28 5 CHECKS Number Amount Number Amount Number Amount 102 350 103 1,000 Requirement 2. Jounalize the entries based on the bank reconciliation. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) 101 2,900 Begin with the EFT collection of the note AMOUNT OTHER DEDUCTIONS DATE Review the bank reconciliation. EFT-EZ Rent 02/01 430 Accounts and Explanation Date Debit Credit NSF Check 02/13 600 Feb. 28 Print Done Choose from any list or enter any number in the input fields and then continue to the next question. Review the bank reconciliation Accounts and Explanation Date Debit Credit Feb. 28 Journalize the interest earned on the company's cash balance Review the bank reconciliation. Accounts and Explanation Date Debit Credit Feb. 28 Journalize the service charge. Review the bank reconciliation Accounts and Explanation Date Debit Credit Feb. 28 Journalize the NSF check returned from a customer. Review the bank reconciliation Accounts and Explanation Date Debit Credit Feb. 28 Journalize the EFT payment to EZ rent Review the bank reconcliation. Date Accounts and Explanation Debit Credit Feb. 28 Choose from any list or enter any number in the input fields and then continue to the nextStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started