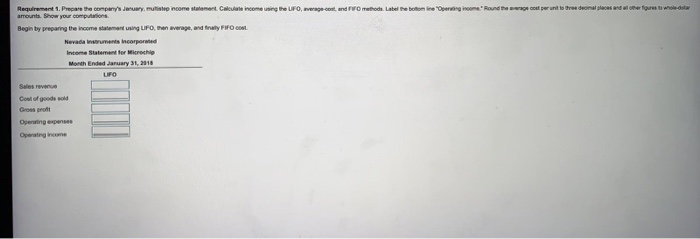

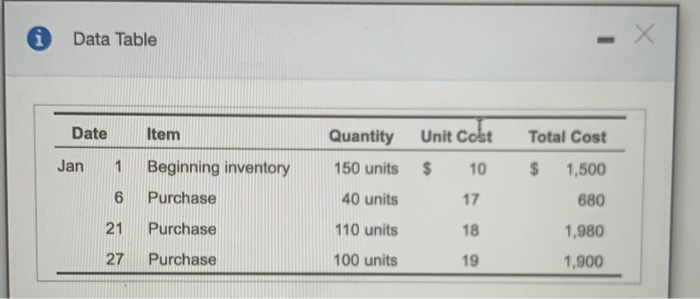

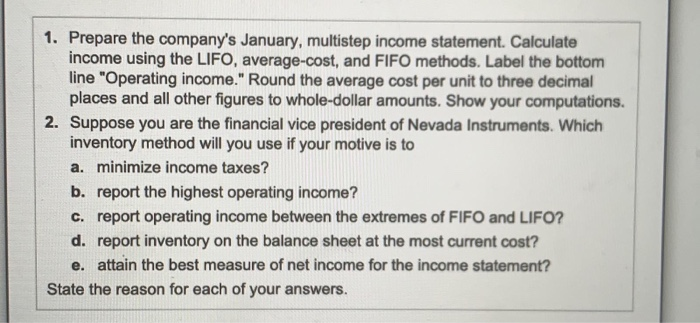

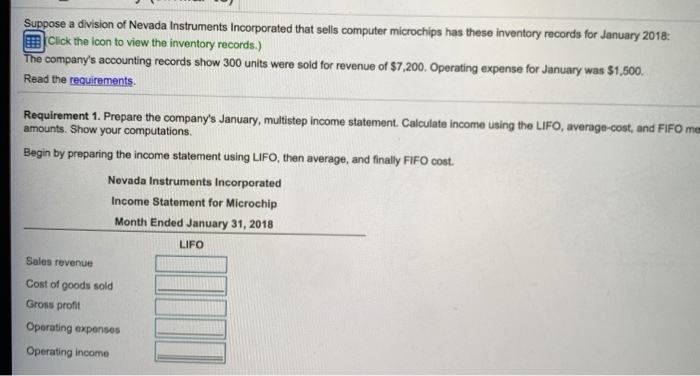

Requirement 1. Prepare the company's January, multe income statement Calculate income using the UFO, average-cent, and method. Label te boton line Operating income.round the cont per unit to the decimal places and figures wedol amounts. Show your computations Begin by preparing the income statement using UFO, the average and finally Foco Nevada incorpored Income Statement for Microchip Month Ended January 31, 2018 UFO Servere Coul of goods sold Crop Operating expenses i Data Table Date Item Quantity Unit Cost Total Cost Jan 1 Beginning inventory 150 units $ 10 $ 1,500 6 Purchase 40 units 17 680 21 Purchase 110 units 18 1,980 1,900 27 Purchase 100 units 19 1. Prepare the company's January, multistep income statement. Calculate income using the LIFO, average-cost, and FIFO methods. Label the bottom line "Operating income." Round the average cost per unit to three decimal places and all other figures to whole-dollar amounts. Show your computations. 2. Suppose you are the financial vice president of Nevada Instruments. Which inventory method will you use if your motive is to a. minimize income taxes? b. report the highest operating income? c. report operating income between the extremes of FIFO and LIFO? d. report inventory on the balance sheet at the most current cost? e. attain the best measure of net income for the income statement? State the reason for each of your answers. Suppose a division of Nevada Instruments Incorporated that sells computer microchips has these inventory records for January 2018: Click the icon to view the inventory records.) The company's accounting records show 300 units were sold for revenue of $7,200. Operating expense for January was $1,500. Read the requirements Requirement 1. Prepare the company's January, multistep income statement. Calculate income using the LIFO, average-cost, and FIFO me amounts. Show your computations Begin by preparing the income statement using LIFO, then average, and finally FIFO cost. Nevada Instruments Incorporated Income Statement for Microchip Month Ended January 31, 2018 LIFO Sales revenue Cost of goods sold Gross profit Operating expenses Operating income