Answered step by step

Verified Expert Solution

Question

1 Approved Answer

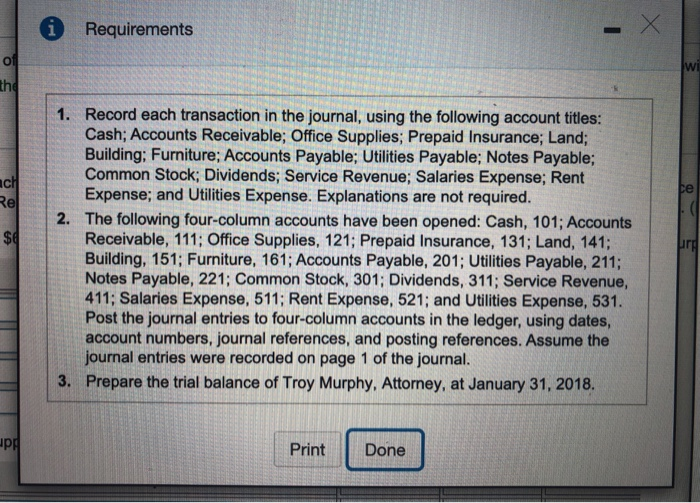

Requirement 1. Record each transaction in the journal, using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Land; Building; Furniture; Accounts Payable;

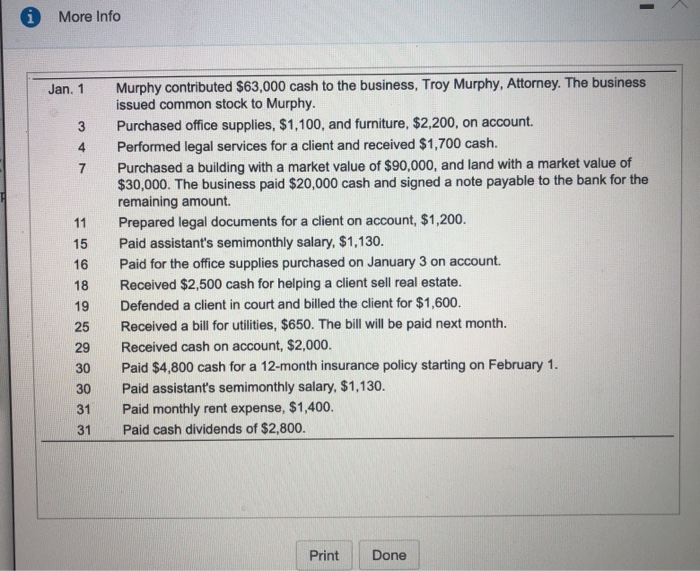

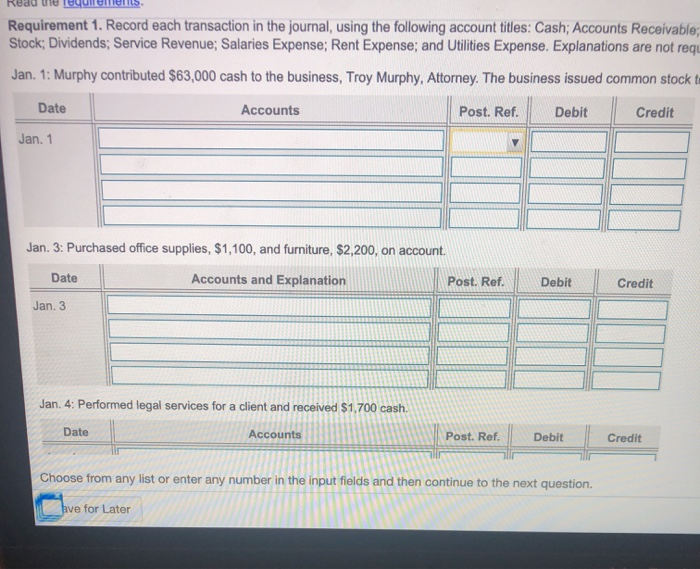

Requirement 1. Record each transaction in the journal, using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Land; Building; Furniture; Accounts Payable; Utilities Payable; Notes Payable; Common Stock; Dividends; Service Revenue; Salaries Expense; Rent Expense; and Utilities Expense. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.)

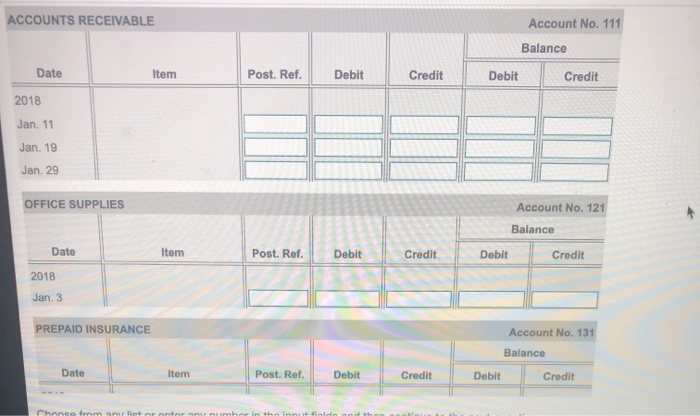

Requirement 2. The following four-column accounts have been opened: Cash, 101; Accounts Receivable, 111; Office Supplies, 121; Prepaid Insurance, 131; Land, 141; Building, 151; Furniture, 161; Accounts Payable, 201; Utilities Payable, 211; Notes Payable, 221; Common Stock, 301; Dividends, 311; Service Revenue, 411; Salaries Expense, 511; Rent Expense, 521; and Utilities Expense, 531. Post the journal entries to four-column accounts in the ledger, using dates, account numbers, journal references, and posting references. Assume the journal entries were recorded on page 1 of the journal and record entries with the same date in the order presented in the transaction list. (If a box is not used in the table, leave the box empty; do not enter a zero. Compute the new balance for each account after posting the transaction.)

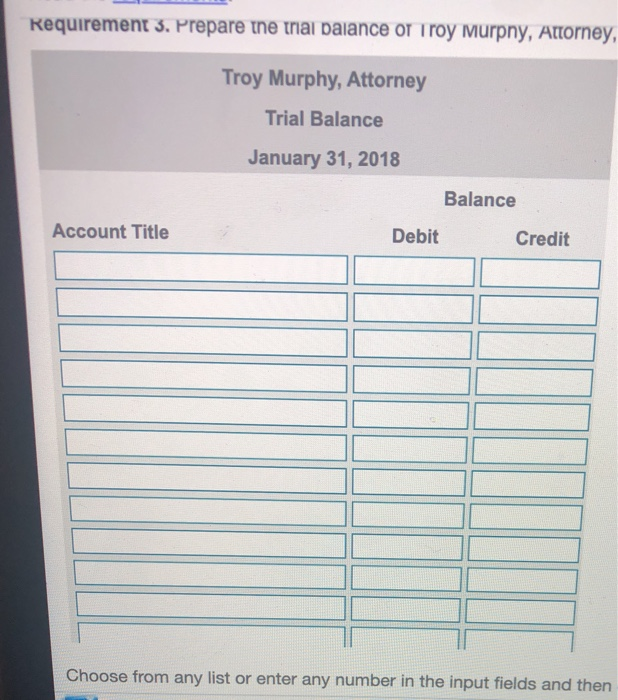

Requirement 3. Prepare the trial balance of Troy Murphy Attorney, at January 31, 2018.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started