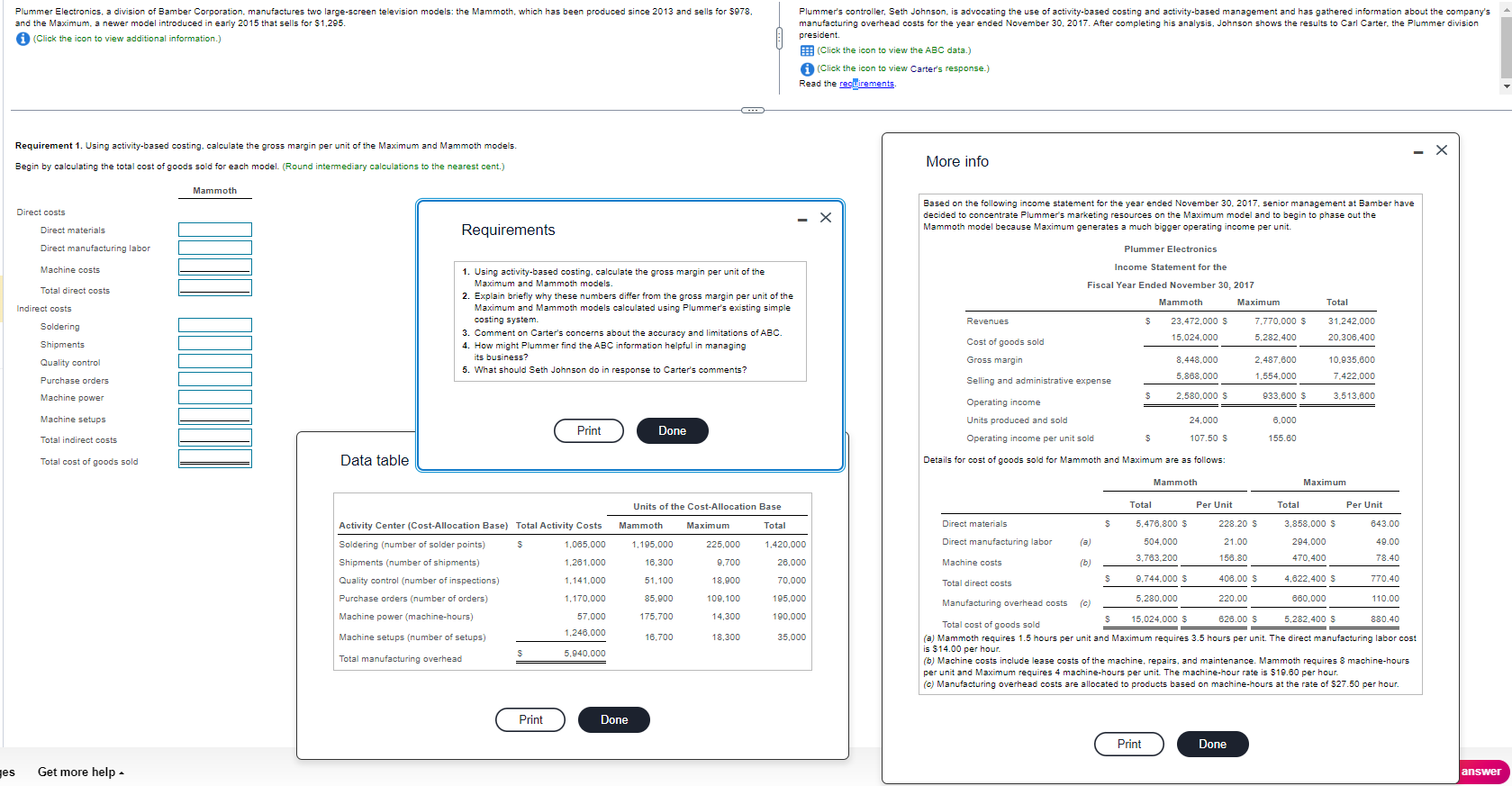

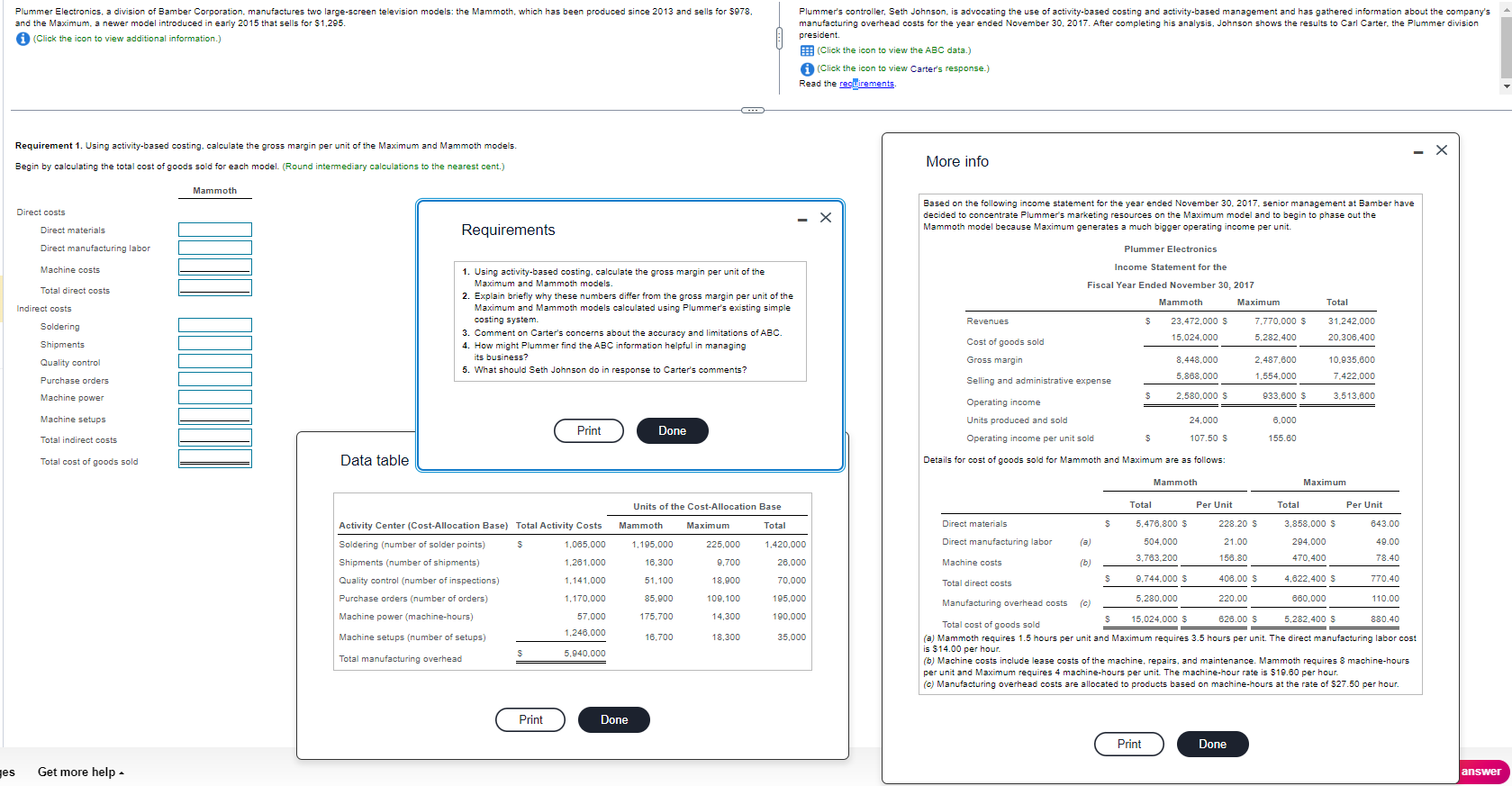

Requirement 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models. Begin by calculating the total cost of goods sold for each model. (Round intermediary calculations to the nearest cent.) More info Based on the following income statement for the year ended November 30, 2017, senior management at Bamber have decided to concentrate Plummer's marketing resources on the Maximum model and to begin to phase out the Mammoth model because Maximum generates a much bigger operating income per unit. Plummer Electronics 1. Using activity-based costing, calculate the gross margin per unit of the Income Statement for the Maximum and Mammoth models. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and costing system. 3. Comment on Carter's concerns about the accuracy and limitations of ABC. 4. How might Plummer find the ABC information helpful in managing 5. What should Seth Johnson do in response to Carter's comments? Data table Details for cost of goods sold for Mammoth and Maximum are as follows: Mammoth Maximum (a) Mammoth requires 1.5 hours per unit and Maximum requires 3.5 hours per unit. I he direct manutactuning labor cos: (b) Machine costs include lease costs of the machine, repairs, and maintenance. Mammoth requires 8 machine-hours per unit and Maximum requires 4 machine-hours per unit. The machine-hour rate is $19.60 per hour. (c) Manufacturing overhead costs are allocated to products based on machine-hours at the rate of $27.50 per hour. Requirement 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models. Begin by calculating the total cost of goods sold for each model. (Round intermediary calculations to the nearest cent.) More info Based on the following income statement for the year ended November 30, 2017, senior management at Bamber have decided to concentrate Plummer's marketing resources on the Maximum model and to begin to phase out the Mammoth model because Maximum generates a much bigger operating income per unit. Plummer Electronics 1. Using activity-based costing, calculate the gross margin per unit of the Income Statement for the Maximum and Mammoth models. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and costing system. 3. Comment on Carter's concerns about the accuracy and limitations of ABC. 4. How might Plummer find the ABC information helpful in managing 5. What should Seth Johnson do in response to Carter's comments? Data table Details for cost of goods sold for Mammoth and Maximum are as follows: Mammoth Maximum (a) Mammoth requires 1.5 hours per unit and Maximum requires 3.5 hours per unit. I he direct manutactuning labor cos: (b) Machine costs include lease costs of the machine, repairs, and maintenance. Mammoth requires 8 machine-hours per unit and Maximum requires 4 machine-hours per unit. The machine-hour rate is $19.60 per hour. (c) Manufacturing overhead costs are allocated to products based on machine-hours at the rate of $27.50 per hour