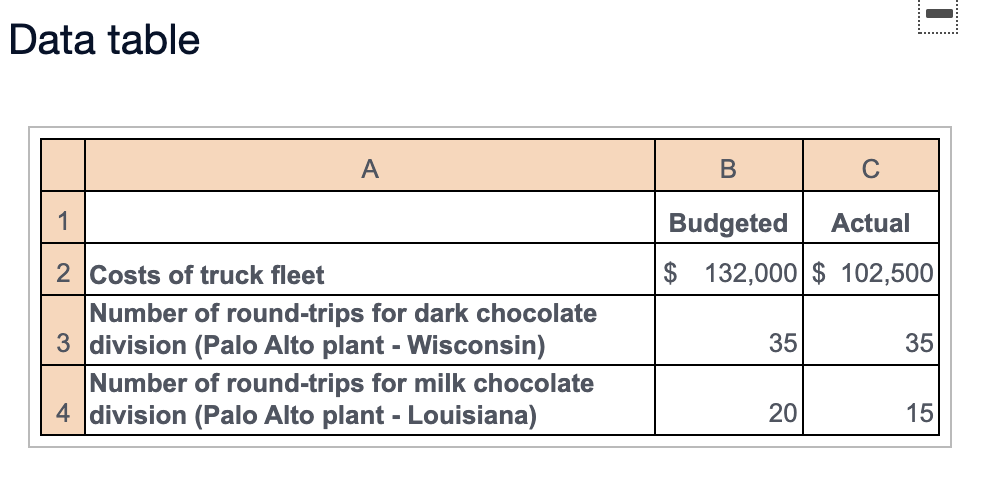

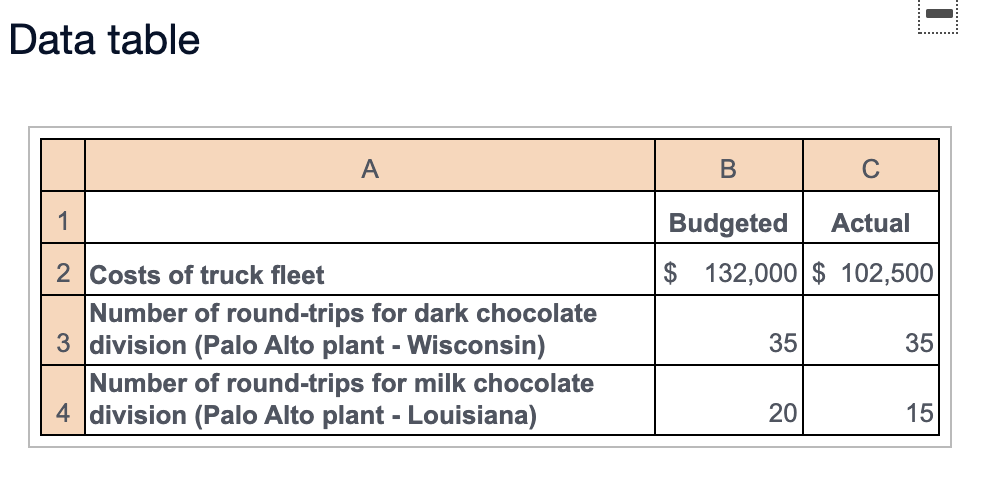

Requirement 1. Using the single-rate method, allocate costs to the dark chocolate division and the milk chocolate division in these three ways. a. Calculate the budgeted rate per round-trip and allocate costs based on round-trips budgeted for each division. The budgeted rate per round-trip is $ 2,400 . This translates to indirect costs allocated to the dark chocolate division for $ 84,000 and milk chocolate division for $ 48,000. b. Calculate the budgeted rate per round-trip and allocate costs based on actual round-trips used by each division. . The budgeted rate per round-trip is $ 2,400 . This translates to indirect costs allocated to the dark chocolate division for $ 84,000 and milk chocolate division for $ 36,000. c. Calculate the actual rate per round-trip and allocate costs based on actual round-trips used by each division. The actual rate per round-trip is 2,050 . This translates to indirect costs allocated to the dark chocolate division for $ 71,750 and milk chocolate division for $ 30,750. Requirement 2. Describe the advantages and disadvantages of using each of the three methods in requirement 1. When budgeted rates/budgeted quantities are used, the dark chocolate and milk chocolate divisions know at the start of 2020 that they will be charged a total of for transportation of dark chocolate and for transportation of milk chocolate. In effect, the fleet resource becomes a cost for each division. This type of cost may motivate the managers to the trucking fleet. More info The company has a separate division for each of its two products: dark chocolate and milk chocolate. Chocolat purchases ingredients from Wisconsin for its dark chocolate division and from Louisiana for its milk chocolate division. Both locations are the same distance from Chocolat's Palo Alto plant. Chocolat Inc. operates a fleet of trucks as a cost center that charges the divisions for variable costs (drivers and fuel) and fixed costs (vehicle depreciation, insurance, and registration fees) of operating the fleet. Each division is evaluated on the basis of its operating income. - Data table A B 1 Budgeted Actual $ 132,000 $ 102,500 2 Costs of truck fleet Number of round-trips for dark chocolate 3 division (Palo Alto plant - Wisconsin) Number of round-trips for milk chocolate 4 division (Palo Alto plant - Louisiana) 35 35 20 15