Question

Requirement 13Use the contribution margin approach to compute the change in net operating income if the selling price increases by 3%, raw material costs increase

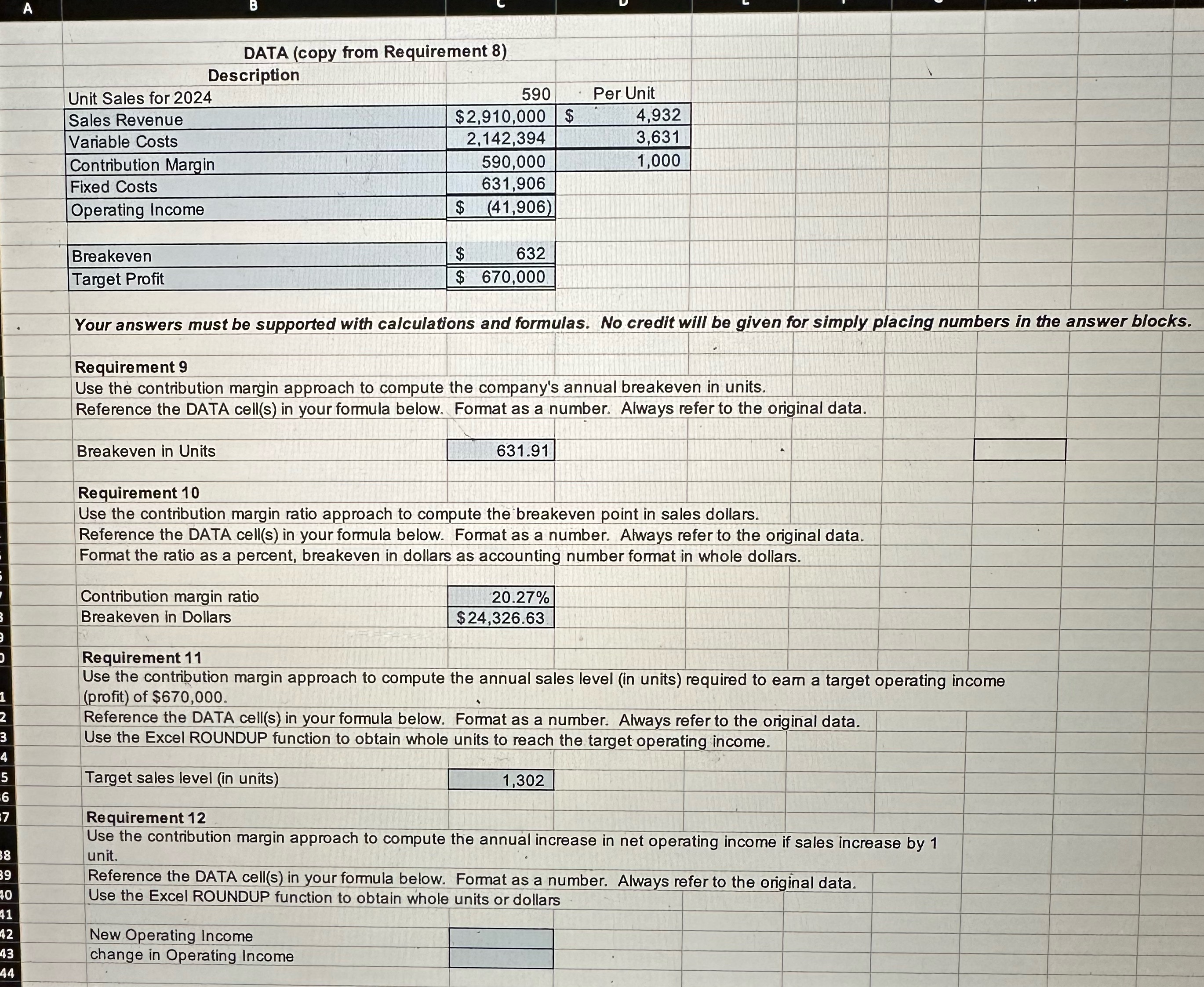

Requirement 13Use the contribution margin approach to compute the change in net operating income if the selling price increases by 3%, raw material costs increase by 7% and sales fall by 100 units.Reference the DATA cells) in your formula below. Format as a number. Always refer to the original data.Use the Excel ROUNDUP function to obtain whole units or dollarsnew operating income: ?change in operating income: ?Requirement 14Use the contribution margin approach to compute the change in net operating income if the selling price per unit increases by $30per unit and the sales fall by 100 units.Reference the DATA cells) in your formula below. Format as number.Use the Excel ROUNDUP function to obtain whole units or dollarsnew operating income: ?change in operating income: ?Requirement 15Use the contribution margin approach to compute the change in net operating income if the sales increase by 9% and advertising spending is increased by $8,000.Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original dataUse the Excel ROUNDUP function to obtain whole units or dollarsnew operating income: ?change in operating income: ?Requirement 16Use the contribution margin approach to calculate margin of safety in dollars, as a percent and in units.Reference the DATA cells) in your formula below. Format as a number. Always refer to the original data.Use the Excel ROUNDUP function to obtain whole units or dollarsmargin safety $: ?margin safety %: ?margin safety units: ?Requirement 17Use the contribution margin approach to calculate operating leverage. What is the estimated percent increase in net income If sales increase 15%? What is the New Operating Income?Reference the DATA cells) in your formula below. Format as a number. Always refer to the original data.operating leverage: ?change in operation income %: ?new operating income $: ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started