Requirement:

1)sales budget 2) production budget 3)Direct material purchases budget 4)Direct labour budget 5) Factory overhead budget 6) Closing inventory budget 7) Cost of goods sold budget

8) Selling and administration expenses budget 9) cash budget 10) Budget statement of comprehensive income year ending 31 December 2019

11) projected financial position as at 31 December 2019

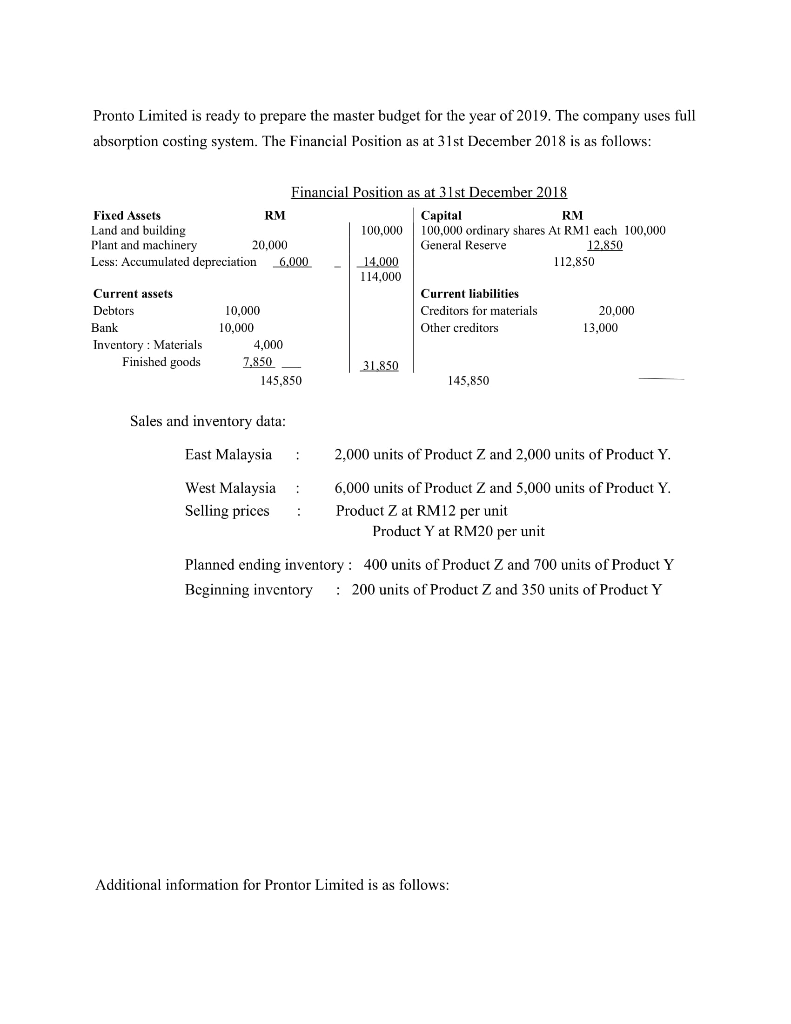

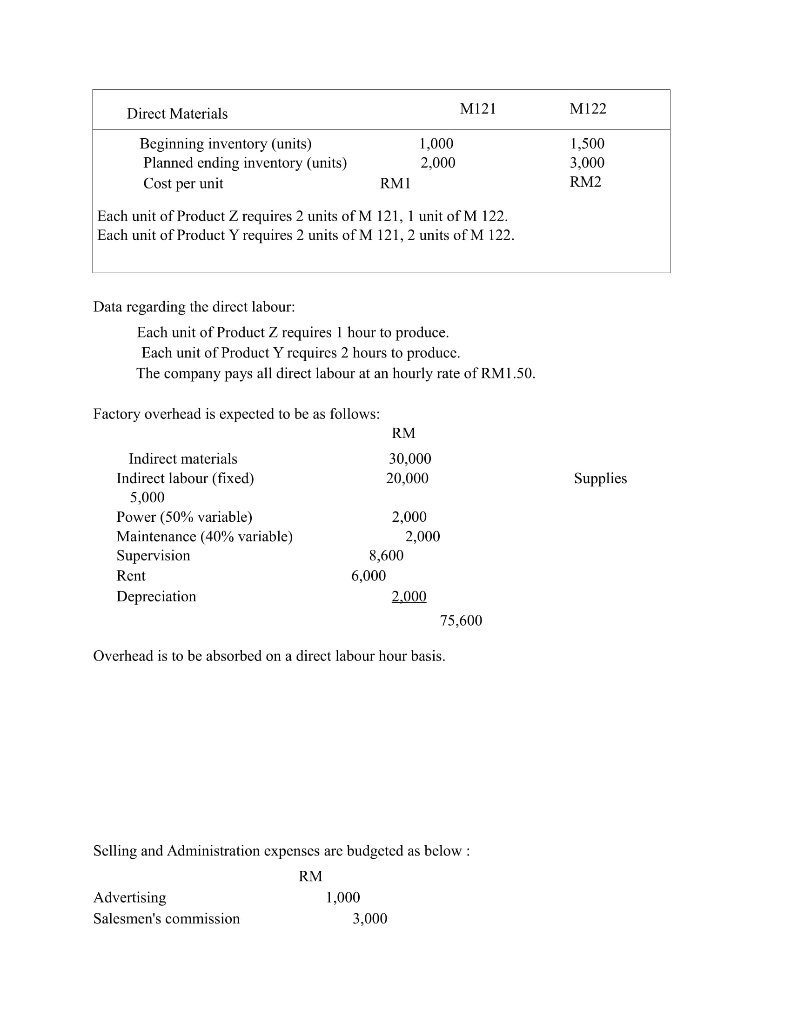

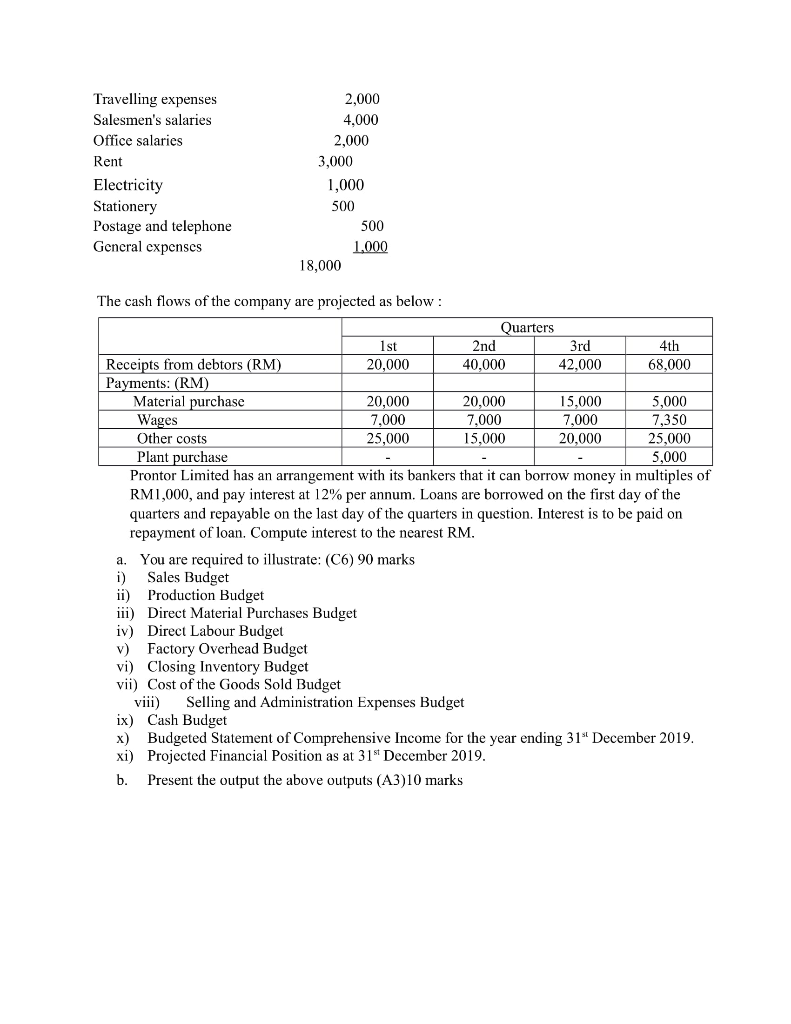

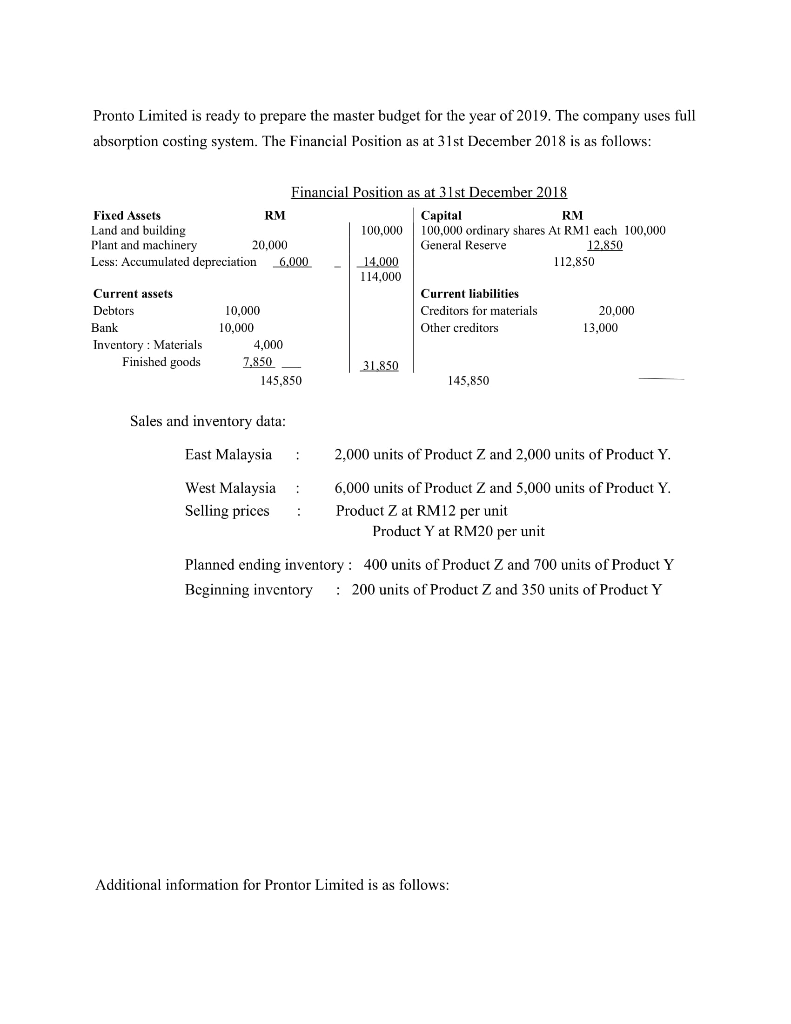

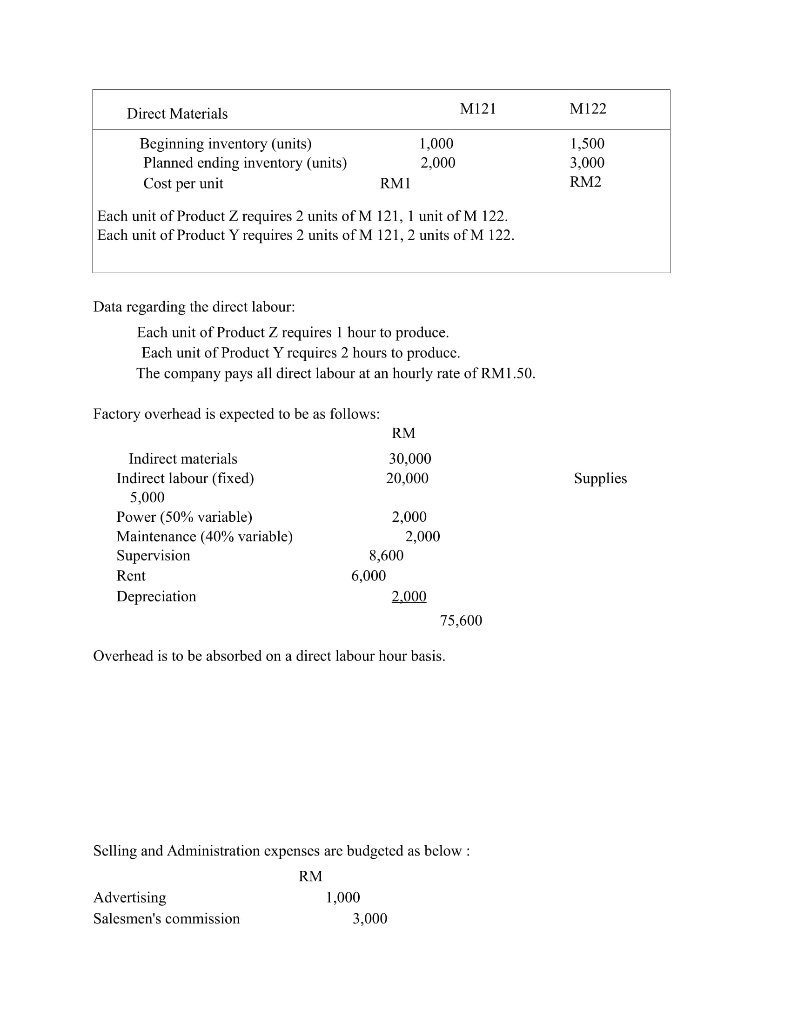

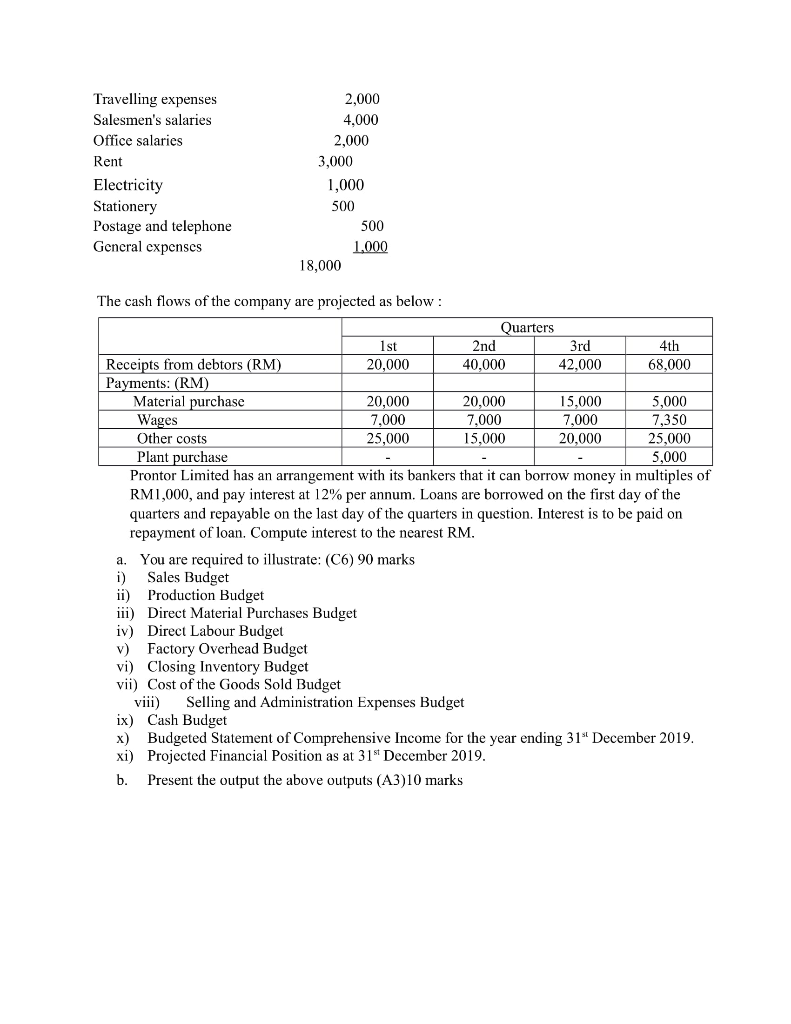

Pronto Limited is ready to prepare the master budget for the year of 2019. The company uses full absorption costing system. The Financial Position as at 31st December 2018 is as follows Fixed Assets Land and building Plant and machinery Less: Accumulated depreciation RM Capital RM 100,000100,000 ordinary shares At RM1 each 100,000 20,000 General Reserve 12.850 6,000 14,000 114,000 112,850 Current assets Dcbtors Bank Inventory: Mate Current liabilities Creditors for materials Other creditors 0,000 10,000 20.000 13,000 rials Finished goods 4,000 7.850 31850 145,850 145,850 Sales and inventory data East Malaysia:2,000units of Product Z and 2,000 units of Product Y. West Malaysia:6,000 units of Product Z and 5,000 units of Product Y. Selling pricesProduct Z at RM12 per unit Product Y at RM20 per unit Planned ending inventory: Bcginning inventory 400 units of Product Z and 700 units of Product Y : 200 units of Product Z and 350 units of Product Y Additional information for Prontor Limited is as follows Direct Materials M121 M122 Beginning inventory (units) Planned ending inventory (units) Cost per unit 1,000 2,000 1,500 3,000 RM2 RM1 Each unit of Product Z requires 2 units of M 121, 1 unit of M 122 Each unit of Product Y requires 2 units of M 121, 2 units of M 122 Data regarding the direct labour Each unit of Product Z requires 1 hour to produce Each unit of Product Y requires 2 hours to producc The company pays all direct labour at an hourly rate of RM1.50 Factory overhead is expected to be as follows Indirect materials Indirect labour (fixed) RM 30,000 20,000 Supplies 5,000 Power (50% variable) Maintenance (40% variable) Supervision Rent Depreciation 2,000 2,000 8,600 6,000 2.000 75,600 Overhead is to be absorbed on a direct labour hour basis Selling and Administration expenses are budgeted as bclow RM Advertising Salesmen's commission 1,000 3,000 2,000 4.000 Travelling expenses Salesmen's salaries Office salaries Rent Electricity Stationery Postage and telephone Gcneral expcnscs 2,000 3,000 1,000 500 500 1000 18,000 The cash flows of the company are projected as below arters 3rd 42,000 4th 68,000 20,000 40,000 Receipts from debtors (RM Payments: (RM) 20,000 7,000 15,000 15,000 7,000 20,000 Material purchase 20,000 7,000 25,000 5,000 Wages 7,350 Other costs 25,000 Plant purchase 5,000 Prontor Limited has an arrangement with its bankers that it can borrow money in multiples of RM 1 ,000, and pay interest at 12% per annum. Loans are borrowed on the first day of the quarters and repayable on the last day of the quarters in question. Interest is to be paid on repayment of loan. Compute interest to the nearest RM a. You are required to illustrate: (C6) 90 marks i) Sales Budget ii) Production Budget iii) Direct Material Purchases Budget iv) Direct Labour Budget v) Factory Overhead Budget vi) Closing Inventory Budget vii) Cost of the Goods Sold Budget viii) Selling and Administration Expenses Budget ix) Cash Budget x) Budgeted Statement of Comprehensive Income for the year ending 31st December 2019 xi) Projected Financial Position as at 31st December 2019 b. Present the output the above outputs (A3)10 marks Pronto Limited is ready to prepare the master budget for the year of 2019. The company uses full absorption costing system. The Financial Position as at 31st December 2018 is as follows Fixed Assets Land and building Plant and machinery Less: Accumulated depreciation RM Capital RM 100,000100,000 ordinary shares At RM1 each 100,000 20,000 General Reserve 12.850 6,000 14,000 114,000 112,850 Current assets Dcbtors Bank Inventory: Mate Current liabilities Creditors for materials Other creditors 0,000 10,000 20.000 13,000 rials Finished goods 4,000 7.850 31850 145,850 145,850 Sales and inventory data East Malaysia:2,000units of Product Z and 2,000 units of Product Y. West Malaysia:6,000 units of Product Z and 5,000 units of Product Y. Selling pricesProduct Z at RM12 per unit Product Y at RM20 per unit Planned ending inventory: Bcginning inventory 400 units of Product Z and 700 units of Product Y : 200 units of Product Z and 350 units of Product Y Additional information for Prontor Limited is as follows Direct Materials M121 M122 Beginning inventory (units) Planned ending inventory (units) Cost per unit 1,000 2,000 1,500 3,000 RM2 RM1 Each unit of Product Z requires 2 units of M 121, 1 unit of M 122 Each unit of Product Y requires 2 units of M 121, 2 units of M 122 Data regarding the direct labour Each unit of Product Z requires 1 hour to produce Each unit of Product Y requires 2 hours to producc The company pays all direct labour at an hourly rate of RM1.50 Factory overhead is expected to be as follows Indirect materials Indirect labour (fixed) RM 30,000 20,000 Supplies 5,000 Power (50% variable) Maintenance (40% variable) Supervision Rent Depreciation 2,000 2,000 8,600 6,000 2.000 75,600 Overhead is to be absorbed on a direct labour hour basis Selling and Administration expenses are budgeted as bclow RM Advertising Salesmen's commission 1,000 3,000 2,000 4.000 Travelling expenses Salesmen's salaries Office salaries Rent Electricity Stationery Postage and telephone Gcneral expcnscs 2,000 3,000 1,000 500 500 1000 18,000 The cash flows of the company are projected as below arters 3rd 42,000 4th 68,000 20,000 40,000 Receipts from debtors (RM Payments: (RM) 20,000 7,000 15,000 15,000 7,000 20,000 Material purchase 20,000 7,000 25,000 5,000 Wages 7,350 Other costs 25,000 Plant purchase 5,000 Prontor Limited has an arrangement with its bankers that it can borrow money in multiples of RM 1 ,000, and pay interest at 12% per annum. Loans are borrowed on the first day of the quarters and repayable on the last day of the quarters in question. Interest is to be paid on repayment of loan. Compute interest to the nearest RM a. You are required to illustrate: (C6) 90 marks i) Sales Budget ii) Production Budget iii) Direct Material Purchases Budget iv) Direct Labour Budget v) Factory Overhead Budget vi) Closing Inventory Budget vii) Cost of the Goods Sold Budget viii) Selling and Administration Expenses Budget ix) Cash Budget x) Budgeted Statement of Comprehensive Income for the year ending 31st December 2019 xi) Projected Financial Position as at 31st December 2019 b. Present the output the above outputs (A3)10 marks