Answered step by step

Verified Expert Solution

Question

1 Approved Answer

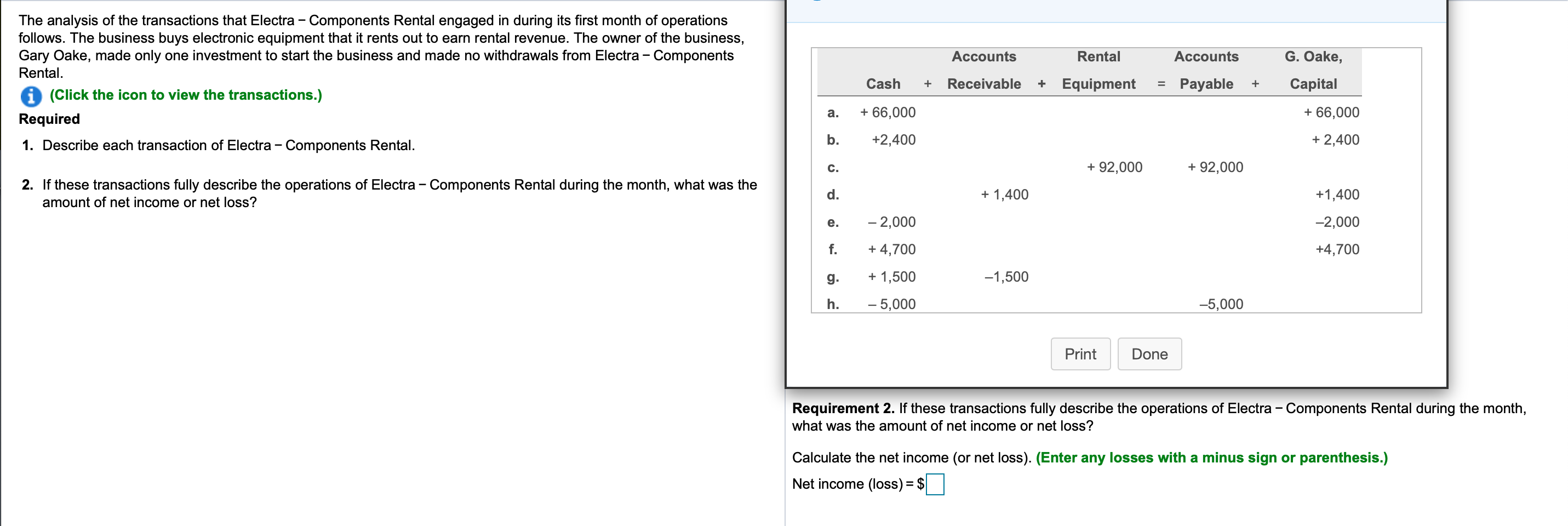

Requirement 2 Accounts Rental Accounts G. Oake, The analysis of the transactions that Electra - Components Rental engaged in during its first month of operations

Requirement 2

Accounts Rental Accounts G. Oake, The analysis of the transactions that Electra - Components Rental engaged in during its first month of operations follows. The business buys electronic equipment that it rents out to earn rental revenue. The owner of the business, Gary Oake, made only one investment to start the business and made no withdrawals from Electra - a - Components Rental. (Click the icon to view the transactions.) Required 1. Describe each transaction of Electra - Components Rental. Cash + Receivable + Equipment Payable + Capital a. + 66,000 + 66,000 b. +2,400 + 2,400 C. + 92,000 + 92,000 2. If these transactions fully describe the operations of Electra - Components Rental during the month, what was the amount of net income or net loss? d. + 1,400 +1,400 e. -2,000 -2,000 f. +4,700 +4,700 g. + 1,500 -1,500 h. - 5,000 -5,000 Print Done Requirement 2. If these transactions fully describe the operations of Electra - Components Rental during the month, what was the amount of net income or net loss? Calculate the net income (or net loss). (Enter any losses with a minus sign or parenthesis.) Net income (loss) = $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started