Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirement 2 Assume that you are the project developer and carry out the following For the purposes of this exercise, assume that the development will

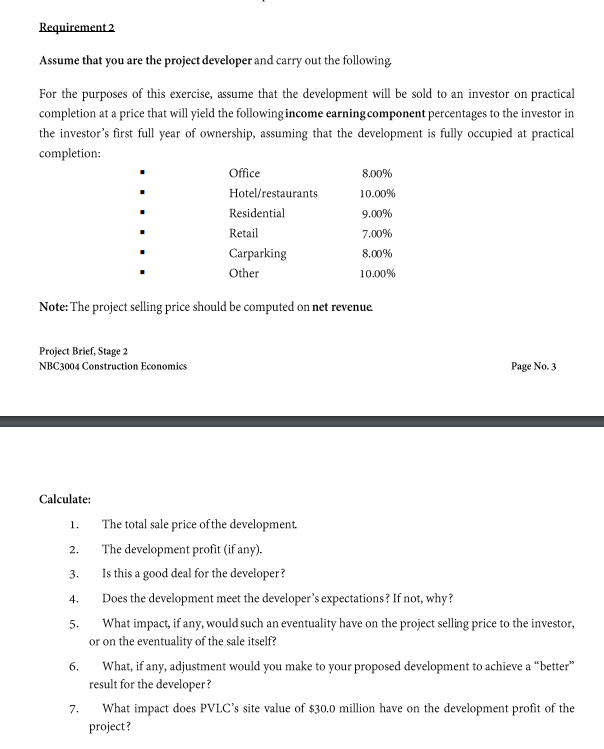

Requirement 2 Assume that you are the project developer and carry out the following For the purposes of this exercise, assume that the development will be sold to an investor on practical completion at a price that will yield the following income earning component percentages to the investor in the investor's first full year of ownership, assuming that the development is fully occupied at practical completion: Note: The project selling price should be computed on net revenue. Project Brief, Stage 2 NBC3004 Construction Economics Page No. 3 Calculate: 1. The total sale price of the development. 2. The development profit (if any). 3. Is this a good deal for the developer? 4. Does the development meet the developer's expectations? If not, why? 5. What impact, if any, would such an eventuality have on the project selling price to the investor, or on the eventuality of the sale itself? 6. What, if any, adjustment would you make to your proposed development to achieve a "better" result for the developer? 7. What impact does PVLC's site value of $30.0 million have on the development profit of the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started