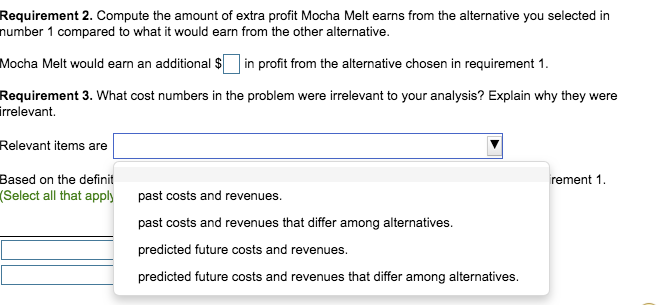

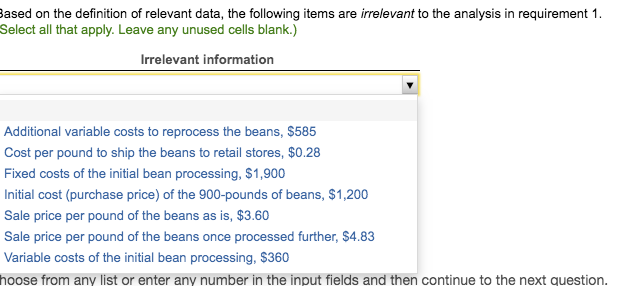

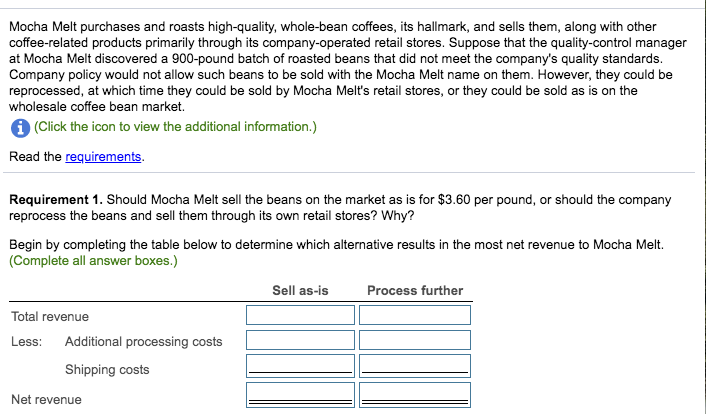

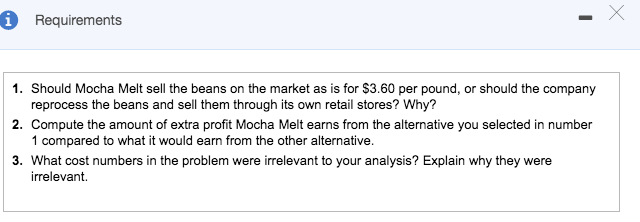

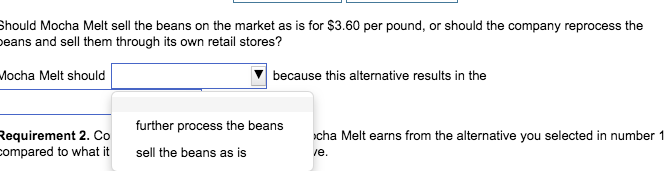

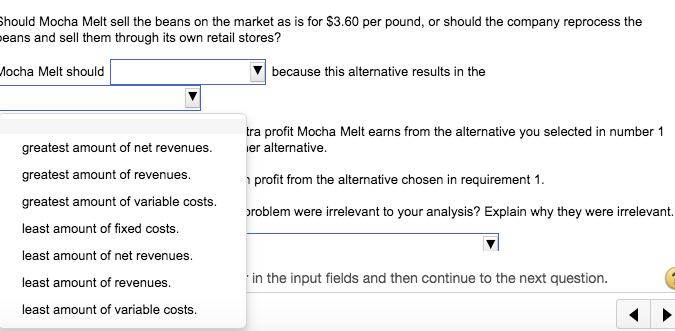

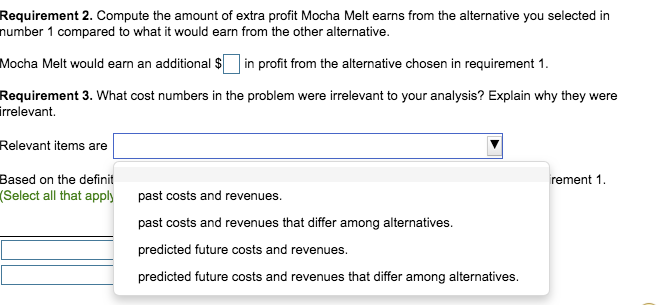

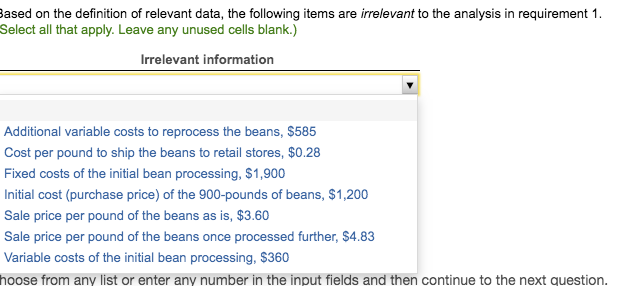

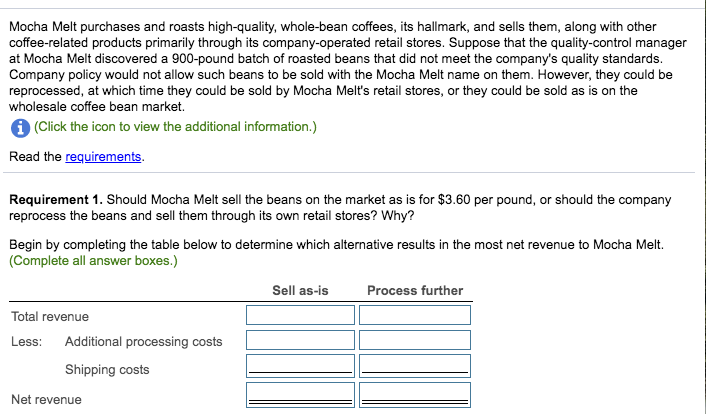

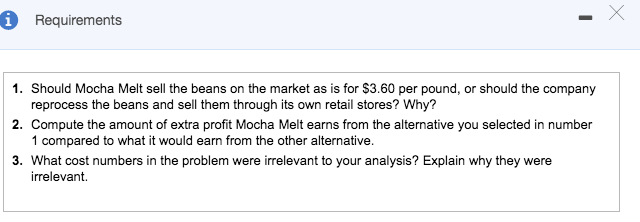

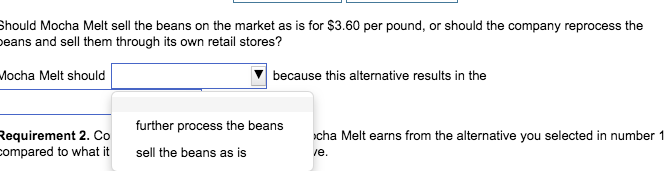

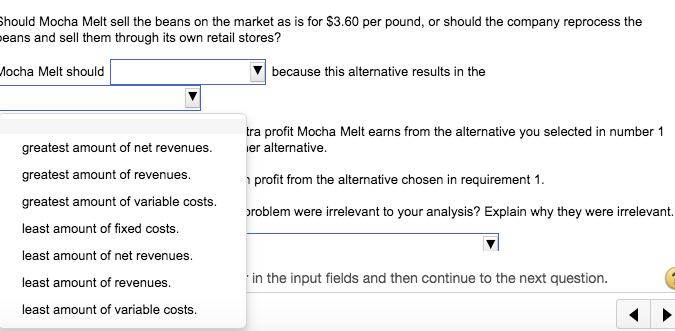

Requirement 2. Compute the amount of extra profit Mocha Melt earns from the alternative you selected in number 1 compared to what it would earn from the other alternative. Mocha Melt would earn an additional $ in profit from the alternative chosen in requirement 1. Requirement 3. What cost numbers in the problem were irrelevant to your analysis? Explain why they were irrelevant Relevant items are irement 1. Based on the definit (Select all that apply past costs and revenues. past costs and revenues that differ among alternatives. predicted future costs and revenues. predicted future costs and revenues that differ among alternatives. Based on the definition of relevant data, the following items are irrelevant to the analysis in requirement 1. Select all that apply. Leave any unused cells blank.) Irrelevant information Additional variable costs to reprocess the beans, $585 Cost per pound to ship the beans to retail stores, $0.28 Fixed costs of the initial bean processing, $1,900 Initial cost (purchase price) of the 900-pounds of beans, $1,200 Sale price per pound of the beans as is, $3.60 Sale price per pound of the beans once processed further, $4.83 Variable costs of the initial bean processing, $360 hoose from any list or enter any number in the input fields and then continue to the next question. Mocha Melt purchases and roasts high-quality, whole-bean coffees, its hallmark, and sells them, along with other coffee-related products primarily through its company-operated retail stores. Suppose that the quality control manager at Mocha Melt discovered a 900-pound batch of roasted beans that did not meet the company's quality standards. Company policy would not allow such beans to be sold with the Mocha Melt name on them. However, they could be reprocessed, at which time they could be sold by Mocha Melt's retail stores, or they could be sold as is on the wholesale coffee bean market. (Click the icon to view the additional information.) Read the requirements. Requirement 1. Should Mocha Melt sell the beans on the market as is for $3.60 per pound, or should the company reprocess the beans and sell them through its own retail stores? Why? Begin by completing the table below to determine which alternative results in the most net revenue to Mocha Melt. (Complete all answer boxes.) Sell as is Process further Total revenue Less: Additional processing costs Shipping costs Net revenue A Requirements 1. Should Mocha Melt sell the beans on the market as is for $3.60 per pound, or should the company reprocess the beans and sell them through its own retail stores? Why? 2. Compute the amount of extra profit Mocha Melt earns from the alternative you selected in number 1 compared to what it would earn from the other alternative. 3. What cost numbers in the problem were irrelevant to your analysis? Explain why they were irrelevant Should Mocha Melt sell the beans on the market as is for $3.60 per pound, or should the company reprocess the Deans and sell them through its own retail stores? Mocha Melt should because this alternative results in the further process the beans Requirement 2. Co compared to what it cha Melt earns from the alternative you selected in number 1 Ie. sell the beans as is Should Mocha Melt sell the beans on the market as is for $3.60 per pound, or should the company reprocess the Deans and sell them through its own retail stores? Mocha Melt should because this alternative results in the tra profit Mocha Melt earns from the alternative you selected in number 1 ier alternative. greatest amount of net revenues. greatest amount of revenues. profit from the alternative chosen in requirement 1. greatest amount of variable costs. problem were irrelevant to your analysis? Explain why they were irrelevant. least amount of fixed costs. least amount of net revenues. in the input fields and then continue to the next question. least amount of revenues. least amount of variable costs