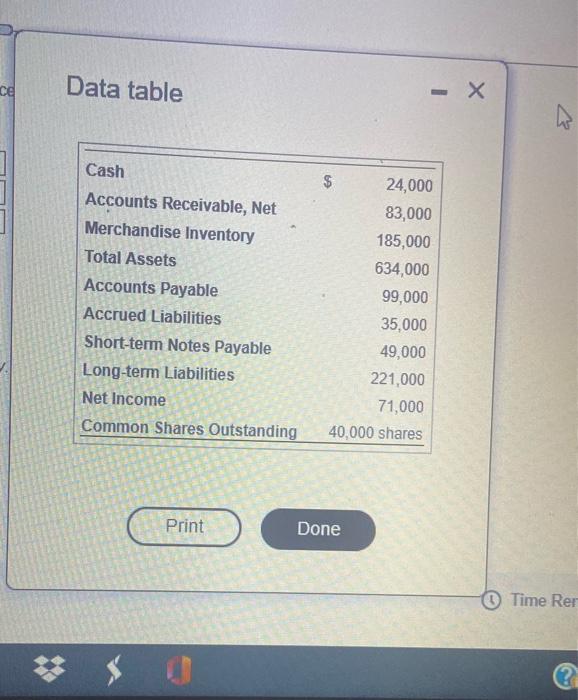

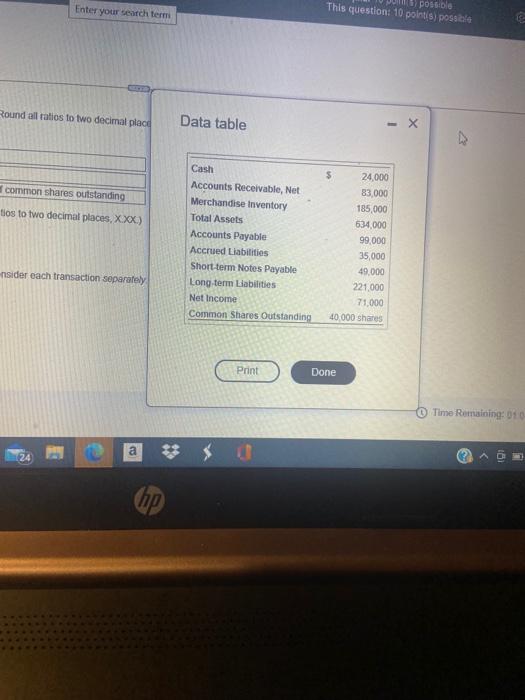

Requirement 2. Compute the three ratios after evaluating the effects of each transaction. Consider each transaction separately. (Click on the icon to view the transactions.) Current Ratio Debt Ratio Earnings per Share b. Requirement 2. Compute the three ratios after evaluating the effects of each transaction. Consider each transaction separately. (Click on the icon to view the transactions.) Current Ratio Debt Ratio Earnings per Share b. ce Data table Cash Accounts Receivable, Net Merchandise Inventory Total Assets Accounts Payable Accrued Liabilities Short-term Notes Payable Long-term Liabilities Net Income Common Shares Outstanding 24,000 83,000 185,000 634,000 99,000 35,000 49,000 221,000 71,000 40,000 shares Print Done Time Rer Requirement 2. Compute the three ratios after evaluating the effects of each transaction. Consider each transaction separately. (Click on the icon to view the transactions) Current Ratio Debt Ratio Earnings per Share 2 = b. Enter your search term This question: 10 points) possile possible Round all ratios to two decimal place Data table X common shares outstanding tios to two decimal places, XXX.) Cash Accounts Receivable, Net Merchandise Inventory Total Assets Accounts Payable Accrued Liabilities Short-term Notes Payable Long term Liabilities Net Income Common Shares Outstanding $ 24,000 83.000 185,000 634.000 99,000 35,000 49,000 221.000 71.000 40 000 shares nsider each transaction separately Print Done Time Remaining: 010 a 24 2 19 hp Requirement 2. Compute the three ratios after evaluating the effects of each transaction. Consider each transaction separately. (Click on the icon to view the transactions.) Current Ratio Debt Ratio Earnings per Share b. Requirement 2. Compute the three ratios after evaluating the effects of each transaction. Consider each transaction separately. (Click on the icon to view the transactions.) Current Ratio Debt Ratio Earnings per Share b. ce Data table Cash Accounts Receivable, Net Merchandise Inventory Total Assets Accounts Payable Accrued Liabilities Short-term Notes Payable Long-term Liabilities Net Income Common Shares Outstanding 24,000 83,000 185,000 634,000 99,000 35,000 49,000 221,000 71,000 40,000 shares Print Done Time Rer Requirement 2. Compute the three ratios after evaluating the effects of each transaction. Consider each transaction separately. (Click on the icon to view the transactions) Current Ratio Debt Ratio Earnings per Share 2 = b. Enter your search term This question: 10 points) possile possible Round all ratios to two decimal place Data table X common shares outstanding tios to two decimal places, XXX.) Cash Accounts Receivable, Net Merchandise Inventory Total Assets Accounts Payable Accrued Liabilities Short-term Notes Payable Long term Liabilities Net Income Common Shares Outstanding $ 24,000 83.000 185,000 634.000 99,000 35,000 49,000 221.000 71.000 40 000 shares nsider each transaction separately Print Done Time Remaining: 010 a 24 2 19 hp