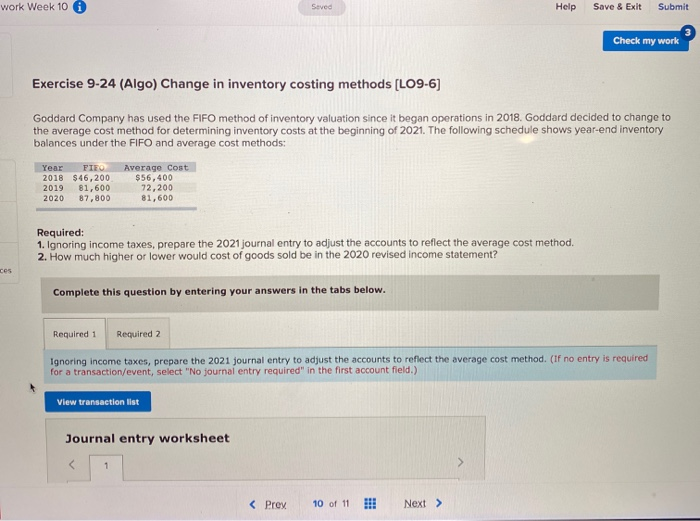

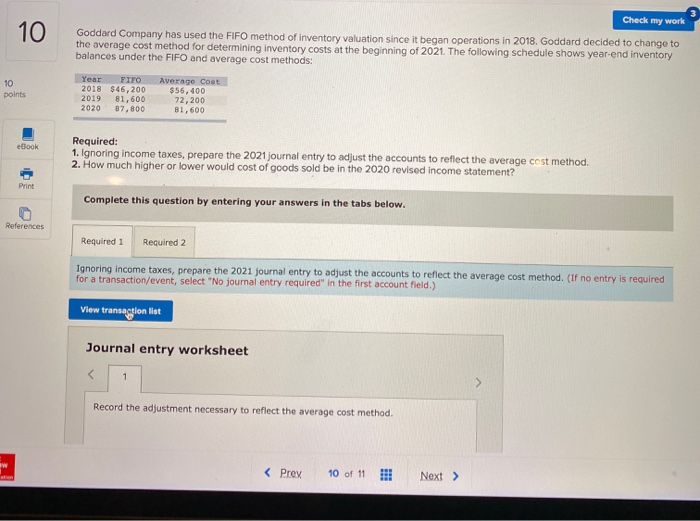

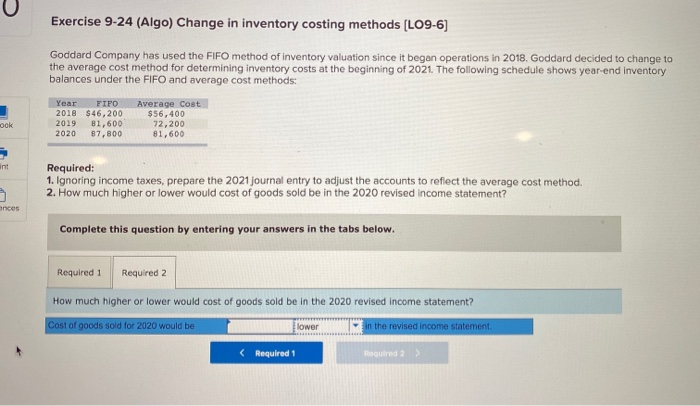

work Week 100 Seved Help Save & Exit Submit Check my work Exercise 9-24 (Algo) Change in inventory costing methods (LO9-6) Goddard Company has used the FIFO method of inventory valuation since it began operations in 2018. Goddard decided to change to the average cost method for determining inventory costs at the beginning of 2021. The following schedule shows year-end inventory balances under the FIFO and average cost methods: Year 2018 2019 2020 FIEO $46,200 81,600 87,800 Average Cost $56,400 72,200 81,600 Required: 1. Ignoring income taxes, prepare the 2021 journal entry to adjust the accounts to reflect the average cost method. 2. How much higher or lower would cost of goods sold be in the 2020 revised income statement? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Ignoring income taxes, prepare the 2021 journal entry to adjust the accounts to reflect the average cost method. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Check my work Goddard Company has used the FIFO method of inventory valuation since it began operations in 2018. Goddard decided to change to the average cost method for determining inventory costs at the beginning of 2021. The following schedule shows year-end inventory balances under the FIFO and average cost methods: points Year 2018 2019 2020 FIFO $46,200 81,600 87,800 Average cost $56, 400 72,200 81,600 Book Required: 1. Ignoring income taxes, prepare the 2021 journal entry to adjust the accounts to reflect the average cost method. 2. How much higher or lower would cost of goods sold be in the 2020 revised income statement? Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Ignoring income taxes, prepare the 2021 journal entry to adjust the accounts to reflect the average cost method. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record the adjustment necessary to reflect the average cost method. Exercise 9-24 (Algo) Change in inventory costing methods (LO9-6] Goddard Company has used the FIFO method of inventory valuation since it began operations in 2018. Goddard decided to change to the average cost method for determining inventory costs at the beginning of 2021. The following schedule shows year-end Inventory balances under the FIFO and average cost methods: Year FIFO 2018 $46,200 2019 1,600 2020 87.800 Average Cost $56,400 72,200 81,600 ok Required: 1. Ignoring income taxes, prepare the 2021 journal entry to adjust the accounts to reflect the average cost method. 2. How much higher or lower would cost of goods sold be in the 2020 revised Income statement? ances Complete this question by entering your answers in the tabs below. Required 1 Required 2 How much higher or lower would cost of goods sold be in the 2020 revised income statement? Cost of goods sold for 2020 would be lower in the revised income statement