Question

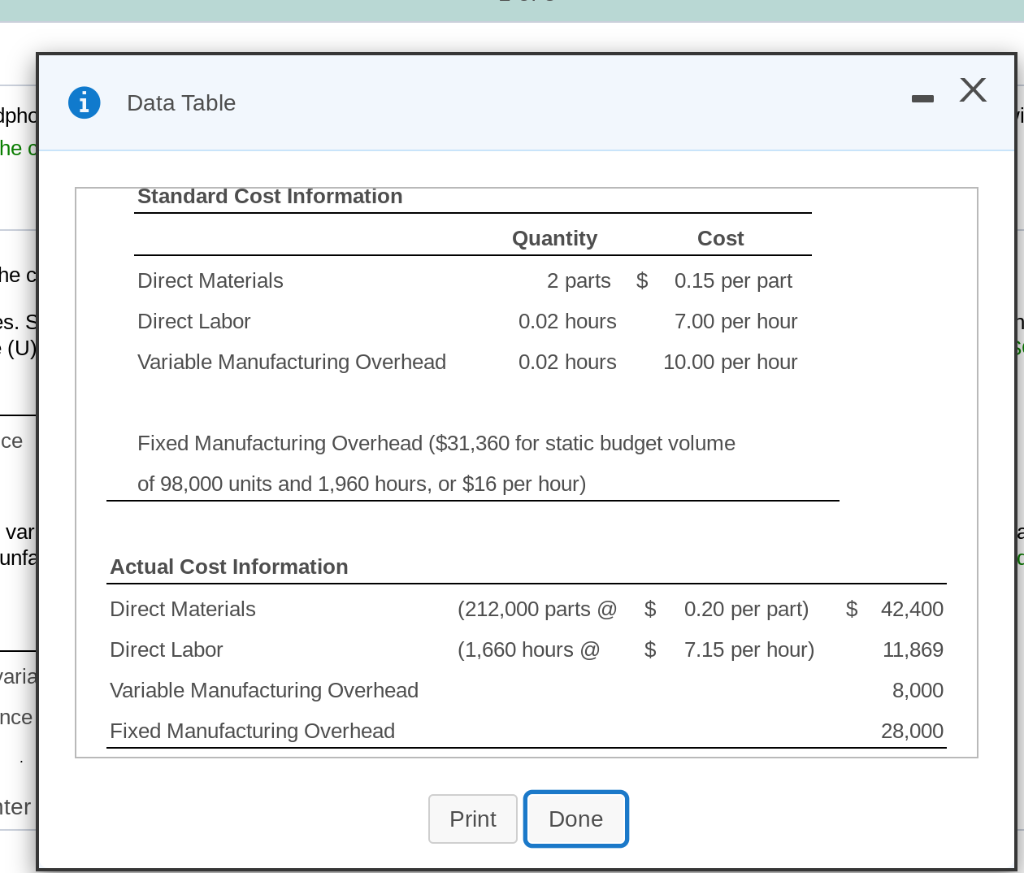

Requirement 2. For manufacturing overhead, compute the variable overhead cost and efficiency variances and the fixed overhead cost and volume variances. Now compute the variable

Requirement 2. For manufacturing overhead, compute the variable overhead cost and efficiency variances and the fixed overhead cost and volume variances.

Now compute the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity; VOH = variable overhead.)

|

|

| Formula |

| Variance | |

| VOH cost variance | = |

| = |

|

|

| VOH efficiency variance | = |

| = |

|

|

Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity.)

|

|

| Formula |

| Variance | |

| FOH cost variance | = |

| = |

|

|

| FOH volume variance | = |

| = |

|

|

Requirement 3.

HeadsetHeadset's

management used better quality materials during September. Discuss the trade-off between the two direct material variances.

HeadsetHeadset's

management knew that using higher quality materials would result in a(n)

favorable direct material cost variance

favorable direct material efficiency variance

unfavorable direct material cost variance

unfavorable direct material efficiency variance

. They hoped these materials would result in more efficient usage than "standard" materials. The result was an overall

favorable direct material cost variance

favorable direct material flexible budget variance

unfavorable direct labor flexible budget variance

unfavorable direct material flexible budget variance

.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started