Answered step by step

Verified Expert Solution

Question

1 Approved Answer

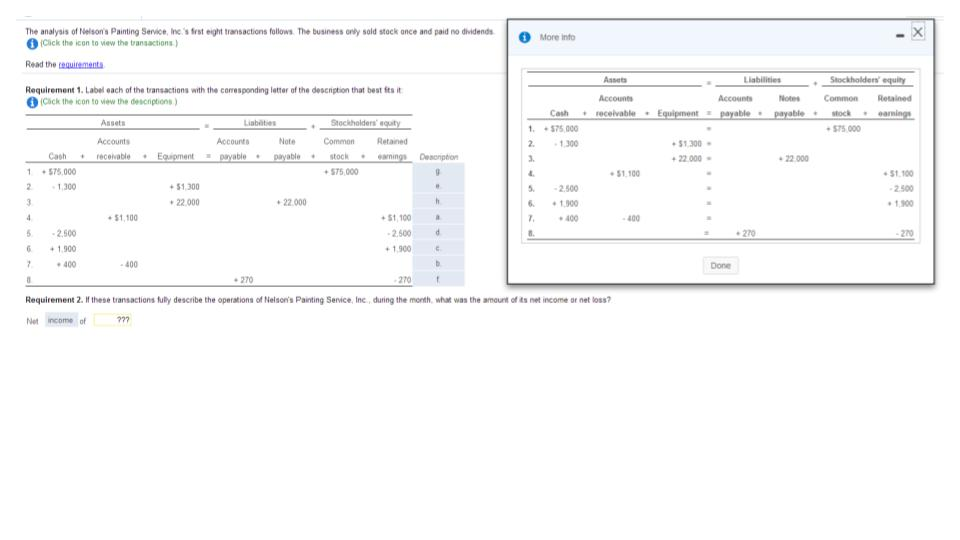

Requirement 2. If these transactions fully describe the operations of Nelson's Painting ServiceNelson's Painting Service, Inc., during the month, what was the amount of its

Requirement 2. If these transactions fully describe the operations of

Nelson's Painting ServiceNelson's Painting Service,

Inc., during the month, what was the amount of its net income or net loss?

The analysis of Nelson's Painting Service, Inc's frst eight transactions follows The business only sold stock ance and paid no dividends More into (Cick the icon to iew the transactions) Read the cequirements Requirement 1.Label each of the transactions with the coresponding latter of the description that best fts it Stockholderns Assets Liabilities (Cck the icon to wew the descriptions Account Common Retained Cash receivableE Equipment sock Assets Liabates Stockholders eouity 1 $75 000 $75.000 AccountsNote CommonRetained 2 1.300 $1.300 22 000 Accounts 22 000 1 +575.000 1.300 $75,000 51.100 $1.300 22.000 5 2.500 6 1,900 61.900 7400 $1.100 2.500 1.900 22.000 $1,100 2.500 1.900 $1,100 400 2.500 1.900 400 270 270 400 Done 270 270 Requirement 2If these transactions tupy descnbe the operations of Nelson's Parting Service. Inc. dunng the month what was the armaurt of 4s net income or net loss? Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started