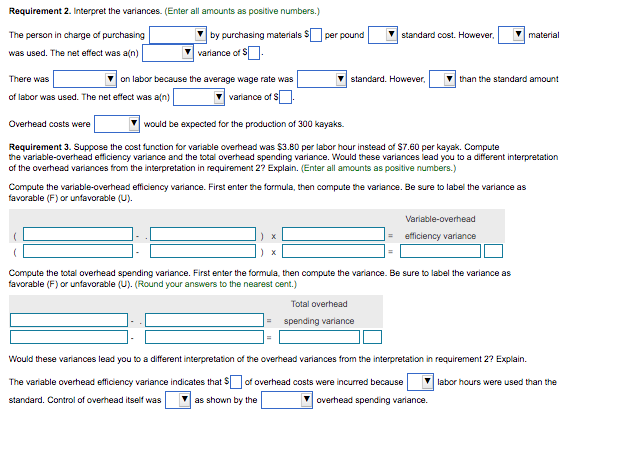

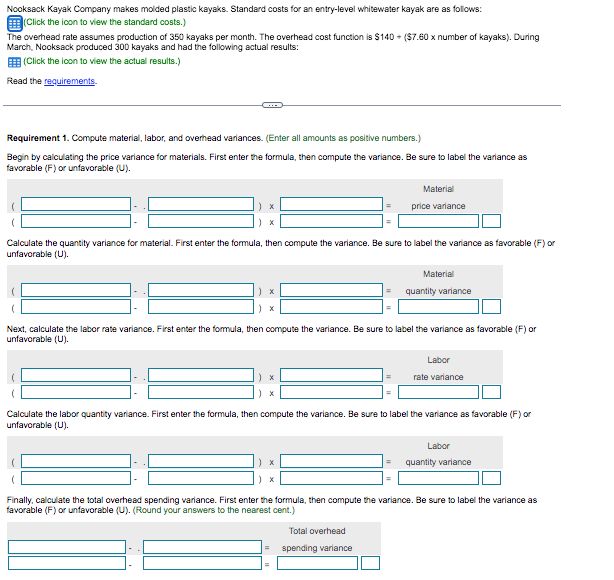

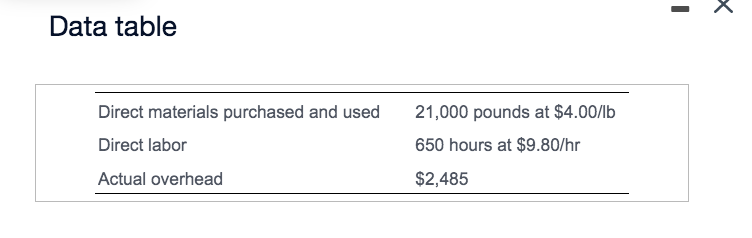

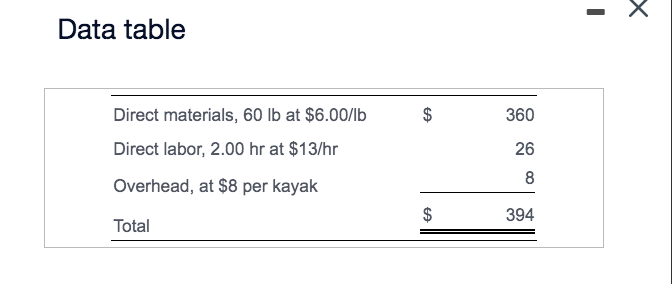

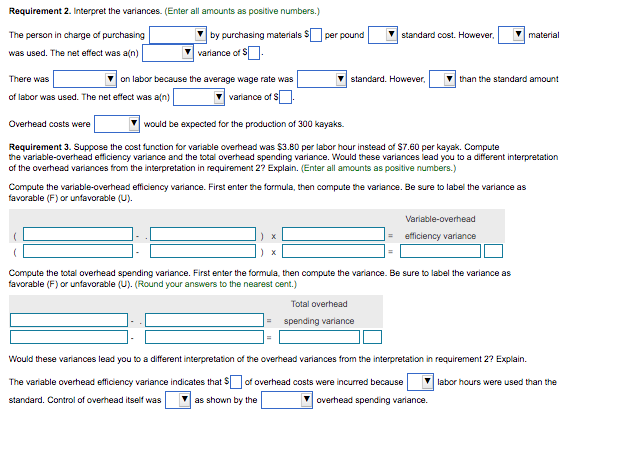

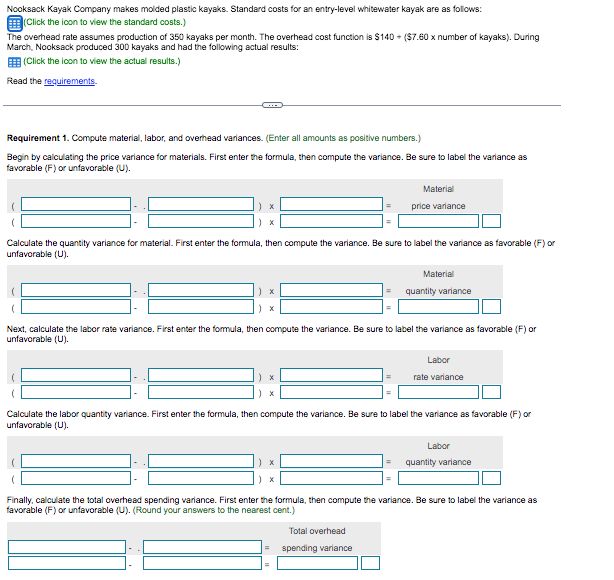

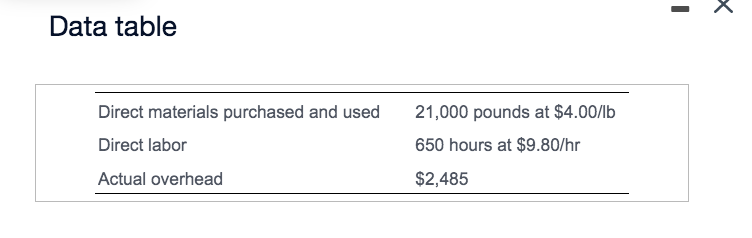

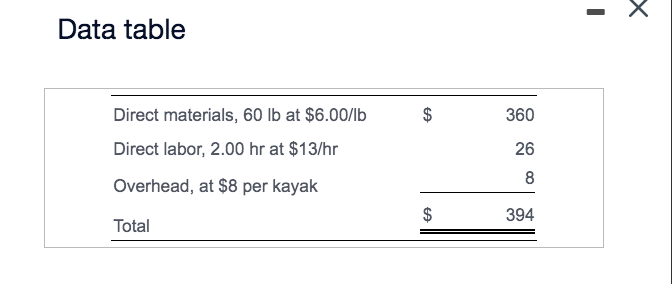

Requirement 2. Interpret the wariances. (Enter all amounts as positive numbers.) The person in charge of purchasing by purchasing materials $ per pound standard cost. However, material was used. The net effect was a(n) wariance of S. There was on labor because the average wage rate was standard. However, than the standard amount of labor was used. The net effect was a(n) variance of $ Overhead costs were would be expected for the production of 300 kayaks. Requirement 3. Suppose the cost function for variable overhead was $3.80 per labor hour instead of $7.60 per kayak. Compute the variable-overhead efficiency variance and the total overhead spending variance. Would these variances lead you to a different interpretation of the overhead variances from the interpretation in requirement 2? Explain. (Enter all amounts as positive numbers.) Compute the variable-overhead efficlency variance. First enter the formula, then compute the variance. Be sure to label the variance as favorable (F) or unfavorable (U). Compute the total overhead spending variance. First enter the formula, then compute the variance. Be sure to label the variance as favorable (F) or unfavorable (U). (Round your answers to the nearest cent.) Would these variances lead you to a different interpretation of the overhead variances from the interpretation in requirement 2 ? Explain. The variable overhead efficlency variance indicates that $ of overhead costs were incurred because labor hours were used than the standard. Control of overhead itself was as shown by the overhead spending variance. Nooksack Kayak Company makes molded plastic kayaks. Standard costs for an entry-level whitewater kayak are as follows: 'Click the ioon to view the standard costs.) The overhead rate assumes production of 350 kayaks per month. The overhead cost function is $140+($7.60 number of kayaks). During March, Nooksack produced 300 kayaks and had the following actual results: (Click the icon to view the actual results.) Read the Requirement 1. Compute material, labor, and overhead variances. (Enter all amounts as positive numbers.) Begin by calculating the price wariance for materials. First enter the formula, then compute the variance. Be sure to label the wariance as favorable (F) or unfavorable (U). Calculate the quantity variance for material. First enter the formula, then compute the variance. Be sure to label the variance as favorable (F) or unfavorable (U). Next, calculate the labor rate variance. First enter the formula, then compute the variance. Be sure to label the variance as favorable (F) or unfavorable (U). Calculate the labor quantity vaniance. First enter the formula, then compute the variance. Be sure to label the vaniance as favorable (F) or unfavorable (U). Finally, calculate the total overhead spending variance. First enter the formula, then compute the variance. Be sure to label the wariance as favorable (F) or unfavorable (U). (Round your answers to the nearest cent.) Data table Data table