Answered step by step

Verified Expert Solution

Question

1 Approved Answer

requirement #2 On April 30, Candy Party Planners had a $42,000 balance in Accounts Receivable and a $3,894 credit balance in Allowance for Uncollectible Accounts.

requirement #2

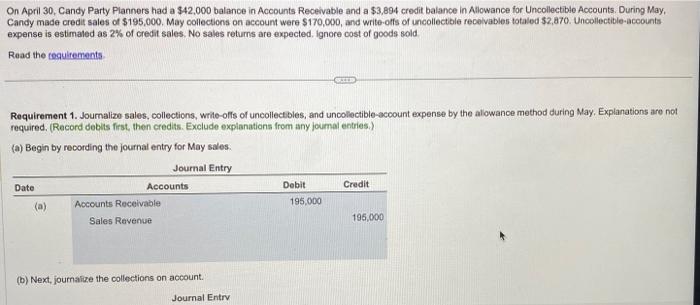

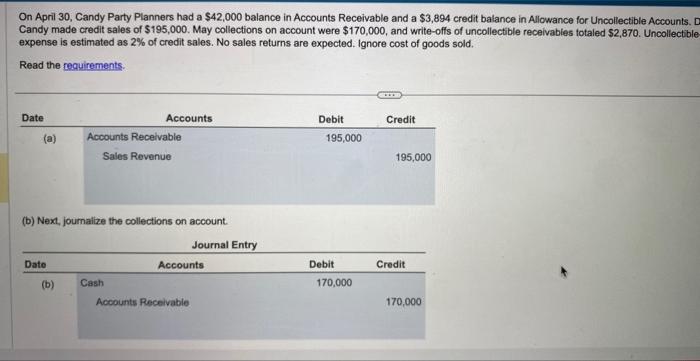

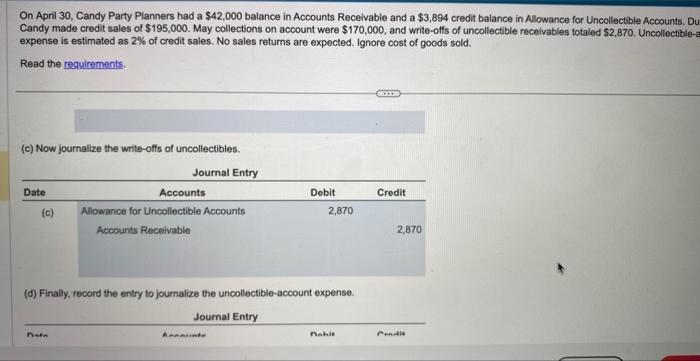

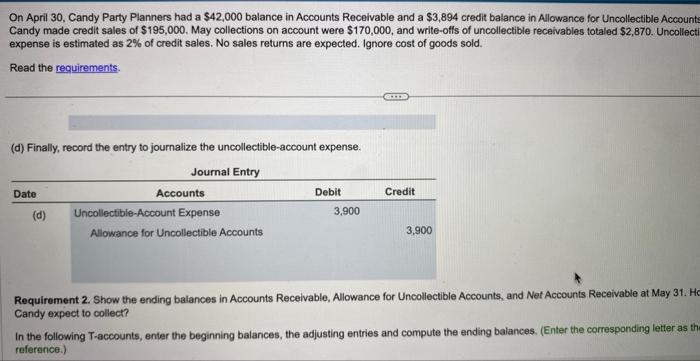

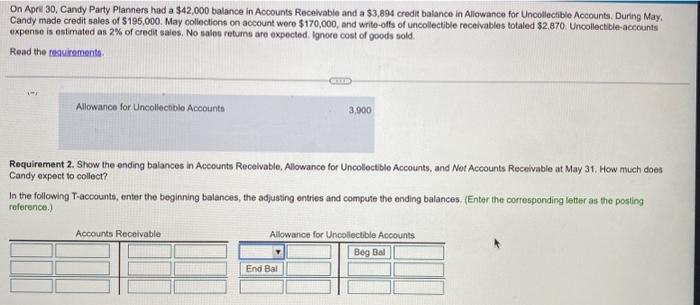

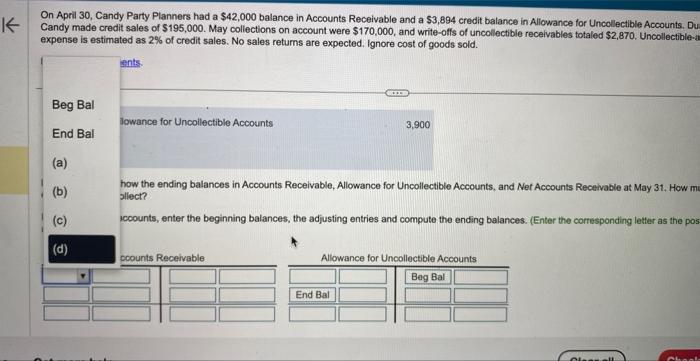

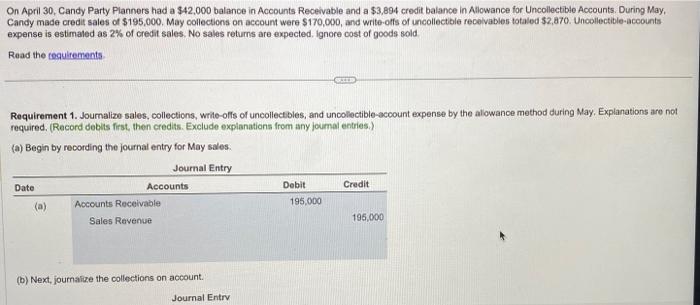

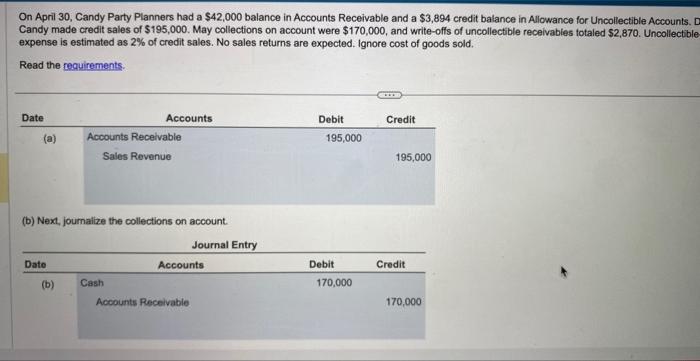

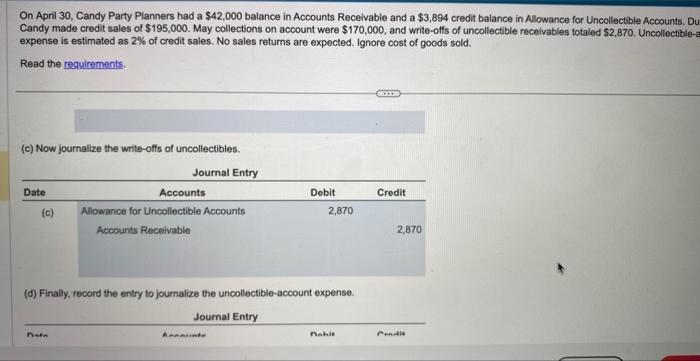

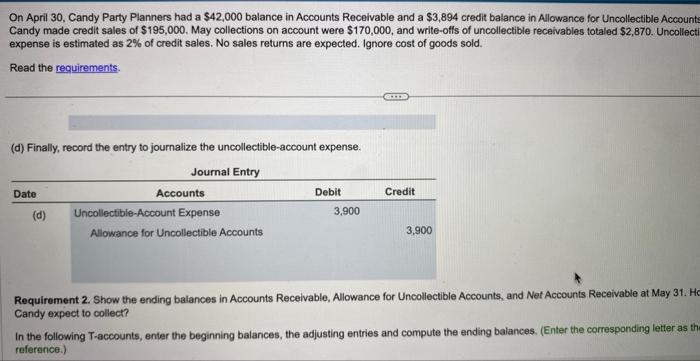

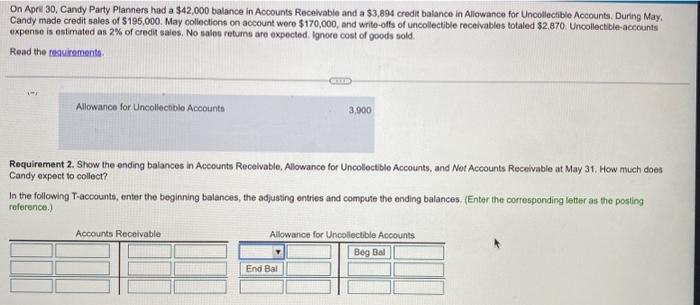

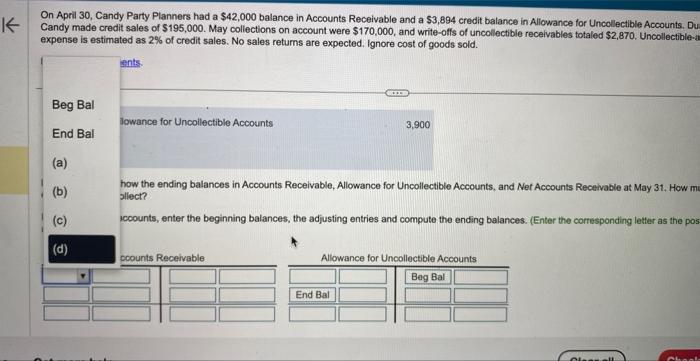

On April 30, Candy Party Planners had a $42,000 balance in Accounts Receivable and a $3,894 credit balance in Allowance for Uncollectible Accounts. During May, Candy made credit sales of $195,000. May collections on account were $170,000, and write-offs of uncollectible recelvables totaled $2,870. Uncollectible-accounts expense is estimaled as 2% of credit sales. No sales retums are expected. ignore cost of goods sold. Read the fegultements. Requirement 1. Joumalize sales, collections, write-offs of uncollectibles, and uncollectible-account expense by the aliowance method during May. Explanations are not required. (Record debits first, then credits. Exclude explanations from any joumal entries.) (a) Begin by recording the journal entry for May sales: (b) Next, joumalize the collections on account. On April 30, Candy Party Planners had a $42,000 balance in Accounts Receivable and a $3,894 credit balance in Allowance for Uncollectible Accounts. Candy made credit sales of $195,000. May collections on account were $170,000, and write-offs of uncollectible recelvables totaled $2,870. Uncollectible expense is estimated as 2% of credit sales. No sales returns are expected. Ignore cost of goods sold. Read the requirements. (b) Next, journalize the collections on account. On April 30, Candy Party Planners had a $42,000 balance in Accounts Receivable and a $3,894 credit balance in Allowance for Uncollectible Accounts. D Candy made credit sales of $195,000. May collections on account were $170,000, and write-offs of uncollectible receivables totaled $2,870. Uncollectibleexpense is estimated as 2% of credit sales. No sales returns are expected. Ignore cost of goods sold. Read the requirements: (c) Now journalize the write-offs of uncollectibles. (d) Finally, record the entry to journalize the uncollectible-account expense. On April 30, Candy Party Planners had a \$42,000 balance in Accounts Recelvable and a $3,894 credit balance in Allowance for Uncollectible Account Candy made credit sales of $195,000. May collections on account were $170,000, and write-offs of uncollectible receivables totaled $2,870. Uncollect expense is estimated as 2% of credit sales. No sales returns are expected. Ignore cost of goods sold. Read the requirements. (d) Finally, record the entry to journalize the uncollectible-account expense. Requirement 2. Show the ending balances in Accounts Receivable, Allowance for Uncollectible Accounts, and Net Accounts Receivable at May 31. H Candy expect to collect? In the following T-accounts, enter the beginning balances, the adjusting entries and compute the ending balances. (Enter the corresponding letter as th reference.) On Apri 30, Candy Party Planners had a \$42,000 balance in Accounts Recelvable and a $3,894 credit balance in Allowance for Uncollectible Accounts. During May, Candy made credit sales of $195,000. May collections on account were $170,000, and write-offs of uncollectible receivables totaled $2,870. Uncollect ble:accounts expense is estimated as 2% of credit sales. No sales returns are expected. lgnore cost of goods sold. Read the reauiroments. Requirement 2. Show the ending balances in Acceunts Recelvable, Alowance for Uncollectible Accounts, and Not Accounts Recelvable at May 31. How much does Candy expect to collect? In the following T-accounts, enter the beginning balances, the adjusting entries and compute the ending balances. (Enter the corresponding letter as the posting reference.) On April 30, Candy Party Planners had a $42,000 balance in Accounts Receivable and a $3,894 credit balance in Allowance for Uncollectible Accounts. De Candy made credit sales of $195,000. May collections on account were $170,000, and write-offs of uncollectible receivabies totaled $2,870, Uncollectible-1 expense is estimated as 2% of credit sales. No sales returns are expected. Ignore cost of goods sold. Beg Bal End Bal lowance for Uncollectible Accounts 3,900 (a) (b) how the (c) Iccounts, enter the beginning balances, the adjusting entries and compute the ending balances. (Enter the corresponding letter as the pos

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started