Question

Requirement 2. Prepare the month ended January 31, 2017 income statement of Dunst Consulting. Use the multi-step format. List Service Revenue under gross profit and

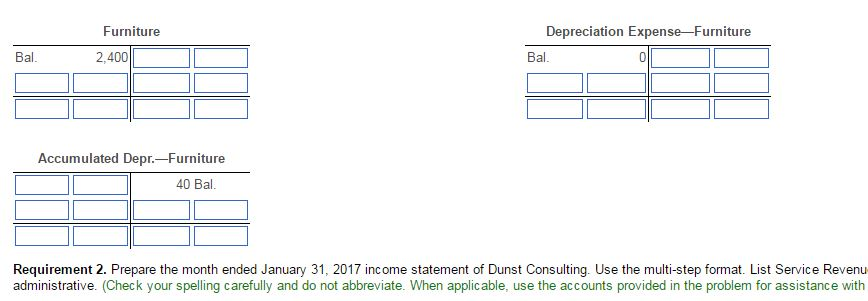

Requirement 2. Prepare the month ended January 31, 2017 income statement of Dunst Consulting. Use the multi-step format. List Service Revenue under gross profit and ignore classifying the expenses as selling and administrative. (Check your spelling carefully and do not abbreviate. When applicable, use the accounts provided in the problem for assistance with account names, and use "Income Summary" as appropriate.)

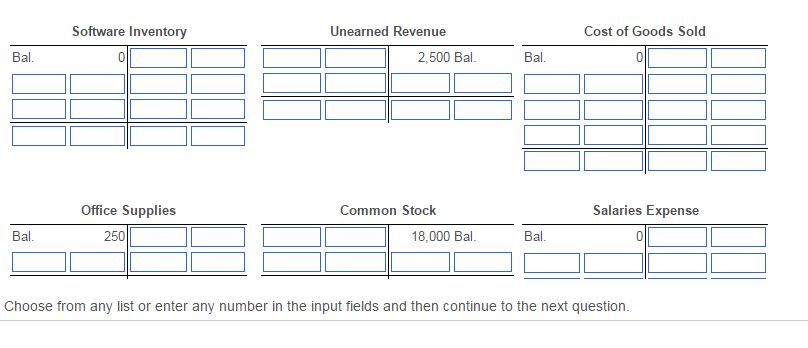

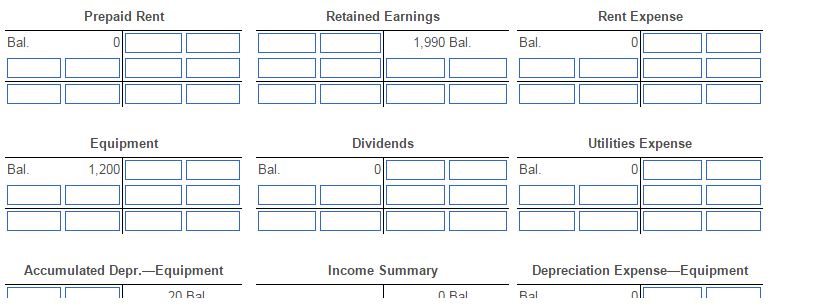

Requirement 3. Journalize and post the closing entries. Denote each closing amount as Clo. After posting all closing entries, prove the equality of debits and credits in the ledger.

Begin by journalizing the closing entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Check your spelling carefully and do not abbreviate. When applicable, use the accounts provided in the problem for assistance with account names, and use "Income Summary" as appropriate.)

Start by closing revenues.

Post the closing entries. Use "Clo." and the corresponding number as shown in the journal entry as posting

then the income statment then the closing entires in the journal then the closing entries on t-accounts then the post closing trial balnce and then the gross profit

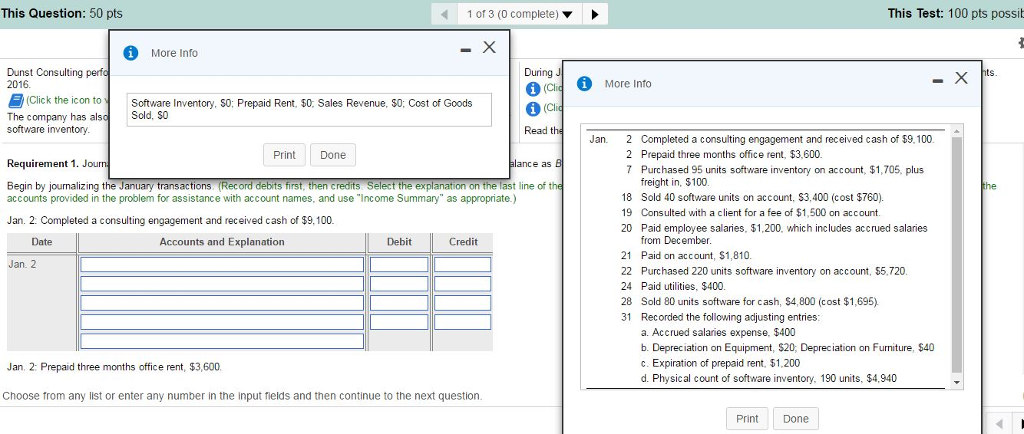

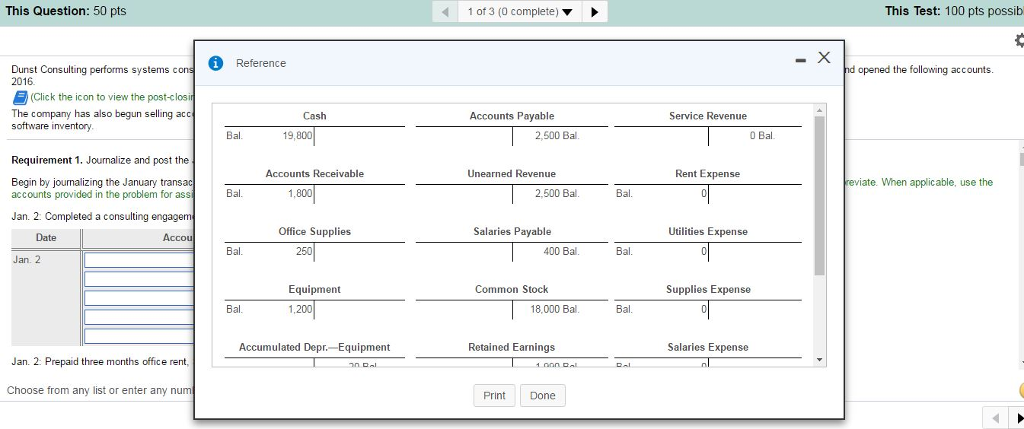

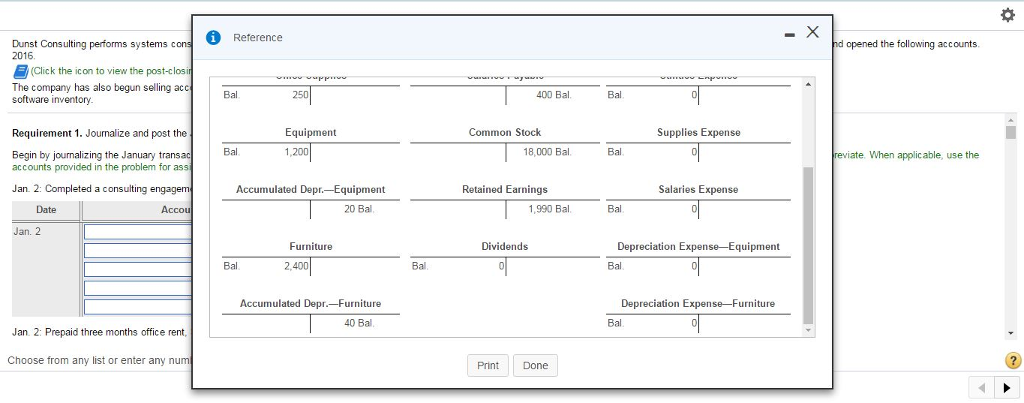

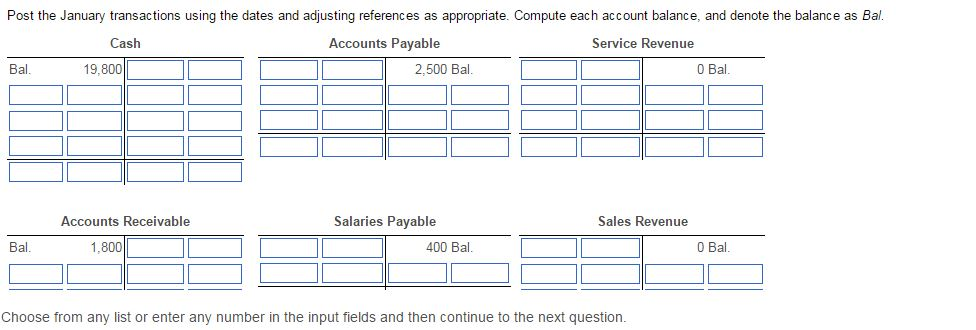

This Question 50 pts 1 of 3 (0 complete More Info Dunst Consulting perfo During J 2016. (Click the icon to v Software Inventory. so: Prepaid Rent, $0. Sales Revenue, $0: Cost of Goods The company has also sold, $0 software inventory. Read the Print Done Requirement 1. Journ Begin by journalizing the January transactions (Record debits first then credits elect the explanation on the last line of the accounts provided in the problem for assistance with account names, and use ncome Summary" as appropriate. Jan. 2. Completed a consulting engagement and received cash of $9.100. Date Accounts and Explanation Debit credit Jan. 2 Jan. 2: Prepaid three months office rent, $3,600. Choose from any list or enter any number in the input fields and then continue to the next question This Test 00 pts possib More info Jan. 2 Completed a consulting engagement and received cash of $9.100. 2 Prepaid three months office rent, $3,600. 7 Purchased 95 units software inventory on account, $1,705, plus freight in, $100. 18 Sold 40 software units on account, $3,400 (cost $760). 19 Consulted with a client for a fee of $1,500 on account. 20 Paid employee salaries, $1,200, which includes accrued salaries from December. 21 Paid on account, S1,810. 22 Purchased 220 units software inventory on account. S5.720. 24 Paid utilities, $400. 28 Sold 80 units software for cash, $4,800 (cost $1,695) 31 Recorded the following adjusting entries: a. Accrued salaries expense, $400 b. Depreciation on Equipment, $20. Depreciation on Furniture, $40 c. Expiration of prepaid re $1.200 d. Physical count of software inventory, 190 units, $4.940 Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started