Answered step by step

Verified Expert Solution

Question

1 Approved Answer

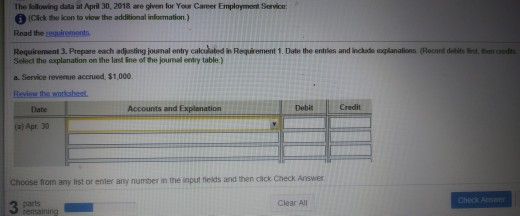

requirement 3. Prepare a journal entry calculated in requirement 1. Date the entries and include explanations. Record debits first, then credits. Select the explanation on

requirement 3. Prepare a journal entry calculated in requirement 1. Date the entries

and include explanations. Record debits first, then credits. Select the explanation on the last line of the journal entry table.

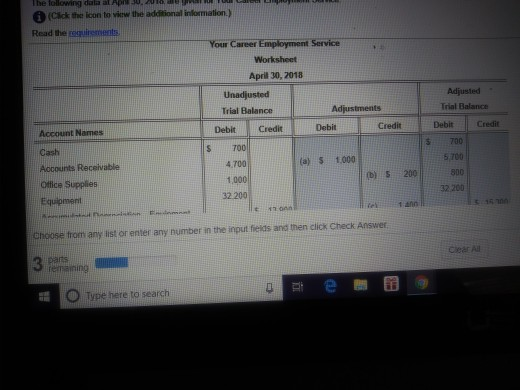

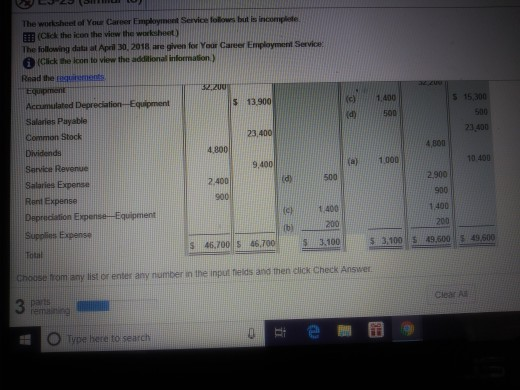

The following data at April 30, 2018 are given for Your Career Employment ServicE ICick the icon to viw the additional infoernation.) Read the euiremonts Requirement 3. Prepare each adjusting journal entry caladated in Requirement 1. Date the entriles and inchade explianations. (Rocord debites Bet, adt Select the explanation on the last Ene of the journal entry table.) a. Service revenue accrued, $1,000 Reviow the workahesl Accounts and Explanation Debit Credit Date (a) Apr. 30 Choose from any list or enter any number in the input fields and then dick Check Answer Clear All check A remaining 1 (Cick the icon to vinw the aditional information.) Career Employment Service April 30, 2018 Adjusted Trial Balance Trial Balance Debit Credit Account Names Cash Accounts Receivable Office Supplies Debit Credit Debit Credi S 700 4.700 1,000 32 200 5700 5 700 800 32 200 (a) S 1000 (b) S 200 Choose trom any list or enter any number in the input fieids and then click Check Answer. O Type here to search The worksheet of Your Career Employinont Service folows but is BEB (Cick the icon the view the worksheet) The following data at April 30, 2018 are given for Your Career Employment Service: 0 (Click the lcon to view the additionalinformaltion) Read the ns Accumulated Salaries Payable Common Stock Dividends Service Revenue Salaries Expense Rent Expense $ 13.900 (c)/1400 500 23.400 23 4,800 4,800 9,400 (a) 1.000 10 400 500 2900 900 1400 200 2.400 (ch ib) 1.400 200 Supplies Expense 5 3,100 49,600 49,600 3.100S Choise from jany list or enter any number in the input heids and then elick Check Answer. S 46,700 S 46, O type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started