Answered step by step

Verified Expert Solution

Question

1 Approved Answer

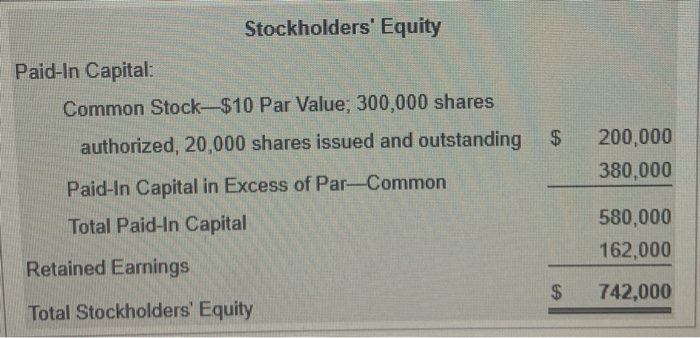

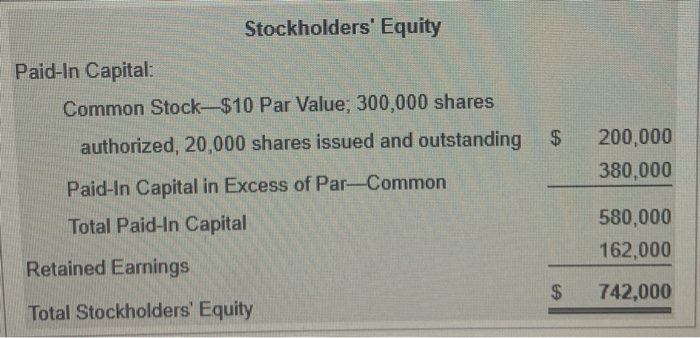

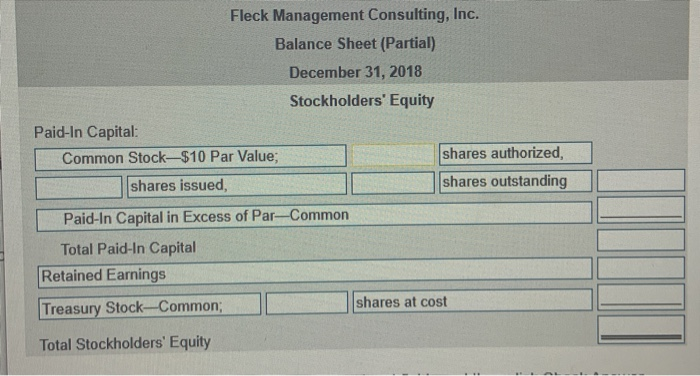

Requirement 3: prepare the stockholders' equity section of the balance sheet at December 31, 2018 Stockholders' Equity Paid-In Capital: Common Stock-$10 Par Value; 300,000 shares

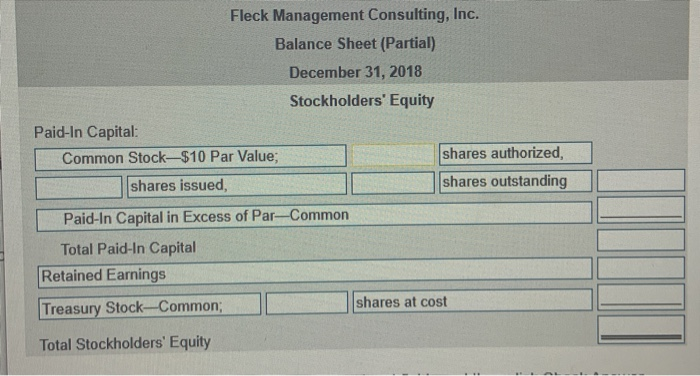

Requirement 3: prepare the stockholders' equity section of the balance sheet at December 31, 2018

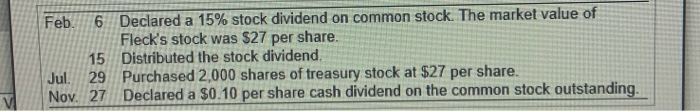

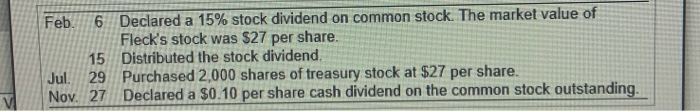

Stockholders' Equity Paid-In Capital: Common Stock-$10 Par Value; 300,000 shares authorized, 20,000 shares issued and outstanding $ 200,000 380,000 Paid-In Capital in Excess of Par-Common Total Paid-In Capital 580,000 162,000 Retained Earnings $ 742,000 Total Stockholders' Equity Feb. 6 Declared a 15% stock dividend on common stock. The market value of Fleck's stock was $27 per share. 15 Distributed the stock dividend. Jul 29 Purchased 2,000 shares of treasury stock at $27 per share. Nov. 27 Declared a $0.10 per share cash dividend on the common stock outstanding. Fleck Management Consulting, Inc. Balance Sheet (Partial) December 31, 2018 Stockholders' Equity Paid-In Capital: Common Stock-$10 Par Value; shares authorized, shares issued shares outstanding Paid-In Capital in Excess of Par-Common Total Paid-In Capital Retained Earnings shares at cost Treasury Stock-Common; Total Stockholders' Equity Stockholders' Equity Paid-In Capital: Common Stock-$10 Par Value; 300,000 shares authorized, 20,000 shares issued and outstanding $ 200,000 380,000 Paid-In Capital in Excess of Par-Common Total Paid-In Capital 580,000 162,000 Retained Earnings $ 742,000 Total Stockholders' Equity Feb. 6 Declared a 15% stock dividend on common stock. The market value of Fleck's stock was $27 per share. 15 Distributed the stock dividend. Jul 29 Purchased 2,000 shares of treasury stock at $27 per share. Nov. 27 Declared a $0.10 per share cash dividend on the common stock outstanding. Fleck Management Consulting, Inc. Balance Sheet (Partial) December 31, 2018 Stockholders' Equity Paid-In Capital: Common Stock-$10 Par Value; shares authorized, shares issued shares outstanding Paid-In Capital in Excess of Par-Common Total Paid-In Capital Retained Earnings shares at cost Treasury Stock-Common; Total Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started