Question

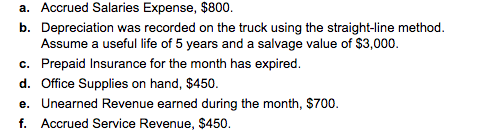

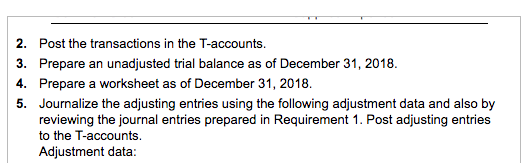

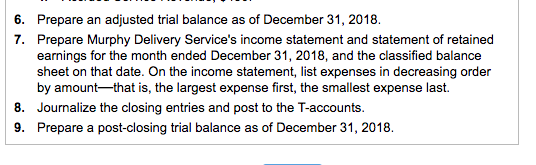

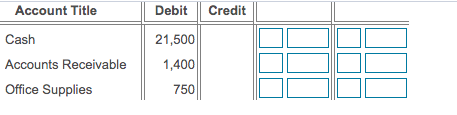

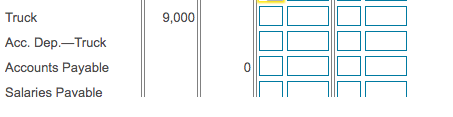

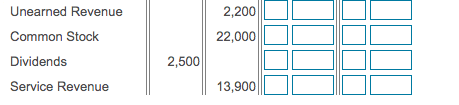

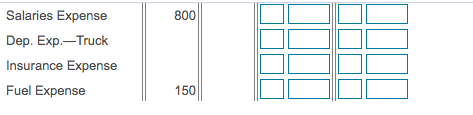

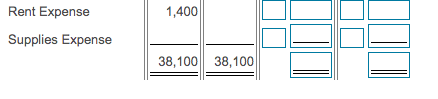

Requirement 4. Prepare a worksheet as of December 31, 2018. The Unadjusted Trial Balance columns have been completed for you using the unadjusted trial balance

Requirement 4. Prepare a worksheet as of December 31, 2018. The Unadjusted Trial Balance columns have been completed for you using the unadjusted trial balance you prepared in Requirement 3. Complete the worksheet one section at a time beginning with the Adjustments section. Enter the adjustments along with the adjustment letter references(a), (b), (c), etc.into the columns as appropriate. In the following step, complete the Adjusted Trial Balance section of the worksheet. For this section, and for the Income Statement and Balance Sheet sections, enter a "0" on the normal side of the account for any accounts with a zero balance. Lastly, complete the worksheet by preparing the Income Statement and Balance Sheet columns. For the Income Statement and Balance Sheet sections, only enter the "0" for a zero balance if the account is typically included in that section of the worksheet. (Abbreviations used: Acc. = Accumulated, Dep. = Depreciation, Exp. = Expense.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started