Question

Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The

Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $150. d) The estimated income taxes are $100.

Requirement #5: Post the adjusting entries on March 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed.

REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below.

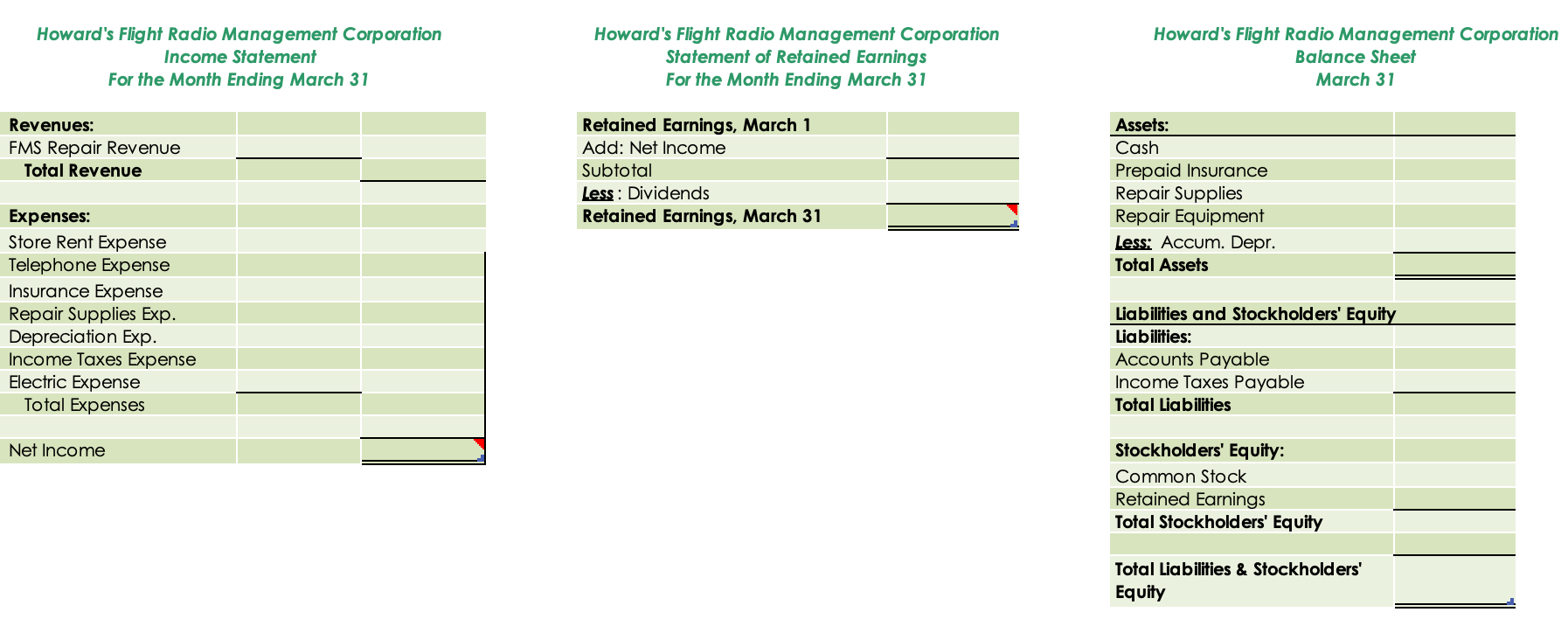

Requirement #7: Prepare the financial statements for Howard's Flight Radio Management Corporation as of March 31 in the space below. You will only be preparing the Income Statement, Statement of Retained Earning, and the Balance Sheet. The Statement of Cash Flows is a required Financial Statement, but is not required for this project.

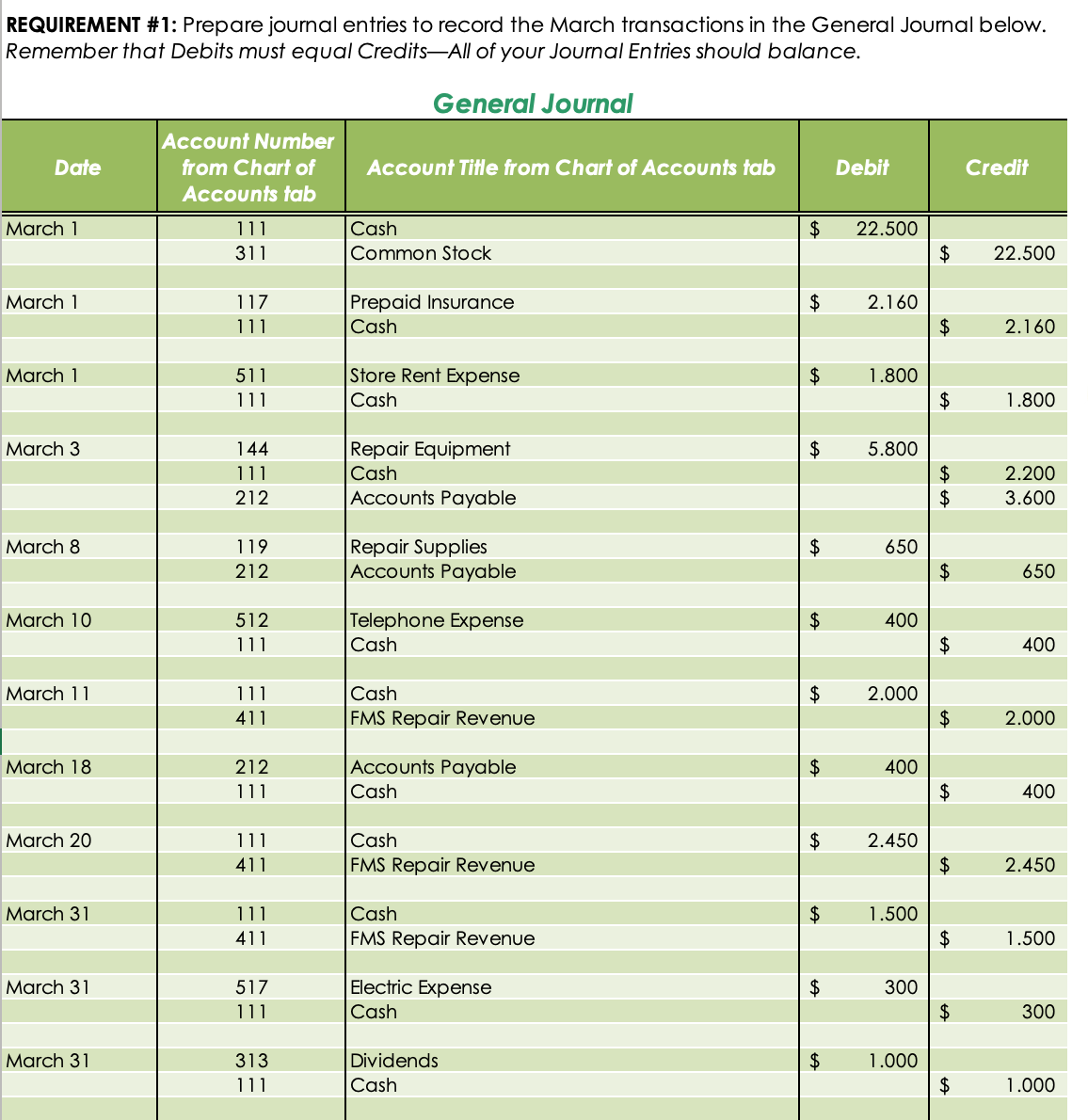

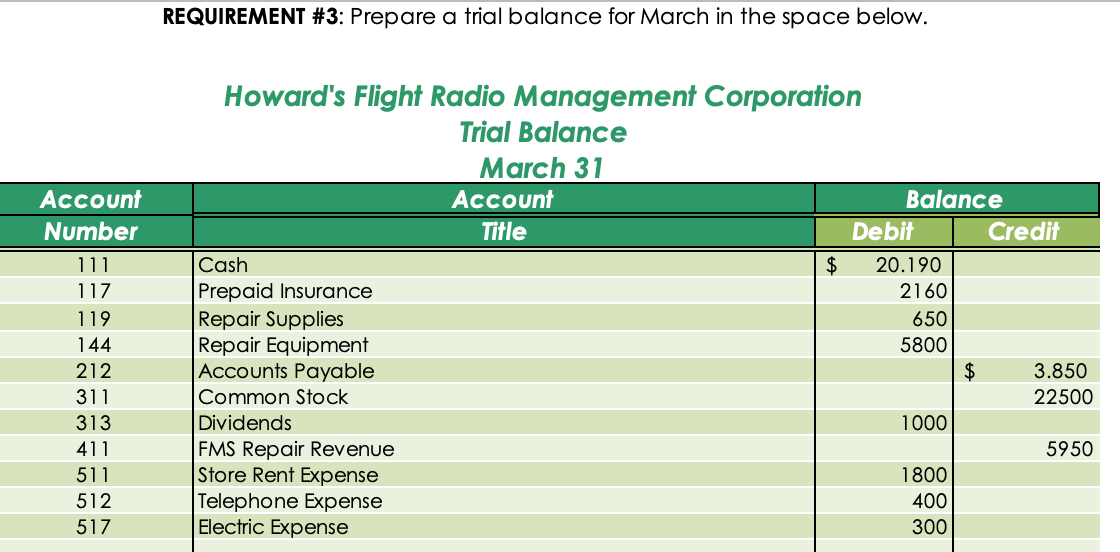

REQUIREMENT \# 1: Prepare journal entries to record the March transactions in the General Journal below. Remember that Debits must equal Credits-All of your Journal Entries should balance. REQUIREMENT \#3: Prepare a trial balance for March in the space below. Howard's Flight Radio Management Corporation Income Statement For the Month Ending March 31 Howard's Flight Radio Management Corporation Statement of Retained Earnings For the Month Ending March 31 Howard's Flight Radio Management Corporation Balance Sheet March 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started