REQUIREMENT 4!- prepare the statement of cost of goods manufactured for janrary. ALSO prepare the income statement for janurary.

INCOME STATEMENT AND COST OF GOODS MANUFACTURED STATEMENT

please!!!

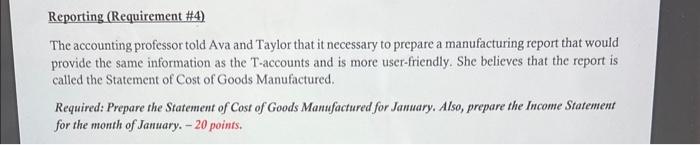

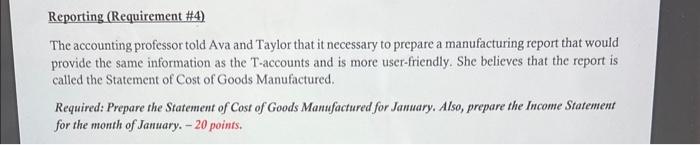

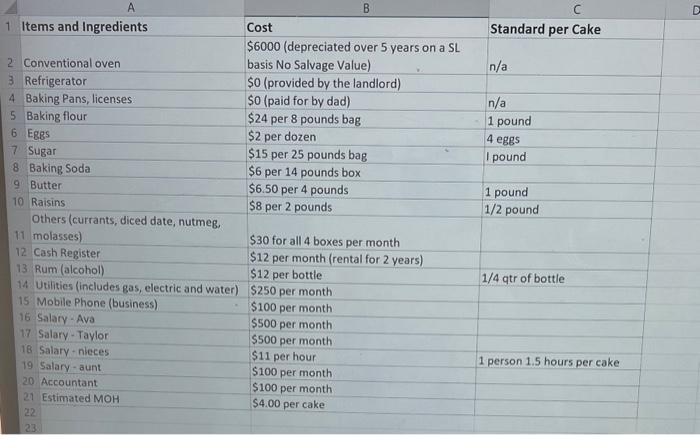

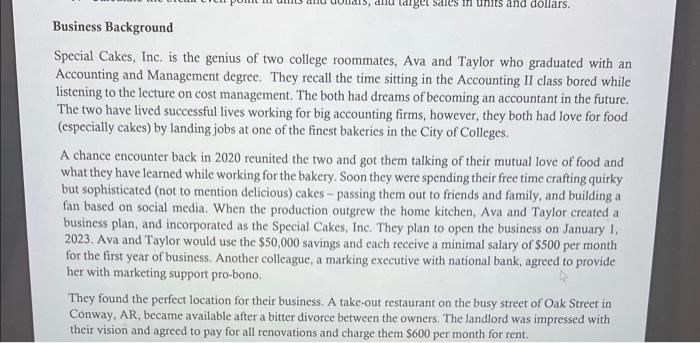

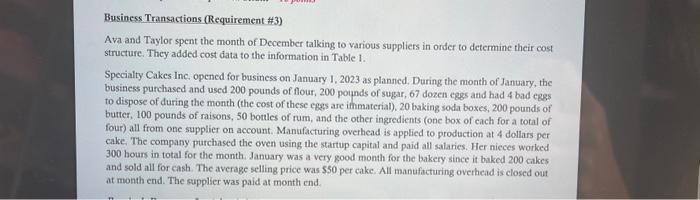

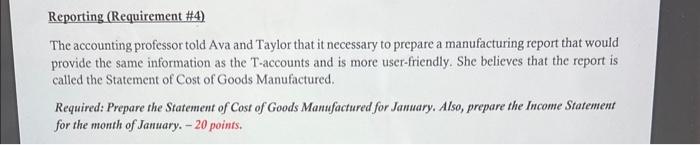

Reporting (Requirement \#4) The accounting professor told Ava and Taylor that it necessary to prepare a manufacturing report that would provide the same information as the T-accounts and is more user-friendly. She believes that the report is called the Statement of Cost of Goods Manufactured. Required: Prepare the Statement of Cost of Goods Manufactured for January. Also, prepare the Income Statement for the month of January. - 20 points. Business Background Special Cakes, Inc. is the genius of two college roommates, Ava and Taylor who graduated with an Accounting and Management degree. They recall the time sitting in the Accounting II class bored while listening to the lecture on cost management. The both had dreams of becoming an accountant in the future. The two have lived successful lives working for big accounting firms, however, they both had love for food (especially cakes) by landing jobs at one of the finest bakerics in the City of Colleges. A chance encounter back in 2020 reunited the two and got them talking of their mutual love of food and what they have learned while working for the bakery. Soon they were spending their free time crafting quirky but sophisticated (not to mention delicious) cakes - passing them out to friends and family, and building a fan based on social media. When the production outgrew the home kitchen, Ava and Taylor created a business plan, and incorporated as the Special Cakes, Inc. They plan to open the business on January 1 , 2023. Ava and Taylor would use the $50,000 savings and cach receive a minimal salary of $500 per month for the first year of business. Another colleague, a marking executive with national bank, agreed to provide her with marketing support pro-bono. They found the perfect location for their business. A take-out restaurant on the busy street of Oak Street in Conway, AR, became available after a bitter divorce between the owners. The landlord was impressed with their vision and agreed to pay for all renovations and charge them $600 per month for rent. Business Transactions (Requirement \#3) Ava and Taylor spent the month of December talking to various suppliers in order to determine their cost structure. They added cost data to the information in Table 1. Specialty Cakes Inc, opened for business on January I, 2023 as planned. During the month of January, the business purchased and used 200 pounds of flour, 200 pounds of sugar, 67 dozen eggs and had 4 bad egss to dispose of during the month (the cost of these eggs are ithmaterial), 20 baking soda boxes, 200 pounds of butter, 100 pounds of raisons, 50 botles of rum, and the other ingredients (one box of each for a total of four) all from one supplier on account. Manufacturing overhead is applied to production at 4 dollars per cake. The company purchased the oven using the startup capital and paid all salaries. Her nieces worked 300 hours in total for the month. January was a very good month for the bakery since it baked 200 cakes and sold all for cash. The average selling price was 550 per cake. All manufacturing overhend is closed out at month end. The supplier was paid at month end. Reporting (Requirement \#4) The accounting professor told Ava and Taylor that it necessary to prepare a manufacturing report that would provide the same information as the T-accounts and is more user-friendly. She believes that the report is called the Statement of Cost of Goods Manufactured. Required: Prepare the Statement of Cost of Goods Manufactured for January. Also, prepare the Income Statement for the month of January. - 20 points. Business Background Special Cakes, Inc. is the genius of two college roommates, Ava and Taylor who graduated with an Accounting and Management degree. They recall the time sitting in the Accounting II class bored while listening to the lecture on cost management. The both had dreams of becoming an accountant in the future. The two have lived successful lives working for big accounting firms, however, they both had love for food (especially cakes) by landing jobs at one of the finest bakerics in the City of Colleges. A chance encounter back in 2020 reunited the two and got them talking of their mutual love of food and what they have learned while working for the bakery. Soon they were spending their free time crafting quirky but sophisticated (not to mention delicious) cakes - passing them out to friends and family, and building a fan based on social media. When the production outgrew the home kitchen, Ava and Taylor created a business plan, and incorporated as the Special Cakes, Inc. They plan to open the business on January 1 , 2023. Ava and Taylor would use the $50,000 savings and cach receive a minimal salary of $500 per month for the first year of business. Another colleague, a marking executive with national bank, agreed to provide her with marketing support pro-bono. They found the perfect location for their business. A take-out restaurant on the busy street of Oak Street in Conway, AR, became available after a bitter divorce between the owners. The landlord was impressed with their vision and agreed to pay for all renovations and charge them $600 per month for rent. Business Transactions (Requirement \#3) Ava and Taylor spent the month of December talking to various suppliers in order to determine their cost structure. They added cost data to the information in Table 1. Specialty Cakes Inc, opened for business on January I, 2023 as planned. During the month of January, the business purchased and used 200 pounds of flour, 200 pounds of sugar, 67 dozen eggs and had 4 bad egss to dispose of during the month (the cost of these eggs are ithmaterial), 20 baking soda boxes, 200 pounds of butter, 100 pounds of raisons, 50 botles of rum, and the other ingredients (one box of each for a total of four) all from one supplier on account. Manufacturing overhead is applied to production at 4 dollars per cake. The company purchased the oven using the startup capital and paid all salaries. Her nieces worked 300 hours in total for the month. January was a very good month for the bakery since it baked 200 cakes and sold all for cash. The average selling price was 550 per cake. All manufacturing overhend is closed out at month end. The supplier was paid at month end